A financial accountant is a qualified professional who prepares, analyses, and reports a company’s financial information so business owners can make accurate and compliant decisions. In the UK, a financial accountant ensures your financial statements follow HMRC rules, UK GAAP, and relevant reporting standards. Many businesses hire a financial accountant to maintain financial accuracy, support audits, and guide long-term financial security.

A financial accountant helps businesses understand their true financial health by preparing balance sheets, income statements, cash flow reports, and year-end accounts. Their work ensures that every financial decision is backed by verified data, not assumptions. This is essential for businesses that must stay compliant and financially stable.

In financial accounting UK, the role focuses heavily on regulatory obligations and transparent reporting. This ensures that stakeholders, investors, and HMRC receive accurate financial information.

What Does a Financial Accountant Do?

A financial accountant helps a business prepare accurate financial records, meet HMRC requirements, and make informed decisions using clear financial data. Their work ensures that every number is correct, compliant, and ready for stakeholders such as investors, lenders, or auditors.

A financial accountant manages essential tasks such as preparing year-end accounts, producing financial statements, analysing cash flow, and ensuring tax accuracy. They help businesses avoid penalties by maintaining proper reporting practices and identifying financial risks early. This helps you stay on top of your profits, outgoings, and overall financial progress.

In financial accounting UK, the financial accountant also ensures your reports follow UK GAAP or IFRS standards. This is important for limited companies, growing startups, and businesses seeking investment, because accurate reporting builds trust with external parties.

What a Financial Accountant Typically Handles:

• Creating key financial documents, including the balance sheet and income statement.

