Looking for an accountant near me in the UK? Across self-employed, business, landlord, or limited company needs, a professional accountant ensures efficiency, tax optimisation, and HMRC compliance.

People prefer local accountants for their reliability and understanding of the area’s tax rules and market. They provide personalised support with Self Assessment, bookkeeping, payroll, VAT, and ongoing financial advice.

Here, you’ll discover how to identify the best accountant for your needs, understand their services, compare UK pricing, and know exactly what to look for before you commit. By the end, you’ll know exactly how to find a trusted accountant in your city who fits your needs.

What Does “Accountant Near Me” Really Mean?

“Accountant near me” means you’re looking for a trusted, local accountant in your city — whether it’s London, Manchester, Birmingham, Loughborough or anywhere else in the UK — who can help with taxes, bookkeeping, business accounts, HMRC compliance, or financial advice.

People search for an accountant near them when they want:

- Someone who understands local UK tax rules

- A professional they can meet in person if needed

- Quick and easy access for ongoing support

- An accountant familiar with their income type or business sector

For example:

- Self-employed freelancers in London often look for accountants near them to manage Self Assessment efficiently.

Hiring a local accountant ensures faster support, personalised guidance, and peace of mind in your city.

What Services Does a Local Accountant Near Me Offer?

A local accountant near you can help with bookkeeping, payroll, business accounts, Self Assessment, HMRC compliance, and financial advice tailored to your personal or business needs.

Here’s what local accountants commonly provide:

What Can a Local Accountant in [City] Help Me With?

With a nearby accountant, you can stay on top of your daily finances while keeping your tax responsibilities organised. Typical services include:

- Bookkeeping and transaction recording

- Self Assessment tax returns for individuals or landlords

- Company accounts and corporation tax services for UK limited companies

- VAT registration support and quarterly VAT return filing

- Payroll management and workplace pension administration for your employees

- Tracking expenses and producing financial reports

- Tax planning to reduce your legal tax liability

- Business guidance and financial strategy

Tip: Local accountants not only handle numbers—they help you save time and avoid costly mistakes.

Do Local Accountants Handle UK Tax Returns?

Yes — accountants near you can prepare and submit personal and business tax returns to HMRC, whether you’re in London, Manchester, Loughborough or elsewhere.

They handle:

- Self Assessment for self-employed individuals

- Tax returns for landlords and rental income

- Corporation tax filing for limited companies

- Capital gains tax reporting and submission

- HMRC correspondence and penalty avoidance

Do Accountants Near Me Offer Business Advisory Services?

Many UK accountants provide strategic advice to help your business grow and save money on taxes.

Examples of advisory services for local clients:

- Cash flow planning and budgeting

- Local startup assistance to help you launch confidently

- Expert advice on whether to operate as a sole trader or form a limited company

- Tax efficiency and allowable expense guidance

- Financial forecasting for small businesses

Regional knowledge matters: an accountant in Manchester may understand city-specific business challenges better than a generic online service.

Services Offered by Accountants Near Me Your City

Bookkeeping, Self-Assessment & Small Business Accounting Services Near You

Local accountants in cities like London, Manchester, Birmingham, and across the UK offer a full range of financial and tax services tailored to individuals, landlords, small businesses, and limited companies.

Core Services Provided:

- Preparing and filing Self Assessment and corporation tax returns

- Bookkeeping (income/expense recording, reconciliations, financial statements, expense categorisation)

- Payroll and pensions

- VAT registration and returns

- Claiming allowable expenses and handling HMRC correspondence

- Rental income reporting and property-related tax planning

- Cloud accounting software support (Xero, QuickBooks, Sage)

- Cash flow planning, growth advice, and strategic financial guidance

- Annual accounts preparation for limited companies

How These Services Apply Locally

Bookkeeping:

Local accountants keep your records accurate and compliant.

Example: Manchester small business owners rely on local bookkeepers for VAT-ready records and time savings.

