A small business accountant does far more than handle figures — they become a reliable advisor who helps UK business owners stay compliant, stay organised financially, and make confident, informed decisions. Whether you run a startup, limited company, or growing small business, the right accountant ensures accurate books, correct tax filings, and no missed financial opportunities.

With complex HMRC rules, VAT obligations, and payroll tasks, managing everything alone can be overwhelming. A skilled startup accountant UK can save time, reduce stress, and even boost profitability through expert bookkeeping, tax planning, cash flow support, and strategic financial advice.

In this guide, we’ll break down the key benefits, services, costs, and tips for choosing the best small business accountant — helping you make a confident, informed choice for your business success.

What Functions Does a Small Business Accountant Perform?

A skilled small business accountant helps streamline bookkeeping, manage taxes efficiently, and maintain organised financial records. Unlike general accountants, they focus on the unique challenges faced by startups, sole traders, and limited companies in the UK. Their expertise covers bookkeeping, tax compliance, payroll, and financial planning, helping business owners make smarter decisions without getting lost in paperwork.

For example, a small café in London may rely on a local small business accountant to track daily sales, manage VAT returns, and forecast cash flow for seasonal fluctuations. By doing so, the business remains within HMRC guidelines and avoids unnecessary charges.

In short, a startup accountant UK is not just a number cruncher—they are a strategic partner who guides your business towards financial stability and growth, allowing you to focus on running your operations effectively.

How Accountants Add Value to Small Businesses in the UK

Hiring a small business accountant helps UK business owners stay compliant, avoid costly mistakes, and make smarter financial decisions. They handle HMRC obligations such as VAT returns, corporation tax, and payroll—tasks that can quickly lead to fines if done incorrectly.

Tax Compliance and HMRC Requirements

An accountant ensures your tax returns are accurate, submitted on time, and fully compliant with UK regulations. It matters most for companies that process VAT, trade digitally, or have diverse revenue sources.

Financial Forecasting and Cash Flow Management

Accountants do more than handle compliance — they guide cash flow, budgeting, and long-term growth planning. Their insights allow you to invest confidently without risking day-to-day stability.

Saving Money Through Deductions

A skilled accountant identifies tax deductions and allowances you might miss—such as equipment, travel, or home-office expenses—helping reduce your overall tax bill.

Q: What makes an accountant important for UK small businesses?

A: To stay HMRC-compliant, improve cash flow, optimise finances, and save money through accurate tax planning.

Services Provided by Small Business Accountants

From bookkeeping to financial planning, a small business accountant offers solutions that make managing money simpler and growth-focused. Their work goes beyond filing taxes—they act as your financial partner, ensuring your business runs smoothly and efficiently.

- Core Bookkeeping and Accounting Support

With accurate bookkeeping of income, expenses, and invoices, accountants give you a transparent view of your cash flow, supporting smarter business choices. For example, a retail shop may use a small business accountant to reconcile daily sales and monthly expenses.

- Payroll Management

Managing salaries, pensions, and PAYE compliance can be complex. A small business accountant ensures staff payments are correct and on time, while keeping your business compliant with HMRC payroll regulations.

- Tax Filing and VAT Returns

Accountants handle corporation tax, income tax, and VAT filings, reducing errors and penalties. They also advise on tax planning strategies to maximise deductions and allowances.

- Business Advisory and Financial Planning

Beyond compliance, accountants provide strategic advice. They can help plan budgets, forecast growth, and make investment decisions that strengthen your business financially.

- Specialised Services

Some accountants offer services tailored to specific industries, such as e-commerce VAT, contractor finances, or charity accounting, providing expertise that generic accountants may lack.

Q: The Ways a Small Business Accountant Can Assist You

A: They handle bookkeeping, payroll, tax filing, VAT returns, financial planning, and offer business growth advice tailored to UK small businesses.

How the Working Process with a Small Business Accountant Works

- Initial Consultation – Discuss your business, identify needed services, and set expectations.

- Onboarding & Setup – Review records, set up accounting software, and agree on document sharing.

- Ongoing Bookkeeping & Compliance – Provide data; accountant manages reconciliation, payroll, and VAT.

- Strategic Advice & Planning – Review progress, forecast cash flow, and get growth guidance.

- Annual Accounts & Tax Filing – Prepare year-end accounts and ensure all deductions are claimed.

