If you’re trying to find accountant services in the UK, you’re not alone. Every year, thousands of small business owners, freelancers, and self-employed professionals search for reliable financial help to save time, reduce stress, and avoid tax mistakes. Whether you’re preparing your first tax return or managing growing business accounts, the right accountant can make all the difference.

In this guide, we’ll help you find accountant support that fits your exact needs — from understanding what an accountant does to comparing costs, verifying qualifications, and hiring online or locally. You’ll gain clarity on how to pick a trustworthy accountant, what services to expect, and how to make a smooth switch if you decide to change. Let’s start by breaking down what an accountant actually does and why having one can save you more than just money.

What Does an Accountant Actually Do?

An accountant helps individuals and businesses manage their money efficiently, ensuring everything from bookkeeping to tax returns is accurate and compliant with UK laws. In simple terms, their job is to keep your finances healthy and free you from the stress of numbers and deadlines.

Most accountants take care of tasks like:

• Completing tax returns: Making sure everything is calculated and filed correctly.

• Maintaining financial records: Monitoring all income, expenses, and documentation.

• Handling payroll and VAT: Looking after employee payments and timely VAT submissions.

- Provide financial advice: Helping you make informed business decisions or plan your personal finances.

- Support with HMRC compliance: Avoiding fines by keeping you legally compliant.

For example, a self-employed person may hire an accountant to file their Self Assessment tax return correctly, while a small business might use one to manage payroll and corporation tax.

An accountant records, analyses, and reports financial data — helping individuals and businesses stay compliant, save money, and make smarter financial decisions.

Do I Really Need an Accountant?

Yes — in most cases, hiring an accountant can save you both time and money. Whether you’re self-employed, running a small business, or managing property income, a qualified accountant ensures your finances are accurate, compliant, and tax-efficient. Many people find accountant services invaluable once they realise how much easier and safer professional support makes their financial life.

When an Accountant Can Be Especially Helpful

You may need one when:

• You’re starting a new venture or working for yourself.

• VAT registration or payroll processing becomes necessary.

• You’re confused about tax allowances or HMRC submissions.

- You’ve received an HMRC enquiry or penalty notice.

- You want strategic advice on growing your business profitably.

Example:

A UK freelancer earning £45,000 a year might think managing taxes alone is cheaper. But with an accountant’s advice, they could claim legitimate expenses (like home office, travel, and equipment) — often saving hundreds or even thousands in taxes.

When Self-Management Is Enough, and When You Need an Expert

If your finances are simple — say, you’re an employee with one source of PAYE income — you might not need to find accountant services just yet.

However, don’t risk it when:

- You have multiple income streams (e.g. rental + self-employment).

- You’ve set up a limited company.

- You’re unsure how to file returns or calculate deductions.

- You prefer the confidence of knowing your finances are managed legally and smoothly.

Think of it this way: doing your own accounts might save you money short-term, but hiring a professional could save you from costly errors later.

You need an accountant if your income or business structure is complex, you’re unsure about HMRC rules, or you want to save time and reduce tax errors. For simple PAYE income, you might manage alone — but professional help pays off as finances grow.

How to Move to a New Accountant or Hire One with No Stress

Moving to a new accountant is usually straightforward. Still, many business owners hesitate, worried about potential interruptions, compliance challenges, or lost records. By following a modern, structured process, you can find accountant support quickly, securely, and efficiently.

Step 1 — Outline Your Priorities and Goals

Get clear on your needs first:

- Do you need full-service accounting, VAT and payroll, or just annual filings?

- Do you operate as a sole trader, freelancer, or a limited company?

- Are you looking for online convenience, local support, or both?

Tip: Write down your top priorities — it will guide your search and make comparisons easier.

Step 2 — Look Into Providers and Select Your Top Candidates

Use trustworthy sources:

- Professional directories (ICAEW, ACCA, AAT)

- Verified online reviews (Google, Trustpilot)

- Referrals from peers or business networks

At this stage, aim to shortlist 3–5 accountants who match your needs.

Step 3 — Check Credentials and Expertise

Before engaging:

- Verify qualifications (ICAEW, ACCA, AAT).

- Ensure they have experience with your business type.

- Ask about the software they use (Xero, QuickBooks, FreeAgent).

This ensures you’re working with a modern, qualified professional who can handle both compliance and strategic advice.

Step 4 — Set Up a Session

Book a free consultation to:

- Discuss your current accounting setup and pain points.

- Understand their process for switching and onboarding.

- Ask about fees, packages, and ongoing support.

Tip: A good accountant explains clearly and tailors advice — if not, keep looking.