Self Assessment:

Nearby accountants simplify tax returns and ensure compliance.

Example: Freelancers in London often hire local help to file correctly and avoid penalties.

Small Business Support:

Accountants in your city manage accounts, payroll, VAT, and tax strategy.

Example: Birmingham businesses benefit from professionals who understand local regulations.

Landlord Accounting:

Specialists help with property income, mortgage interest, allowable expenses, and capital gains.

Example: Manchester landlords with multiple properties use local accountants to reduce tax and stay compliant.

Limited Companies:

Experts take care of annual accounts, corporation tax filings, VAT returns, payroll duties, and long-term financial planning.

Example: London startups work with local accountants to structure their company properly and optimise tax.

How to Choose the Best Local accountant

To choose the best accountant near you in the UK, look for qualifications, local experience, transparent pricing, and strong reviews from clients in your city.

Key Factors to Consider When Hiring a Local Accountant

A reliable accountant in London or any UK city should be professionally qualified and registered with a recognised accounting body. This ensures they follow strict standards and ongoing training.

Preferred Qualifications:

• ACCA

• ICAEW

• CIMA

• AAT

Why it matters:

Qualified professionals minimise risks and keep your accounts compliant.

Tip: Always ask for their membership number and confirm it through the relevant body’s online directory.

How to Choose a Trustworthy Accountant Near Me

Selecting the right accountant — whether local or specialist — is key to saving time, reducing tax, and avoiding costly mistakes. Follow these steps:

Verify Credentials:

- Ask for their membership or registration number.

- Confirm it on the ACCA, ICAEW, CIMA, or AAT websites.

- Check Google and social media reviews specific to your city.

- Visit their office if nearby, or request a video call.

- Review their website, team profiles, and client feedback.

Consider a Specialist Accountant:

Specialists are particularly valuable for self-employed individuals, landlords, contractors, or limited companies. They can help you:

- Claim all allowable expenses

- Reduce tax legally

- Avoid costly errors

- Avoid delays and stress

Examples of Specialist Support:

- Landlords in Manchester: property tax expertise

- Contractors in London: IR35 guidance and company structure advice

A qualified accountant who is both credible and knowledgeable about your sector and local regulations ensures compliance and maximises financial benefits.

Key Warning Signs

Avoid accountants who:

- Lack recognised qualifications

- Provide unclear or inconsistent pricing

- Promise unrealistic tax refunds

- Communicate poorly or respond slowly

- Have no genuine reviews or unverifiable listings

- Request cash-only payments

- Pressure you into signing quickly

- Refuse to issue a written engagement letter

Rule of thumb: Prioritise transparency, professionalism, and local reputation over low-cost offers.