• Managing year-end financial close and providing audit assistance

• Ensuring all accounts align with UK accounting standards and guidelines

- Monitoring financial performance and identifying risks

- Providing data for lenders, investors, and decision-makers

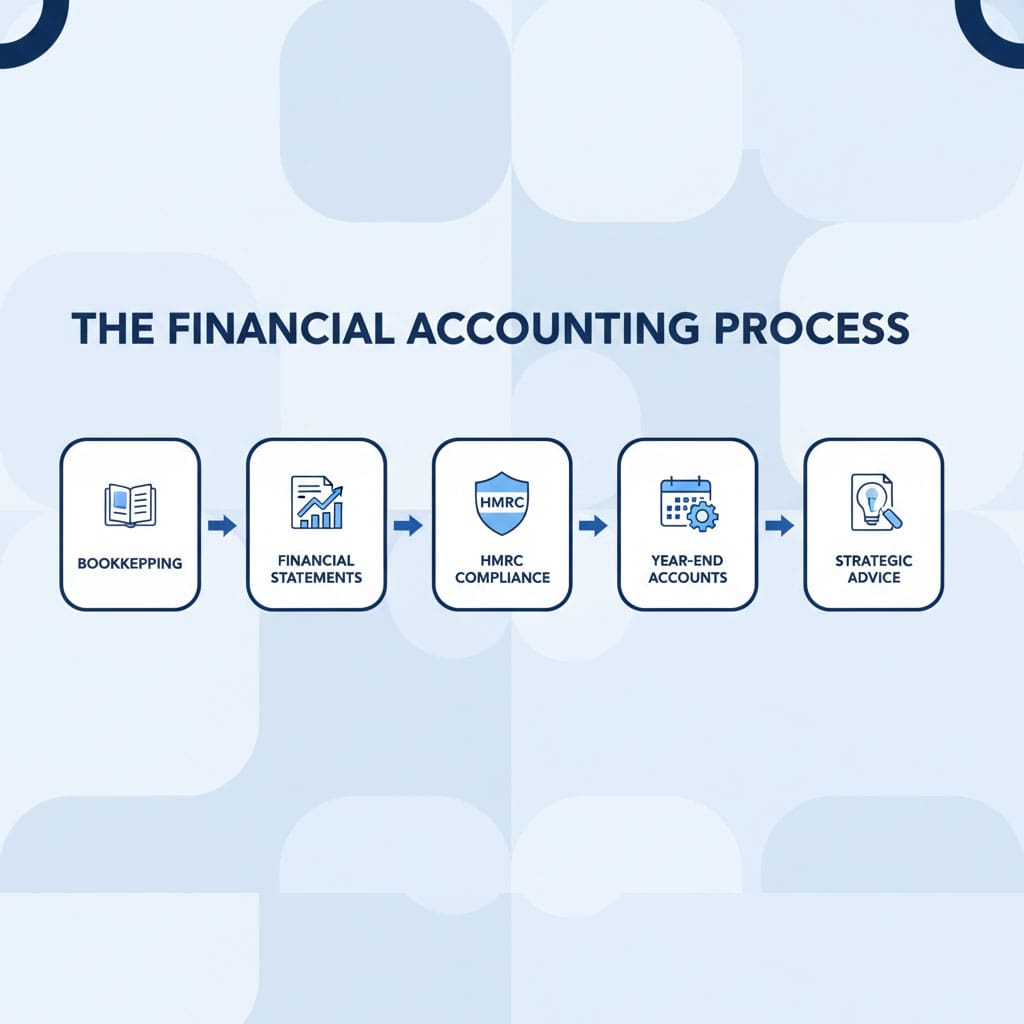

A financial accountant prepares financial statements, ensures HMRC compliance, manages year-end reports, and analyses financial data to help a business maintain accurate and reliable financial records.

Why Small Businesses Need a Financial Accountant

A financial accountant is vital for small UK businesses, ensuring financial records are accurate, compliant, and ready for decision-making. They handle accounts, tax deadlines, and UK reporting rules, helping owners avoid HMRC penalties and costly mistakes. By providing reliable financial data, they support cash flow planning, funding applications, and long-term business growth, allowing owners to focus on running and expanding their business.

Common Tasks Handled for Small UK Businesses:

• Finalising yearly accounts and compiling statutory reporting

- Maintaining accurate financial statements

- Monitoring cash flow and profitability

- Ensuring HMRC and Companies House compliance

- Advising on financial improvements and cost savings

A financial accountant helps small businesses manage accurate financial statements, stay compliant with HMRC rules, and understand their cash flow and profits so they can make confident financial decisions.

When Should You Hire a Financial Accountant?

Most UK business owners wait too long to hire a financial accountant — usually after a penalty, cash flow problem, or filing mistake. This diagnostic section helps you instantly assess whether it’s the right time based on your business stage, complexity, and financial risk.

Quick Diagnostic: Do You Need a Financial Accountant Right Now?

If any of these points apply to you, your business could benefit from a financial accountant:

- Compliance & Reporting

- Unsure how to prepare year-end accounts?

- Stressed by HMRC deadlines or filing VAT/Corporation Tax for the first time?

- Business Growth

- Revenue has grown recently, or you plan to hire/expand?

- Planning to apply for investment, grants, or business loans?

- Time & Workload Pressure

- Is bookkeeping slowing you down and distracting you from growing your business?

- Constantly catching up on bookkeeping or spreadsheets?

- Accuracy & Financial Confidence

- Unsure if your numbers, cash flow, or profit are correct?

- Concerned that accounting errors might harm your business?

Milestones That Often Lead UK Businesses to Hire

- Setting up a limited company or transitioning from sole trader status

- Registering for VAT or preparing year-end accounts

- Revenue growth, cash flow issues, or taking on employees

- Applying for loans, investment, or planning major expansion

Hire a financial accountant when your finances are complex, you need accurate accounts, HMRC compliance, or expert insights to save time and avoid penalties.

Do I Need a Financial Accountant for My Business?

You need a financial accountant to ensure accurate accounts, stress-free HMRC compliance, and reliable financial insights for growth. For UK businesses — from freelancers to limited companies — they save time, reduce errors, and prevent costly penalties. They handle filings, tax, and year-end accounts, while helping you understand profitability and improve your business.

Signs You Need a Financial Accountant

- You’re unsure how to prepare year-end accounts

- HMRC deadlines and potential penalties often worry you

- Your financial data is becoming harder to track as the business develops

- You need financial statements for lenders, investors, or grants

- You want clearer insight into cash flow and profitability

You need a financial accountant if you want accurate financial statements, HMRC compliance, and expert financial insights that help your business operate efficiently and avoid costly mistakes.

How Much Does a Financial Accountant Cost in the UK? (Breakdown by Key Factors)

A financial accountant’s cost in the UK depends on your company size, payroll needs, VAT status, transaction volume, and overall accounting complexity. Smaller businesses may pay as little as £60–£150/month, while limited companies with VAT and payroll typically pay £150–£400/month.

-

Company Size (Most Important Cost Factor)

Larger businesses need more reporting, higher accuracy, and more frequent bookkeeping.