Step 5 — Enable Data Sharing

Once you’ve chosen your new accountant:

- Provide formal permission to transfer records from your current accountant.

- Share necessary documents securely via cloud tools.

Modern accounting firms like Eternity Accountants handle this digitally, reducing delays and errors.

Step 6 — Update HMRC and Registrations

Your new accountant can update your tax agent details with HMRC and any relevant business registrations.

This ensures a completely smooth transition, avoiding penalties or reporting issues.

Step 7 — Review and Optimise Your Accounts

After the transfer:

- Review your opening balances and past tax filings.

- Spot any overlooked deductions or ways to save on taxes.

- Set up recurring processes like payroll, VAT, and bookkeeping.

With a modern approach, you’re not just switching accountants — you’re upgrading your financial management.

When It’s Time to Consider a Change

Slow responses, lack of clarity, high costs without results, missed deadlines, or insufficient support are signs it’s time to change accountants. Your accountant should support and guide you, not create problems.

Step‑by‑Step Modern Accountant Switching Process:

- Define your accounting needs and goals.

- Research and shortlist qualified accountants.

- Check their credentials and relevant sector expertise

- Book a meeting to evaluate compatibility.

- Authorise secure data transfer.

- Update HMRC and other registrations.

- Review accounts and optimise processes.

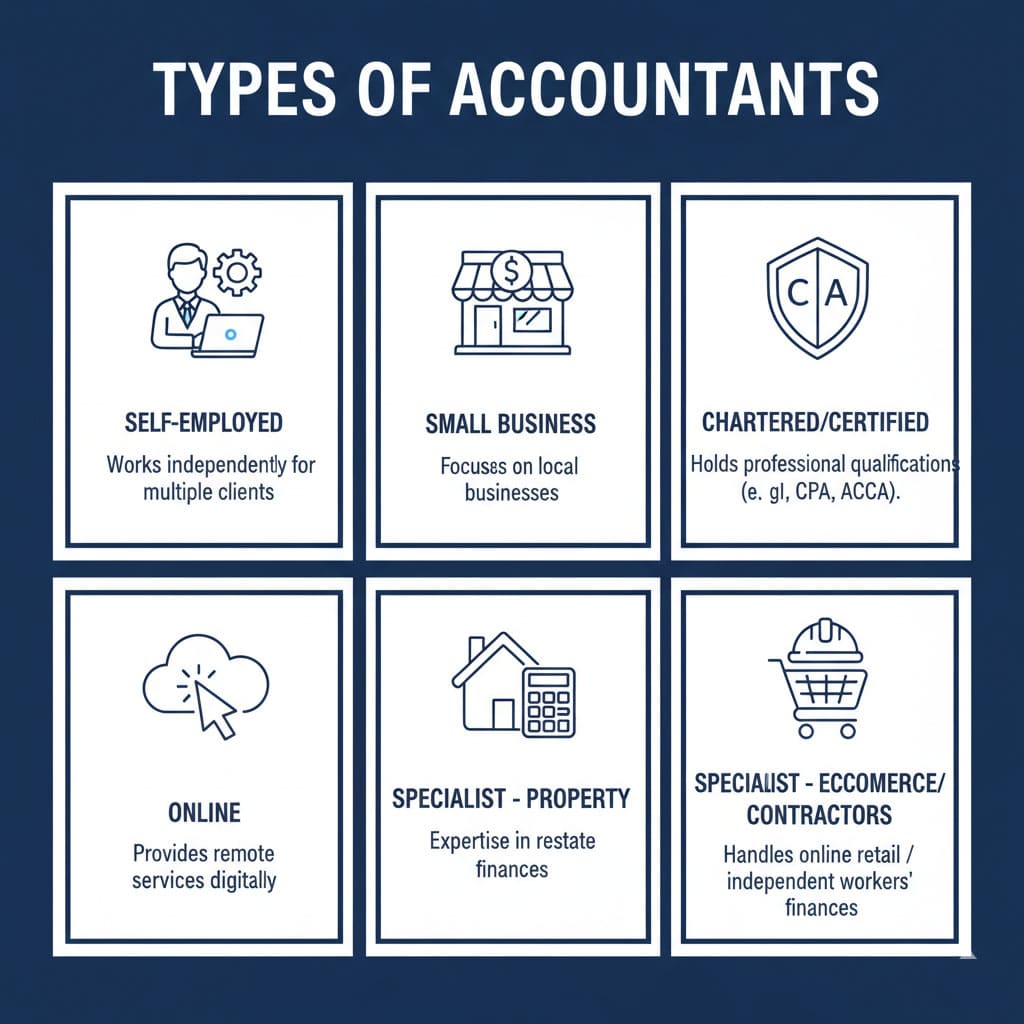

What Type of Accountant Do You Need?