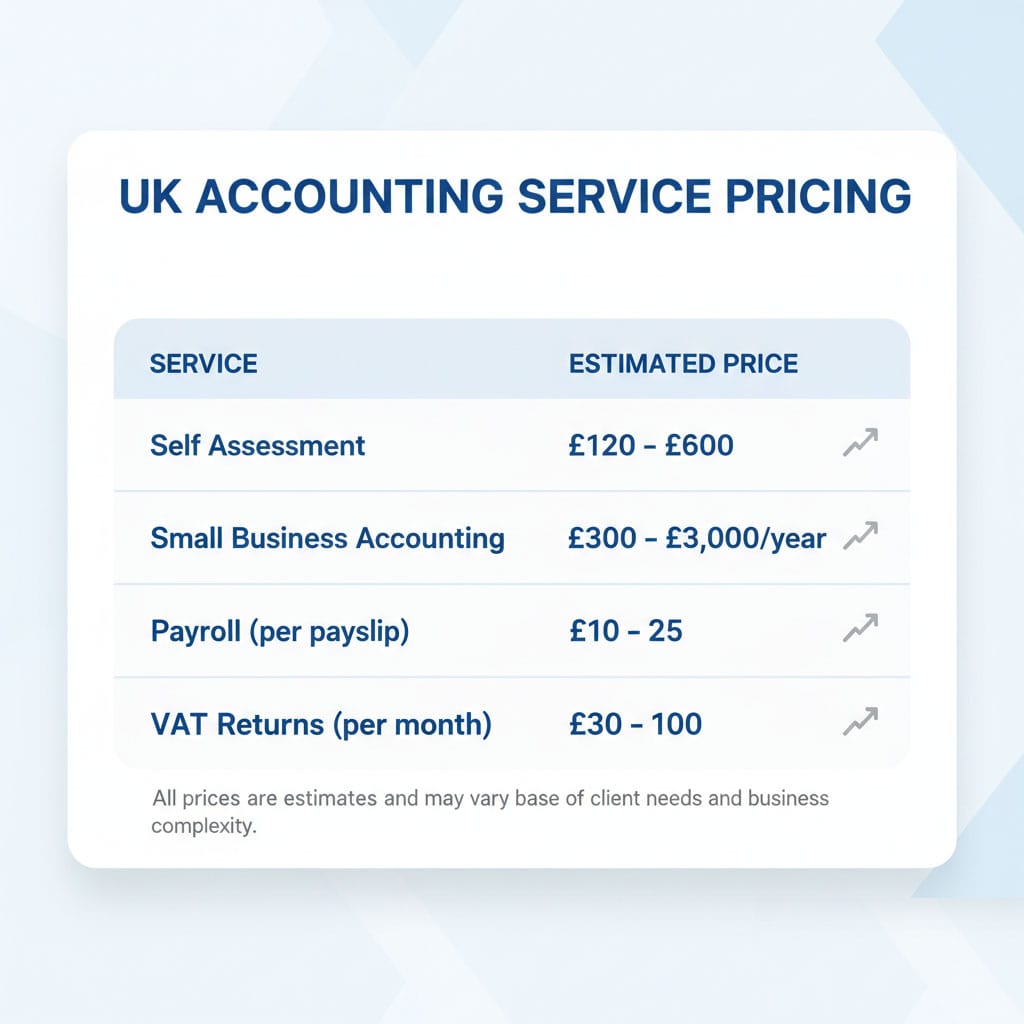

How Much Does an Accountant Near Me Cost in London, Manchester, Birmingham, or Your City? (UK Pricing Guide)

The cost of hiring an accountant in the UK depends on where you are, the type of services required, and how complex your financial situation is.

On average, individuals pay £150–£900 per year, while small businesses pay £600–£3,000+ per year. Costs may be higher in London or larger cities due to demand and operating expenses.

Average Fees for Personal Tax Returns in the UK

A local accountant near you typically charges:

- £120–£250 for a basic Self Assessment (London, Manchester, Birmingham)

- £200–£350 for landlords with one rental property

- £350–£600 for multiple income sources (employment + property + self-employment)

- £300–£700 for capital gains tax reporting

Factors that influence cost:

- Complexity of income

- Missing records or late submissions

- Urgent HMRC deadlines

- Past penalties or HMRC enquiries

Tip: Residents in London may pay slightly more than smaller cities like Manchester or Birmingham, but value and expertise matter most.

Average Fees for Small Businesses

Sole Traders

- £300–£900/year: bookkeeping + Self Assessment + advice

Limited Companies

- £600–£2,500/year, depending on:

- Number of transactions

- VAT registration

- Payroll services

- Bookkeeping complexity

- Ongoing advice

Additional Services

- Payroll: £10–£25 per payslip

- VAT returns: £30–£100/month

- Bookkeeping: £25–£45/hour

- Company formation: £50–£150

Small businesses in London or Birmingham may face higher fees, but a qualified accountant saves more in tax and compliance costs.