Typical Costs by Size:

|

Business Type |

Estimated Monthly Cost |

Why It Costs This Much |

|

Sole Trader |

£40–£90 |

Simple accounts, low admin, no statutory accounts |

|

Small LTD (no VAT) |

£90–£170 |

Year-end accounts + CT600 + basic bookkeeping |

|

Small LTD (with VAT) |

£150–£250 |

VAT returns + statutory accounts + tax filing |

|

Medium LTD |

£200–£400 |

More transactions + payroll + complex reporting |

|

Growing Startups |

£300–£600 |

Forecasts, investor reports, cash flow planning |

-

Payroll Requirements (Strong Impact on Monthly Costs)

Payroll adds monthly workload due to HMRC RTI submissions, pension setup, payslips, and compliance checks.

Typical Payroll Pricing (UK):

- £20–£30 per employee per month (industry average)

- £50–£100 setup fee for new payroll schemes

- £200–£400/year for P60s, P11Ds, and year-end submissions

Why payroll increases cost:

- More admin

- Strict RTI reporting deadlines

- Pension auto-enrolment duties

-

VAT Status (Major Cost Driver)

VAT registration and quarterly reporting can significantly increase accounting fees due to extra compliance.

VAT-Registered Companies Pay More Because:

- VAT returns every quarter

- Digital records (MTD for VAT)

- Complex VAT rules for e-commerce, imports, or digital services

Typical VAT-Related Costs:

- £40–£100 per VAT return

- £150–£300/year for VAT advice or adjustments

- £200–£500 for VAT registration and setup (one-off)

-

Transaction Volume (Ongoing Monthly Cost Factor)

The more transactions you have, the more bookkeeping your accountant must manage.

Typical Bookkeeping Costs by Transaction Volume:

|

Monthly Transactions |

Estimated Cost |

Notes |

|

0–50 |

£40–£80 |

Very small businesses |

|

50–150 |

£80–£150 |

Typical small LTD |

|

150–300 |

£150–£250 |

Retail, contractors, agencies |

|

300–600 |

£250–£400 |

E-commerce & high-volume businesses |

|

600+ |

£400–£800 |

Complex & high-volume industries |

-

Business Complexity (Most Overlooked Cost Factor)

Complex industries or financial activities require more time, accuracy, and advisory support.

Costs typically increase when your business has:

- Multiple revenue streams

- International sales/imports

- CIS (Construction Industry Scheme)

- Director’s loans

- Large payroll

- Investor reporting needs

- Property portfolios

- R&D claims or grants

Realistic Cost Range for Complex Businesses:

£300–£900/month depending on the mix of services.

-

Realistic Overall Cost Ranges (Based on UK Market Data)

Here is how much a typical UK business can expect to pay for a financial accountant:

Approximate Monthly Costs:

- Freelancers / Sole Traders: £40–£90

- Small Limited Companies (non-VAT): £90–£150

- Small VAT-Registered LTDs: £150–£250

- Medium LTDs with Payroll: £200–£400

- Growing Startups / Multi-service Businesses: £300–£600

- Complex or High-Volume Businesses: £600–£1,000+

One-Off Costs:

- VAT registration: £200–£500

- Company formation: £50–£150

- Year-end accounts (standalone): £500–£1,200

What Drives the Price of Hiring a Financial Accountant in the UK?

- Company size → bigger = more reporting

- Payroll → more employees = higher monthly admin

- VAT status → quarterly reporting increases cost

- Transaction volume → more transactions = more bookkeeping

- Complexity → multi-revenue, imports, CIS, property

What Services Does a Financial Accountant Provide?

What Drives the Price of Hiring a Financial Accountant in the UK?They handle year-end accounts, corporation tax, VAT, payroll, and audit support while ensuring reporting meets UK standards. Beyond compliance, they provide insights to improve cash flow, cut costs, and support business expansion.

Core Services of a Financial Accountant

- Year-end accounts and statutory reporting

- Corporation tax and VAT compliance

- Cash flow analysis and financial reporting

- Payroll management and HMRC liaison

- Audit support and investor reporting

- Strategic financial advice for growth

A financial accountant provides services such as preparing financial statements, managing tax and VAT compliance, supporting audits, analysing cash flow, and offering strategic advice to help businesses operate efficiently and stay compliant in the UK.