Financial Support for Freelancers and Self-Employed Individuals

Being self-employed means managing multiple tasks at once. An accountant for self-employed professionals can assist with:

• Correctly filing your Self Assessment tax return

- Track expenses and maximise allowable deductions

- Manage invoices, payments, and receipts

- Stay compliant with HMRC rules year-round

Small Business Accountants

Running a limited company or partnership? Then you’ll need more than basic bookkeeping. A small business accountant provides:

- Corporation Tax filing and planning

- Payroll, VAT, and dividend management

- Financial forecasting and business planning

- Year-end accounts and compliance reporting

Chartered and Certified Accountants

You may have heard terms like “chartered” or “certified” and wondered what they mean.

- Chartered accountants (ICAEW, ICAS) are highly qualified professionals who meet strict standards of ethics and expertise.

- Certified accountants (ACCA) also hold advanced qualifications but may focus more on specific areas like taxation or auditing.

Online Accountants

Technology has changed how people manage their finances. Today, you can easily find accountant services entirely online — ideal for busy entrepreneurs who prefer digital communication.

Benefits of online accountants include:

- Lower fees and flexible plans

- Real-time updates through cloud software (Xero, QuickBooks)

- Easy document sharing and faster turnaround

- Ideal for remote businesses or digital professionals

Specialist Accountants

For example:

- Property accountants help landlords with rental income and capital gains.

- Ecommerce accountants manage online sales, VAT, and multi-platform reporting.

- Contractor accountants handle IR35 compliance and company setup.

Main types of accountants in the UK:

- Self-employed accountants — ideal for freelancers.

- Small business accountants — handle VAT, payroll, and tax planning.

- Chartered/certified accountants — offer high-level expertise and compliance.

- Online accountants — convenient, cost-effective, and tech-driven.

- Specialist accountants — tailored for industries like property or contracting.

Should You Choose a Local or Online Accountant?

When trying to find accountant services in the UK, many business owners wonder whether to pick a local office-based accountant or an online/cloud-based accountant. Both options offer benefits and potential downsides; the ideal choice depends on your business needs, preferred interaction, and convenience.

Pros and Cons of Local Accountants

Pros:

- Familiarity with local business regulations or community networks.

- Easier networking opportunities with nearby professionals.

- Meet in person for advice specific to your situation.

Cons:

- Often higher fees due to office overheads.

- Limited availability outside office hours.

- Less flexibility for remote or digital communication.

Pros and Cons of Online Accountants

Pros:

- Flexible communication via video calls, email, or messaging apps.

- Cloud-based accounting tools allow instant access to accounts anytime, anywhere.

- Often more affordable because of reduced overheads.

Cons:

- No in-person meetings for those who prefer them.

- Some firms may lack knowledge of local business nuances.

- Less personal touch if the accountant handles many clients.

Tax Return Accountants — Hybrid Flexibility for Modern Businesses

Tax Return Accountants offers the best of both worlds:

- Real-time online access: Manage and monitor your accounts from anywhere across the UK.

- Local support: For clients who prefer face-to-face meetings or need personalised guidance, we provide in-person consultations.

- Sector expertise: Freelancers, landlords, contractors, e-commerce sellers — we tailor our services to your business type.

- Flexible communication: Phone, email, video calls, or office visits — whatever suits your schedule.

This hybrid approach ensures that clients get maximum flexibility, expert support, and peace of mind, without compromising on quality or accessibility.

Local vs Online Accountants — Key Takeaways

- Local accountants: best for face-to-face meetings and local insights; usually higher fees.

- Online accountants: best for flexible, cloud-based access; often more affordable.

- Hybrid solution: combines convenience, flexibility, personalised advice, and sector expertise.