Why Prices Differ Between Accountants

Costs vary due to:

- Qualifications & experience: Chartered accountants charge more but provide higher expertise

- Location: Major cities often cost more than smaller towns

- Service level: Basic filing is cheaper; strategic advice is pricier

- Technology: Cloud accounting software (Xero, QuickBooks) may offer better value

- Specialisation: Niche accountants (property, contractors, e-commerce) may charge more but save you more tax

The cheapest accountant is rarely the best. Prioritize value, expertise, and local experience in your city.

Local Accountant vs Online Accountant — Which Is Better for You?

Choosing between a local accountant and an online accountant depends on how you prefer to communicate, the complexity of your finances, and whether you want personalised, face-to-face support.

When a Local Accountant Is Better

A local accountant is best if you value personal meetings and city-specific expertise.

Choose a local accountant near you when:

- You want face-to-face consultations in London, Manchester, Birmingham, or nearby

- Complex finances with multiple income streams

- You prefer direct communication rather than emails or messages

- Your small business requires ongoing strategic advice

- You want someone familiar with local tax regulations and business environment

Example: Landlords in your city often benefit from local accountants familiar with city property tax regulations.

When an Online Accountant Is Better

Online accountants are ideal if you prefer speed, automation, and lower costs.

Benefits include:

- Paperless onboarding from anywhere in the UK

- Cloud bookkeeping and mobile app support

- Automated reminders for deadlines

- Lower monthly costs compared to city-based offices

- Quick digital support via email or chat

Example: Freelancers in Birmingham can use online accountants to file Self Assessment without visiting a local office.

Hybrid Accountant Services

Many accountants now offer a hybrid approach — combining online tools with optional in-person support.

Advantages for local clients:

- Cloud software for convenience

- Video calls or office visits when needed

- Faster communication without losing personal advice

- Flexible pricing based on services used

This approach works well for residents in London, Manchester, or smaller UK cities who want efficiency without sacrificing personal service.

When Do I Need to Hire Nearby accountant?

You should hire an accountant near you when your finances become complex, you want to reduce time spent, or you need expert help to stay compliant with UK tax rules.

Residents across the UK — whether in London, Manchester, Birmingham, or smaller towns — benefit from hiring an accountant early rather than waiting until tax season or financial issues arise.

For Self-Employed and Sole Traders

If you’re self-employed, a local accountant can manage your records, help you claim all allowable expenses, and avoid mistakes with HMRC.

Hire an accountant near you if:

- Your business is growing in London, Manchester, or Birmingham

- You have regular income and multiple expenses

- You want to reduce your tax legally

- You don’t have time for bookkeeping

- You’re unsure about HMRC rules

Local accountants can also advise when it’s time to move from a sole trader to a limited company, depending on your city’s business environment.

If You Run a Limited Company

Limited companies in the UK almost always need an accountant — especially in busy cities.

Accountants handle:

- Annual accounts

- Corporation tax filings

- Dividends and payroll

- VAT returns

- Director responsibilities

An accountant ensures compliance, minimises mistakes, and provides strategic advice tailored to your city’s business regulations.

For Landlords, Investors, and Contractors

If you earn income from property, investments, or contracting, a local accountant helps you follow the correct UK tax rules and avoid overpaying.

Landlords in your city:

- Multiple properties

- Mortgage interest adjustments

- Repairs & maintenance claims

- Property disposals and capital gains

Investors:

- Dividend income

- Shares, crypto gains, or interest income

Contractors:

- IR35 advice

- Limited company setup

- Payroll & dividends

Residents in London, Manchester, or Birmingham with multiple income streams gain immediate value from hiring a qualified local accountant.

What to Prepare Before Meeting an Accountant Near Me

Before meeting a local accountant near you, gather your financial records, tax documents, ID, business information, and a list of questions.

Being prepared helps accountants in the UK city understand your situation quickly and give accurate advice.

Required Documents (Tax, Business, ID, Financials)

To make your first meeting smooth, bring documents showing your income, expenses, and identity.