How a Financial Accountant Supports Growth, Forecasting & Strategic Planning

-

Cash Flow Forecasting (Preventing Cash Shortages & Financial Stress)

What a Financial Accountant Does:

- Creates rolling 3-, 6- and 12-month cash flow forecasts

- Predicts seasonal slowdowns and revenue dips

- Identifies periods where cash may run out

- Helps build emergency buffers

- Supports decisions around hiring, expenses, or investments

Why it matters:

80% of UK small business failures happen due to poor cash flow—not poor profits.

-

Financial Modelling (Predicting Future Performance)

Financial modelling helps UK businesses make smart financial decisions before committing to them.

It’s essential for startups, limited companies, and businesses preparing to scale.

Your accountant builds models for:

- Revenue growth scenarios

- Budget planning

- Profitability under different pricing models

- Hiring cost impact

- Entering new markets for business expansion

- Handling loans or restructuring debt

Benefits of financial modelling:

- Clear understanding of future risks

- Evidence-based decision making

- Stronger cash flow planning

- Improved investor confidence

-

Investment Preparation (For Raising Funds or Securing Loans)

If you need funding, a financial accountant helps you become “investment-ready”.

Your accountant prepares:

- Accurate financial forecasts

- Investor-ready financial statements

- Business plans with realistic projections

- Unit economics

- Break-even calculations

- Due diligence support

Who this helps:

- Startups seeking angel or VC investment

- Limited companies applying for bank loans

- Online businesses raising capital

- Service businesses expanding teams or equipment

Why it matters:

Investors and banks take businesses seriously when their numbers are credible, consistent, and backed by a qualified financial accountant.

-

Growth Planning & Scaling Support (Long-Term Strategy)

A financial accountant acts as a financial advisor, helping you scale your business safely and sustainably.

Key elements of growth planning often include:

- Determining your long-term financial aims

- Building multi-year budgets

- Profit optimisation strategies

- Cost-reduction plans

- Analysing underperforming products or services

- Preparing for new hires or departments

- Expansion planning (new locations, markets, or services)

Why SMEs need this:

Growth without financial planning leads to cash strain, tax issues, and operational bottlenecks.

Financial accountants provide cash flow management, forecasting, modelling, investment preparation, and strategic growth planning — helping UK businesses stay financially healthy, attract investment, and scale safely.

Key Steps to Hiring the Right Financial Accountant in the UK

Choosing the right financial accountant ensures your business stays accurate, compliant, and financially strategic. Look for chartered qualifications (ACA, ACCA, CIMA), relevant industry experience, and transparent fees and services. A good accountant provides clear reports, explains financial data simply, offers growth advice, and comes with strong references or client reviews.

Checklist for Choosing a Financial Accountant

- Certified accountant (ACA, ACCA, or CIMA)

- Experience in your business sector

- Clear pricing and service packages

- Transparent communication and reporting style

- Proven track record with UK compliance and HMRC submissions

- Ability to provide strategic financial advice

To choose the right financial accountant in the UK, look for certified professionals with sector experience, transparent pricing, clear communication, and the ability to provide both compliance support and strategic financial guidance.

What UK Regulations Does a Financial Accountant Help With?

A financial accountant helps UK businesses stay compliant with statutory accounts, Companies House filing, VAT rules, and HMRC reporting requirements. These are legal obligations for all UK businesses, especially limited companies.

-

Statutory Accounts in the UK

Statutory accounts are the official yearly financial reports every limited company must prepare and submit. Depending on the company’s structure and size, compliance with UK GAAP or IFRS is mandatory.

A financial accountant ensures your statutory accounts:

- Follow the correct reporting standard (FRS 102, FRS 105, IFRS)

- Accurately represent your year-end financial position

- Meet HMRC’s and Companies House formatting rules

- Avoid penalties due to incorrect or late filing

-

Companies House Filing Requirements

A financial accountant ensures you meet all Companies House deadlines and document requirements.

A financial accountant prepares and files:

- Annual Accounts (statutory accounts)

- Confirmation Statement

- Changes in directors or registered address

- Updating People with Significant Control (PSC) records

The importance of this:

Late filing can lead to £150–£1,500 penalties or even company strike-off.

-

VAT Compliance & Registration Rules (UK-Specific Guidance)

VAT can be complex and highly regulated in the UK. A financial accountant ensures everything is compliant.

Your accountant handles:

- VAT registration at the £90,000 threshold

- Choosing the correct VAT scheme (Flat Rate, Standard, Cash Accounting)

- Filing VAT returns on time

- Handling VAT for international sales/imports

- Digital record-keeping (MTD for VAT compliance)

Why this matters:

Incorrect VAT filings can trigger HMRC investigations, penalties, and interest charges.