- Continuous Support – Handle HMRC queries, audits, and provide ongoing advice.

Q: How does working with a small business accountant actually work?

A: You provide financial data regularly, your accountant manages bookkeeping, compliance, and taxes, and they offer strategic advice and planning to support business growth.

How a Small Business Accountant Supports Different Industries

A small business accountant isn’t one-size-fits-all. Different industries face unique financial challenges, and a specialist accountant can make a huge difference. Here’s how they support key UK sectors:

- E-Commerce Businesses

Online stores deal with VAT on UK/EU sales, platform fees, and inventory management. An accountant for ecommerce business can:

• Handle VAT for domestic and international sales

• Manage multi-platform cash flow

• Advise on software integrations (Shopify, Amazon, WooCommerce)

• Identify tax reliefs for digital expenses

- Contractors & Freelancers

Contractors face IR35 rules, limited company decisions, and self-assessment. An accountant for freelancers help by:

• Ensuring IR35 compliance

• Managing salary/dividends tax-efficiently

• Preparing self-assessment returns

• Advising on allowable expenses

- Service-Based Businesses

Consultants, salons, and agencies often juggle payroll and seasonal cash flow. Accountants help with:

• PAYE and payroll management

• Budgeting for fluctuating income

• Profitability analysis

• Spotting growth opportunities

- Startups & Scale-Ups

New businesses need structure from day one. An accountant for startup UK can:

• Advise on formation and tax-efficient setup

• Forecast cash flow

• Implement accounting software

• Guide on funding, grants, and investment

How a Small Business Accountant Supports Different Industries

E-commerce: VAT, cash flow, software, digital expenses.

Contractors/Freelancers: IR35, dividends, self-assessment, expenses.

Service businesses: Payroll, budgeting, profitability, growth.

Startups/Scale-ups: Formation, cash flow, software, funding guidance.

How Much Will a Small Business Accountant Cost You in the UK?

There isn’t a one-price-fits-all answer — the cost depends on your business needs, required services, and if you prefer working with an online accountant or a traditional practice. On average, small business accounting costs usually fall into these ranges:

- Monthly packages: £50–£300 per month, covering bookkeeping, tax submissions, and advisory support.

- Hourly rates: £30–£100 per hour for individual consultations or specialised financial guidance.

Annual fees: £500–£3,000 for comprehensive accounting services, including payroll and VAT returns.

Factors Affecting Pricing

- Business size and complexity – More transactions and employees increase costs.

- Services required – Full-service accountants cost more than bookkeeping-only services.

- Accountant type – Chartered accountants may charge higher rates, while online accountants often offer competitive, flexible pricing.

Online vs Traditional Accountants

Online accountants often provide cost-effective, software-integrated services, ideal for small or startup businesses. Traditional accountants may offer personalised, face-to-face support, which can be valuable for complex financial situations.

Q: Small Business Accountant Costs Explained for UK Entrepreneurs

A: Costs range from £50–£300 per month, £30–£100 per hour, or £500–£3,000 annually, depending on services, business size, and accountant type.

Detailed Pricing Models & Value Comparison

Typical Pricing Models in the UK

Here are the main ways accountants charge small businesses, with associated ranges and what to look for:

| Model Type | How It’s Charged | Typical UK Fee Range* | What’s Included / Notes |

| Monthly fixed‑package | One predictable fee per month | ~ £60 – £450/month for many small businesses. | Usually includes bookkeeping, annual accounts, tax return, potentially VAT & payroll depending on tier. |

| Annual package / retainer | One annual fee covering year‑end | ~ £720 – £3,000+ per year for limited companies. | Covers compliance (accounts + CT600 + Self Assessment + maybe some advisory) but less ongoing service. |

| Hourly or one‑off fee | Charged per hour or per task | ~ £20‑£45/hour for bookkeeping; ~ £150‑£350 for a Self Assessment tax return. | Good for limited needs (sole trader, no payroll, no VAT). |

| Specialist/complex business | Higher rates for niche or complex | ~ £150‑£300+ per month (or more) for e‑commerce, large transaction volumes, international VAT. | The complexity drives cost—more platforms, transactions, regulation. |

*These are indicative ranges based on 2024‑25 UK market data.

Comparing Costs and Benefits

To assess whether a price is fair, compare what the service includes and how it delivers value beyond just “bookkeeping.”