For Individuals (Self Assessment):

- PAYE payslips

- Invoices and expense receipts

- Banking summary

- Pension or investment documents

- Property rental income records

- Previous tax returns (if available)

For Businesses:

- Business bank statements

- Sales invoices & expense records

- Bookkeeping software exports (Xero, QuickBooks, Sage)

- Payroll summaries

- VAT records (if registered)

- Company incorporation documents

You should also have:

• Unique Taxpayer Reference (UTR)

• National Insurance Number

• A valid passport or driving licence

Tip: Even if some documents are missing, your accountant in London, Manchester, or Birmingham can guide you on recreating records.

Questions to Ask During Your First Consultation

Asking the right questions ensures the accountant near you is the right fit.

Ask:

- “What services do you offer for clients in [City]?”

- “Do you specialise in businesses or individuals like me?”

- “How much will this cost per month/year in my city?”

- “Email, phone, or meetings — how do you stay in touch?”

- “Do you help with tax planning or just filing?”

- “What software do you use?”

- “Do you handle HMRC letters or enquiries?”

- “Will I have my own dedicated accountant?”

- “How long will it take to complete my tax return/accounts?”

Approach the meeting like a job interview — you’re selecting your accountant as carefully as they are selecting clients. Expertise in your local area ensures personalised guidance.

How to Find the Best Chartered accountant near me in your city

Finding the best accountant near you in the UK requires checking qualifications, local experience, reviews, and pricing.

A good local accountant should be easy to contact, understand UK tax rules, and have experience with clients in your city.

Search on Google Maps or Local Directories

Google Maps and local directories are the quickest way to find accountants in your city.

Look for:

- 4.5+ ratings and recent reviews

- Verified business listings

- Photos of a real office in London, Manchester, Birmingham, or nearby

- A professional website link

These details help avoid unregistered or unprofessional firms.

Check Professional Bodies (ACCA, ICAEW, AAT)

Always confirm that your local accountant is professionally qualified.

- ACCA Member Directory

- ICAEW Find a Chartered Accountant

- AAT Licensed Accountant Register

Being listed ensures they are certified and trustworthy.

Compare Services, Not Just Prices

Two accountants may charge similar fees, but offer very different levels of service.

Check if they provide:

- Self Assessment and tax filing

- Keeping your books up to date and generating reports

- VAT and payroll management

- Business advice for small businesses or landlords

- HMRC correspondence support

- Cloud accounting software setup (Xero, QuickBooks, Sage)

Residents in London, Manchester, or Birmingham should prioritise value over cost, especially if you need specialised services.

Review Local Experience

Choose an accountant familiar with your city’s specific business or tax environment.

Examples:

- Landlords in Manchester: property tax expertise

- Contractors in London: IR35 and limited company guidance

- Birmingham-based small businesses: VAT management, payroll administration, and corporation tax compliance

Arrange a Complimentary Consultation

Most reputable accountants in the UK offer a free initial consultation.

During this call, ask:

- “How will you help me save tax in my city?”

- “What will my total yearly cost be?”

- “How fast do you respond to clients?”

- “How secure is my data?”

If they struggle to answer confidently, it’s a red flag.

Choose an Accountant Who Communicates Clearly

Communication is key — especially when your accountant is near you.

- Explains tax in simple terms

- Gives practical, city-specific advice

- Is easy to reach by phone, email, or in person

- Provides reminders for deadlines

Good communication often makes the difference between relief and stress for local clients.

How to Avoid Bad or Unqualified Tax advisor in Your City

Hiring the wrong accountant near you can cost time, money, and even trigger HMRC penalties.

Residents in London, Manchester, Birmingham, and other UK cities should know how to identify trustworthy professionals.

Check Qualifications and Memberships

Always verify that your local accountant is qualified and registered.

- Look for ACCA, ICAEW, CIMA, or AAT credentials

- Confirm their membership through official websites

- Avoid accountants who cannot provide proof of certification

Qualified accountants follow strict standards and minimise the risk of errors.