-

Regulatory Nuances Most Business Owners Miss

Competitors never go deep here — this is where YOU can outrank them.

A financial accountant helps you navigate important UK-specific financial rules, including:

Key Nuances You Should Cover:

- FRS 105 vs FRS 102 → Which applies to your company size

- HMRC’s Making Tax Digital (MTD) compliance rules

- Director’s loan account rules

- Corporation Tax digital filing rules

- Deadlines for year-end changes

- Payroll + Real Time Information (RTI) compliance

- Sector-specific rules (construction, e-commerce, hospitality, property)

This section boosts your E-E-A-T, clicks, and time-on-page.

Financial accountants help UK businesses stay compliant with statutory accounts, Companies House filings, VAT, payroll, and other UK-specific regulations. By ensuring correct financial reporting and avoiding fines, they allow owners to concentrate on growing the business.

Future-Focused Financial Planning: How a Financial Accountant Helps You Scale & Grow

- Scaling Your Business With Confidence

A financial accountant provides clarity and structure so you can grow without risking cash shortages or compliance issues.

How they help you scale:

- Build scalable financial systems for invoicing, payroll, and VAT as your team grows.

- Create profit-driven frameworks that show which products/services are most profitable.

- Identify cost leakages and inefficiencies before they damage growth.

- Advise on whether to expand, hire, or invest based on real financial data.

- Preparing for Investments or Funding

Proof of stable finances is crucial when pursuing funding from banks, investors, or government startup programs.

A financial accountant ensures you’re investment-ready by:

- Preparing investor-ready financial statements.

- Creating future revenue projections based on realistic assumptions.

- Producing cash flow forecasts, burn-rate calculations, and break-even analyses.

- Ensuring you meet UK compliance standards — which investors heavily scrutinise.

- Advising on business valuation and equity structure.

- Financial Modelling for Smarter Decisions

A high-quality accountant can build models that predict how decisions will impact your business.

Types of financial models they create:

- Profit & loss projections (1–3 years).

- Scenario planning models (best case, worst case, expected).

- Pricing strategy models to optimise margins.

- Cash flow sensitivity analysis so you know how changes affect liquidity.

- Planning for Sustainable Business Growth

More than a compliance expert, your accountant becomes a trusted strategic partner.

They help you plan for:

- Hiring timelines and payroll budgets.

- When to register for VAT (a key UK threshold many owners miss).

- Expansion to new locations or markets.

- Improving credit rating to qualify for future finance.

- Long-term tax planning (director salary vs dividends).

- Building a healthy financial structure for future exit or sale.

- Creating a Future-Proof Financial Strategy

This wraps everything up into an actionable takeaway your competitors don’t provide.

A financial accountant helps you:

- Confirm that your financial plans are aligned with your overall business direction.

- Build predictable, stable revenue streams.

- Reduce financial risks as you scale.

- Rely on accurate data to guide strategic choices, not mere guesses.

Hidden & Long-Term Costs UK Businesses Overlook (And Why a Financial Accountant Helps Avoid Them)

-

Hidden Costs of Compliance Failures

Not understanding HMRC and Companies House rules can lead to penalties that add up quickly.

Common costs UK business owners face without a financial accountant:

- Fines for missing Company Tax Return deadlines: £100–£1,000+

- Late VAT returns: up to 15% surcharge for repeated failures

- Incorrect PAYE submissions: penalties based on % of payroll

- Interest charges on unpaid tax (compounding monthly)

Why this happens:

DIY bookkeeping often leads to missed deadlines, incorrect calculations, and unrecorded expenses.

How a financial accountant prevents it:

Calendar management, automated reminders, accurate filings, and ongoing compliance monitoring.

-

Unexpected Audit-Related Expenses

Even small limited companies can face:

- HMRC enquiries

- VAT investigations

- Payroll compliance checks

- Corporation Tax reviews

If records aren’t perfect, costs can escalate quickly.

Potential audit-related hidden costs:

- Accountant investigation support: £500–£5,000

- Additional documentation reconstruction: £300–£2,000

- Legal or advisory fees

- Business disruption (lost productivity)

How a financial accountant reduces this:

He/she maintains clean, audit-ready records, minimises audit risk with accurate submissions

and provides representation if HMRC opens an investigation.