Low Tier (Entry / Sole Trader / Simple Ltd):

- Typical fee: ~ £50‑£100/month or ~£600‑£1,200 annually.

- Includes: Basic bookkeeping, annual accounts submission, Self Assessment tax return, maybe limited advisory.

- Value: Suitable if you have straightforward finances and minimal VAT/ payroll complexity.

- Watch‑out: If you grow (VAT, employees, stock, e‑commerce) this tier may need upgrade.

- Typical fee: ~ £100‑£250/month or ~£1,200‑£3,000 annually.

- Includes: Monthly bookkeeping, quarterly VAT returns, payroll for a few employees, annual accounts + tax planning.

- Value: Good balance of compliance + advisory; keeps you ahead of warnings/ HMRC issues.

- Watch‑out: Ensure the package clearly spells out what’s included and ask about extras (e.g., extra employees, large transaction volumes).

Tips to Maximise Value & Control Costs

- Use cloud accounting software (e.g., Xero, FreeAgent) and keep books clean: less manual work means lower fees.

- Understand exactly what the monthly fee covers (transactions cut‑off, employee count, VAT regime) and what triggers extra charges.

- Ask for transparent pricing tiers and “what’s included” lists.

- Understand when you’ll need to upgrade tier and what that cost looks like (planning for growth pays).

- Compare online vs traditional: many online accountancy packages start lower due to automation and remote delivery.

- Remember: cheapest isn’t always best. A slightly higher fee with better advisory support and fewer HMRC risks may save you money long term.

Example Scenarios (Value Illustration)

- Scenario A: Sole trader, turnover £40k, no employees, no VAT. Accountant charges £75/month. You get compliance handled, peace of mind, minimal interruption.

- Scenario B: Ltd company, turnover £250k, 3 employees, quarterly VAT returns, online sales. Accountant charges £180/month with full bookkeeping + advisory. Versus doing yourself, you save hours, avoid penalties, and get expert advice on dividends & tax savings.

Your Guide to Hiring a Trusted Small Business Accountant

- Check Qualifications and Certifications

Ensure your accountant is qualified and recognised by UK professional bodies like ACCA, ICAEW, or AAT. Holding these certifications guarantees skill and conformity with professional guidelines.

- Skilled in Your Business Field

Work with an accountant who understands your line of business. A small business accountant experienced with retail, e-commerce, or service-based businesses can provide more relevant advice and anticipate sector-specific challenges.

- Explore What Other Clients Say

Consider reviews from other small companies. Positive reviews indicate reliability and professionalism, while case studies can show the tangible impact of their services.

- Evaluate Communication and Accessibility

An accountant should be easy to reach and willing to explain financial concepts in plain English. Transparent communication keeps you informed and confident about your finances.

- Flag Potential Concerns

Avoid accountants who are vague about fees, promise unrealistic tax savings, or lack transparency in reporting. A trustworthy small business accountant prioritises clarity, compliance, and ethical advice.

Q: How do I choose the right small business accountant?

A: Look for qualified professionals with industry experience, positive reviews, clear communication, and transparent fees to ensure reliable financial guidance.

Online vs Local Accountants: Which is Best?

| Feature | Online Accountant | Local Accountant |

| Cost | Usually cheaper, subscription-based | Often higher, traditional fees |

| Communication | Email, chat, video calls | In-person, personalised meetings |

| Tools | Cloud-based, real-time access | Mix of digital + traditional methods |

| Industry Understanding | May lack local/niche insight | Strong local knowledge and networks |

| Best For | Startups, e-commerce, remote teams | Complex or fast-growing businesses |

| Flexibility | High — remote and on-demand | Limited — office hours and scheduling |

Making the Choice

A small business accountant should match your business size, complexity, and preferred interaction style. Many UK businesses now combine both—using an online accountant for routine tasks and a local accountant for strategic advice.

Q: Should I hire an online or local small business accountant?

A: Online accountants are cost-effective and convenient, while local accountants provide personalised, face-to-face support for complex financial needs.

Risk Management and Audit Preparation

A small business accountant helps protect your UK business from financial risks and prepares you for potential HMRC audits. They ensure your records are accurate, complete, and up-to-date, reducing the chance of errors or penalties.