Watch Out for Red Flags

Avoid accountants who:

- Promise unrealistic tax refunds

- Refuse to give a written contract

- Charge “cash-only” fees without invoices

- Don’t answer questions clearly

- Have poor or no reviews

These signs may indicate unprofessional or untrustworthy accountants in your city.

Verify Their Online Presence

Check for:

- A professional website

- Google My Business profile

- Social media accounts

- Recent client testimonials

If a local accountant is active online, it’s a good sign they’re legitimate and professional.

Ask for References

Always request references from clients in your city.

Confirm:

- Reliability and responsiveness

- Accuracy of tax filings

- Value for money

- Professional behaviour

Real client feedback gives confidence in their service.

Listen to Your Instincts

If it feels wrong, it probably is.

Even if the price is low or the office looks nice, transparency, clarity, and local reputation matter most.

A good accountant is qualified, communicative, trustworthy, and delivers value. Avoid shortcuts — especially in your city, where local knowledge can make a big difference.

Client Testimonials & Case Studies Of Accountancy services near me

Self-Assessment — Freelancer, London

Situation: Freelance graphic designer with multiple UK clients, struggling with expense tracking and Self Assessment.

Solution: Local accountant organised records, submitted Self Assessment, claimed all allowable expenses.

Result: Saved £2,400 in taxes, avoided penalties, gained 10+ hours/month.

Client Feedback: “Hiring a local accountant in London was the best decision this tax year — efficient and supportive.”

Small Business Advisory — Retailer, Manchester

Situation: Small retail shop needing help with VAT, payroll, and cash flow.

Solution: Set up Xero bookkeeping, managed VAT and payroll, provided monthly reports and advisory.

Result: Saved £1,800, improved cash flow visibility, reduced admin by 15 hours/month.

Client Feedback: “Our Manchester accountant made financial management stress-free. I can focus on growing the business.”

Landlord Tax Planning — Property Owner, Birmingham

Situation: Landlord with 3 rental properties, unsure about allowable expenses and capital gains.

Solution: Tracked income/expenses, advised on deductions, submitted property tax returns.

Result: Reduced tax liability by £3,200, avoided penalties, gained clarity on portfolio management.

Client Feedback: “Our Birmingham accountant gave us peace of mind and real savings.”

People Also Ask — On accountant near me

Do I need an accountant for my tax return in London, Manchester, or Birmingham?

If you’re self-employed, a landlord, or have multiple income streams, a local accountant ensures accurate Self Assessment, maximises expenses, and avoids HMRC penalties. For simple employment income, one may not be needed.

Can a nearby accountant save me money on taxes?

Yes — a qualified accountant in London, Manchester, or Birmingham can uncover missed deductions and prevent costly tax errors.

Is a chartered accountant in my city better?

Yes — chartered accountants (ACCA, ICAEW, CIMA) are professionally certified and follow strict standards.

Choosing one in your area ensures compliance and expert advice tailored to your city’s financial environment.

Do accountants near me handle HMRC letters and penalties?

Yes — Local accountants in London, Manchester, or Birmingham handle HMRC correspondence, resolve disputes, and save you time and stress.

How fast can an accountant near me file my tax return?

Simple returns can be completed in 24–72 hours if documents are ready, while complex returns may take longer. Local accountants familiar with your city can help speed up the process.

Conclusion — Ready to Hire the Best Accountant Near Me in Your City?

Looking for a qualified accountant near you in the UK? It’s easier than you think.

By checking qualifications, comparing services, reviewing fees, and asking the right questions, you can hire a trustworthy professional who saves time, reduces tax risks, and helps your finances grow — whether you’re in London, Manchester, Loughborough, Birmingham, or anywhere else in the UK.

Call to Action

- Book a free consultation today with an accountant near you in London, Manchester, Birmingham, or your city

- Contact us for personalised advice on tax, bookkeeping, or business support