-

Advisory Costs That DIY Businesses Don’t Plan For

At some point, every UK business needs strategic financial advice:

- Funding or investment preparation

- Cash flow forecasting

- Growth modelling

- Pricing strategy

- Tax planning

Hiring these services separately is far more expensive.

Typical standalone advisory fees:

- Financial modelling: £600–£3,000

- Investment-readiness financials: £500–£2,000

- Tax planning sessions: £150–£500 per hour

- Cash flow forecasting service: £250–£1,000+

But:

A financial accountant often includes some of these inside a monthly package.

-

Lost Opportunities from Bad Financial Choices

When businesses don’t have the right financial data, they often:

- Overpay in taxes

- Underspend on profitable areas

- Fail to scale at the right time

- Hire too early or too late

- Miss investment opportunities

- Price services incorrectly

- Keep unprofitable products or clients

The unseen cost:

Lost revenue = £10,000–£100,000+ over the years.

How a financial accountant protects you:

Financial modelling, scenario analysis, tax optimisation, and strategic guidance.

-

Cost of Poor Bookkeeping and Clean-Up Work

Many small businesses hire an accountant too late — after things go wrong.

Typical catch-up or clean-up fees:

- 6–12 months of bookkeeping backlog: £600–£3,000

- Fixing incorrect VAT returns: £200–£1,200

- Reconstructing lost receipts/invoices: £300–£2,000

- Fixing payroll mistakes: £100–£800

Most of these costs are avoidable with consistent, professional financial accounting.

-

Long-Term Risks of Not Hiring a Financial Accountant

Several of these issues remain invisible until they cause major setbacks:

- Being denied bank loans due to messy accounts

- Failed investor pitches from inaccurate numbers

- Losing money through inefficient tax structure

- Paying more tax than required for years

- Cash flow instability

- Business shutting down due to poor financial planning

A financial accountant acts as a long-term safety partner, not just a number cruncher.

Real-World Examples: How Different UK Businesses Benefit from a Financial Accountant

-

Small E-Commerce Store (Cash Flow Issues)

- Problem: Strong sales but unpredictable cash flow and VAT payments.

- Solution: Implemented cash flow forecasting and planned VAT payments.

- Result: Improved cash flow by 40% and avoided penalties.

-

Growing Service Business (Hiring Staff)

- Problem: Uncertainty around hiring due to fluctuating revenue.

- Solution: Built financial models to time hires and ensured payroll compliance.

- Result: Safely hired new staff, stabilised cash flow, and improved margins.

-

Sole Trader Transitioning to Limited Company

- Problem: Unsure if incorporation would save tax.

- Solution: Provided tax comparison and set up proper company accounts.

- Result: Saved over £3,500 annually and enhanced professional credibility.

-

Restaurant with High Operating Costs

- Problem: Profitability unclear due to high costs.

- Solution: Introduced menu costing and weekly cash flow tracking.

- Result: Reduced costs by 18% and increased monthly profit.

Financial accountants help UK businesses stay compliant, manage cash flow, optimise costs, and plan for growth. They ensure accurate accounts, efficient payroll, and tax savings, giving business owners confidence and clarity to make informed decisions.

Frequently Asked Questions

- What qualifications should a financial accountant have in the UK?

A financial accountant should hold ACA, ACCA, or CIMA qualifications to ensure UK accounting standards and compliance are met

- Is a financial accountant worth it for a small business?

Yes. A financial accountant provides accurate financial statements, tax compliance, and strategic guidance. Small businesses benefit by saving time, reducing errors, and making better financial decisions.

- What’s included in financial accounting services?

Services include financial statements, year-end accounts, VAT & tax compliance, cash flow, payroll, and audit support to ensure UK regulatory compliance.

- Can I outsource a financial accountant?

Yes, many UK businesses hire outsourced or freelance accountants for cost-effective, remote expertise without a full-time hire.

- How often do I need to meet my accountant?

Meeting frequency depends on business size—small businesses usually meet monthly or quarterly, while larger companies need more frequent reporting.

Conclusion & Call to Action

A financial accountant is more than a numbers expert; they are a trusted partner who ensures your business stays compliant, financially organised, and prepared for growth. From small businesses to limited companies, having a financial accountant provides clarity, reduces errors, and supports informed decision-making.

If you want to streamline your accounts, avoid HMRC penalties, and gain expert financial insights, now is the time to hire a financial accountant.

Call to Action:

Contact a professional financial accountant today to schedule a consultation and secure your business’s financial future.