Key ways accountants manage risk:

- Maintain organised bookkeeping and digital receipts

- Check compliance with VAT, payroll, and corporation tax rules

- Prepare supporting documents in case of HMRC inquiries or audits

- Advise on tax planning and legal obligations to minimise exposure

Q: Can a small business accountant help with HMRC audits?

A: Yes. They ensure your records are audit-ready, manage communication with HMRC, and reduce financial and legal risks.

Tech and Cloud Integration with Small Business Accountants

Platforms like Xero, QuickBooks, FreeAgent, and Sage allow real-time access to accounts, automated invoicing, and easy VAT filing.

With cloud integration, you can:

- Share financial data securely with your accountant anytime

- Get real-time insights into cash flow and expenses

- Reduce manual data entry and errors

- Collaborate remotely without the need for in-person meetings

Using a small business accountant alongside cloud software ensures compliance with HMRC, improves efficiency, and frees you to focus on growing your business.

Strategic Role of a Small Business Accountant in Growth Planning

A small business accountant is more than a compliance expert—they act as a strategic partner for business growth. Beyond bookkeeping and tax filing, they help you:

- Forecast cash flow to plan investments or expansions

- Analyse profitability across products, services, or departments

- Assist in evaluating funding options, from grants and loans to investor backing

- Plan for business exit or sale with tax-efficient strategies

Collaborating with a small business accountant allows UK business owners to make smarter decisions, lower financial risks, and plan for long-term success.

Q: How can a small business accountant help my business grow?

A: They provide financial insights, cash-flow forecasting, investment advice, and growth strategies to help your UK business scale successfully.