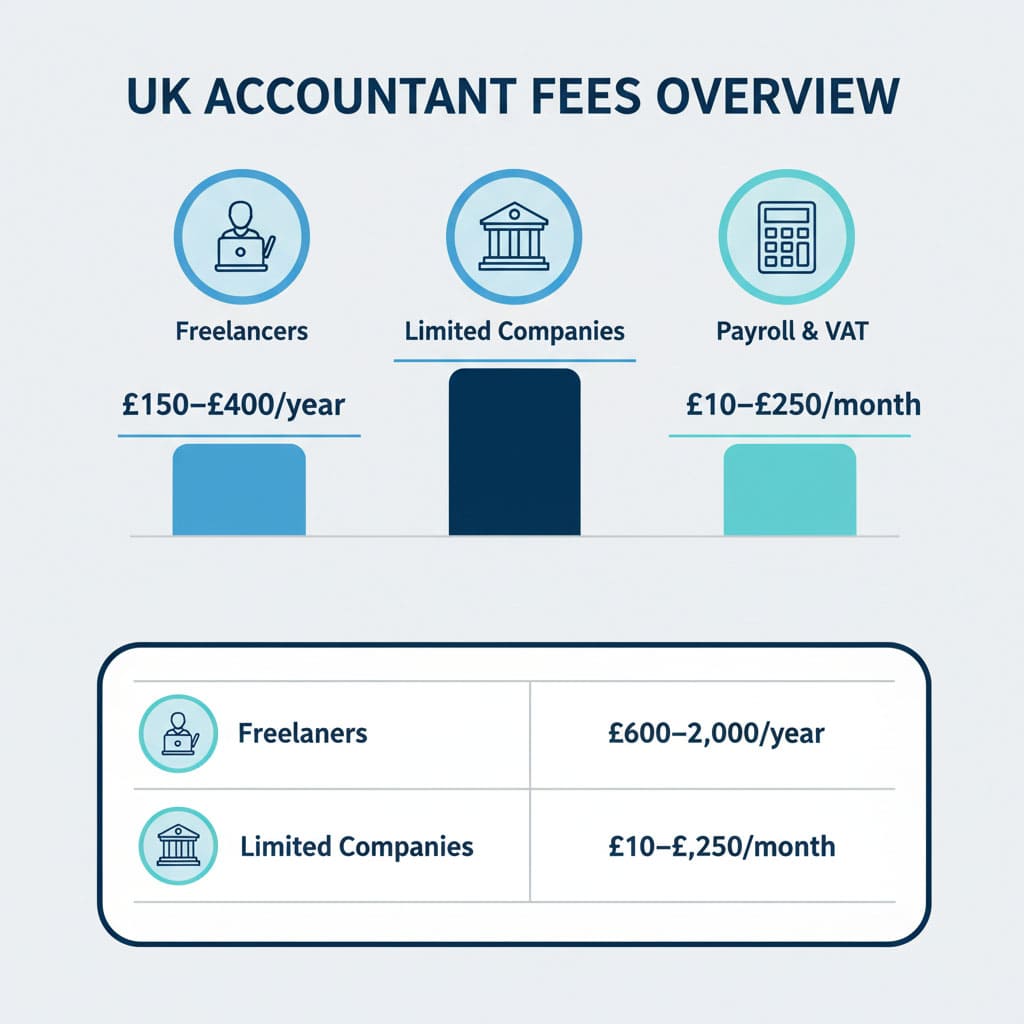

Cost of Accountants in the UK: Fair Pricing and Valuable Support

When searching to find accountant services, UK business owners often focus only on price. But the real question is: what value do you get for your money? Selecting the cheapest option may lead to err, missed deductions, or poor advice. A quality accountant saves you time, ensures compliance, and can even reduce your tax bill.

Here’s a clear breakdown of average UK costs and included services:

Typical Accountant Fees and What They Include

|

Service Type |

Average UK Cost |

What’s Included |

Value Notes |

|

Freelancer / Self-Employed |

£150–£400/year |

Self Assessment filing, expense tracking, basic advice |

Saves time and ensures HMRC compliance; maximises allowable deductions |

|

Limited Company Accounts |

£600–£2,000/year |

Corporation Tax, annual accounts, VAT, dividends |

Full-year business support; strategic tax planning reduces liabilities |

|

Payroll Services |

£10–£20 per employee/month |

Payroll processing, payslips, RTI submissions |

Avoids HMRC penalties; keeps staff paid on time |

|

VAT Returns |

£100–£250 per quarter |

Quarterly filing, digital submissions, VAT advice |

Prevents fines; ensures accuracy |

|

Bookkeeping Services |

£25–£50/hour or monthly fixed fee |

Record keeping, reconciliations, cloud software updates |

Time-saving; ensures accurate financial reporting |

|

Contractor & Specialist Services |

£250–£1,000/year |

IR35 compliance, contractor payroll, niche advice |

Protects limited company compliance; reduces risk and stress |

Note: Online or cloud-based accountants often offer more competitive pricing because they use automation and digital workflows.

Factors That Affect Accountant Costs

Not all accountants charge the same, even for similar services. Here’s what can influence what you’ll pay:

- Business type: Limited companies generally need more compliance than sole traders.

- Service scope: More tasks (VAT, payroll, tax planning) mean higher fees.

- Location: London-based accountants tend to charge more than regional ones.