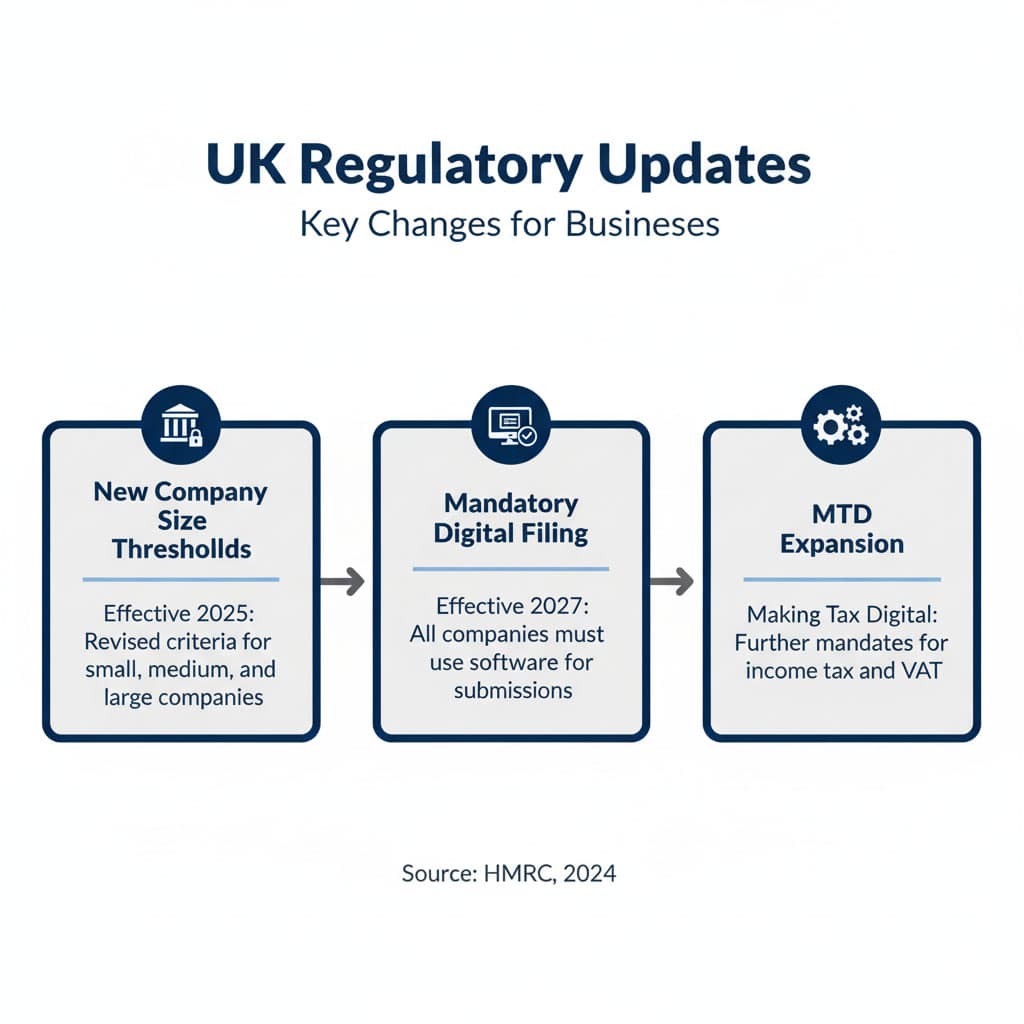

Recent UK Regulatory Changes for Small Businesses

- Higher Company Size & Audit Thresholds (From 6 April 2025)

Company size definitions are rising:

• “Small” turnover increases from £10.2m → £15m; assets from £5.1m → £7.5m.

• More companies will now qualify as “micro” or “small,” reducing reporting burdens.

What it means: Many businesses can file simpler accounts, claim audit exemptions, and reduce admin.

- New Filing Rules (From April 2027)

- All annual accounts must be filed through commercial software — no web or paper filing.

• Abridged accounts will be removed; small/micro companies must submit more detailed information.

What it means: Prepare for software-only filing and increased reporting transparency.

- Making Tax Digital (MTD) Expansion

- VAT-registered businesses must use HMRC-compatible software for VAT submissions.

• More MTD extensions (e.g., income tax) are expected.

Tip: Ensure your accounting software and processes are fully MTD-ready.

Q: What recent UK regulatory changes should small businesses know?

A: Higher company size thresholds (April 2025), software-only filing with more detailed accounts (April 2027), and continued expansion of Making Tax Digital.

Case Studies: How Small Business Accountants Help UK Businesses

Case Study 1: E-Commerce Store – VAT & Multi-Platform Management

- Problem: A London-based online shop selling on Shopify and Amazon struggled with VAT calculations across the UK and EU. Manual bookkeeping led to errors and potential HMRC penalties.

- Solution: The accountant set up cloud accounting software (Xero) integrated with both platforms, automated VAT returns, and streamlined invoicing.

- Result: The business avoided HMRC fines, saved 12 hours per month on manual bookkeeping, and improved cash flow visibility.

Case Study 2: Freelancer / Contractor – Tax Efficiency & Compliance

- Problem: A contractor working through a limited company faced complex IR35 rules and uncertain self-assessment deadlines, risking overpaying taxes.

- Solution: The accountant advised on dividend vs. salary structure, managed PAYE compliance, and prepared accurate self-assessment filings.

- Result: The contractor reduced annual tax liability by 18%, stayed fully compliant, and gained confidence in managing finances.

Frequently Asked Questions

Q: What questions should I ask before hiring a small business accountant?

A: Ask about their qualifications, experience with your industry, fees, communication methods, and whether they provide strategic advice beyond tax filing.

Q: Can hiring a small business accountant help grow my business?

A: Definitely. Beyond compliance, accountants offer financial planning, budgeting, cash flow forecasting, and advice on investment opportunities to support business growth.

Q: How regularly should I check in with my accountant?

A: At a minimum, schedule quarterly meetings to review finances, discuss tax planning, and address cash flow. Some businesses benefit from monthly check-ins for real-time guidance.

Q: Can an accountant support me during an HMRC audit?

A: Definitely. A small business accountant can represent you, prepare documentation, and communicate with HMRC to ensure your audit goes smoothly.

Q: Is Accounting Software Enough to Replace a Professional Accountant?

A: Absolutely. Software helps with bookkeeping, but a professional accountant ensures compliance, optimises taxes, and provides strategic financial advice tailored to UK laws.

Q: How can I verify my accountant’s integrity?

A: Look for professional qualifications, positive reviews, transparent pricing, clear communication, and adherence to ethical standards such as ACCA or ICAEW guidelines.

Conclusion

A small business accountant is a key partner for UK business owners, helping you stay compliant, save money, and support growth. Their expertise covers bookkeeping, payroll, tax planning, and financial strategy — far beyond basic number-crunching.

Choosing the right accountant ensures accurate finances, timely filings, and reliable guidance for major decisions. Whether you prefer a local accountant for personal support or an online service for flexibility, work with someone who understands your business.

Take Action:

Book a consultation with a small business accountant. Consider online accounting services for flexible, cloud-based support.