- Experience level: Chartered accountants or firms with sector expertise may charge premium rates.

- Technology use: Online accountants using tools like Xero or FreeAgent can keep prices lower.

When you find accountant professionals, compare not only their fees but also the value they bring — the right accountant often saves you far more than they cost.

The Importance of Value Over Price

When choosing an accountant, the cheapest option isn’t always the best. The right accountant provides value by:

- Preventing HMRC penalties and fines.

- Identifying tax-saving opportunities.

- Offering proactive advice to grow your business.

- Providing secure, cloud-based tools to save time.

Tip: When comparing accountants, ask not only “How much?” but “What exactly do I get for this fee?”

UK Accountant Costs (2025 Average)

- Freelancers: £150–£400/year — tax filing, expense tracking, advice.

- Limited companies: £600–£2,000/year — full business accounts & tax planning.

- Payroll & VAT: £10–£250/month depending on employees and filing.

- Specialist contractors or landlords: £250–£1,000/year — compliance and sector-specific advice.

How to Hire an Accountant Online

In today’s digital world, you’re not limited to local firms — online accountants offer the same expertise and security, with the bonus of 24/7 access to your finances.

How Online Accountant Services Work

When you find accountant platforms or firms online, the process is simple:

- Book a free consultation — usually through the website or a short form.

- Outline your requirements — they’ll assist in choosing the services that match your business.

- Get a proposal or plan — most online firms offer fixed packages.

- Use cloud accounting software —Xero, QuickBooks, or FreeAgent—to share your data safely.

- Communicate online — via email, portal, or scheduled video calls.

Benefits of Hiring an Accountant Online

When you find accountant services online, you enjoy several major advantages:

- Flexibility: Access your accountant anytime, from anywhere.

- Transparency: Real-time visibility into your accounts and reports.

- Affordability: Online firms typically offer lower fees due to reduced overheads.

- Security: Encrypted platforms keep your financial data protected.

- Speed: Faster response times and automated reporting tools.

Example: A self-employed designer in Manchester can hire an online accountant based in London — receiving the same level of service through secure cloud systems, without ever needing to visit in person.

How to Choose the Right Online Accountant

Before you find accountant services online, make sure to:

- Verify their professional membership (ICAEW, ACCA, or AAT).

- Check reviews or testimonials from verified UK clients.

- Ensure they use recognised accounting software (Xero, QuickBooks).

- Confirm there’s a dedicated contact or client manager.

- Ask about fixed monthly pricing for predictable costs.

This helps you find a qualified online accountant who combines convenience with real expertise — not just a faceless digital platform.

To hire an accountant online in the UK:

- Book a consultation on a trusted accounting platform.

- Discuss your needs and receive a proposal.

- Share financial data securely via cloud tools.

- Communicate online through calls or portals.

- Enjoy flexible, affordable, and transparent accounting support.

Finding an Accountant That Fits Your Business

UK freelancers, landlords, contractors, and e-commerce sellers need specialists who understand their sector to ensure compliance, efficiency, and tax savings.

-

Freelancers and Self-Employed Professionals

Freelancers often face irregular income, multiple clients, and self-assessment tax challenges. The right accountant helps you:

- File Self Assessment tax returns accurately.

- Claim all allowable expenses.

- Plan for quarterly payments and pensions.

-

Property Landlords

Landlords have unique accounting requirements, including rental income, mortgage interest, and capital gains. A specialist accountant can:

- Handle rental income and expense tracking.

- Prepare accounts for multiple properties.

- Advise on tax reliefs, capital gains, and compliance.

3.

Contractors and Limited Company Directors

Contractors face IR35 regulations, limited company compliance, payroll, and dividend planning. A sector-savvy accountant can:

- Ensure IR35 compliance.

- Manage payroll and dividends efficiently.

- Provide strategic advice for tax savings and company growth.

-

E-commerce Sellers

E-commerce businesses deal with multi-platform sales, VAT complexities, and international tax issues. With a specialist accountant, you can:

- Track revenue streams across e-commerce platforms

- Manage VAT for online sales and EU trade.

- Prepare financial reports for growth and investment planning.

Which accountant is right for your business?

- Freelancers: Self Assessment, expenses, and tax planning.

- Landlords: Rental accounts, capital gains, and compliance.

- Contractors: IR35, payroll, and dividends.

- E-commerce: Multi-platform VAT, online sales, and reporting.

What to Look for in a Good Accountant

When you’re trying to find accountant support for your business, not every professional or firm is the same. A good accountant is like a business partner who genuinely understands your goals — not just someone who does the numbers.

Key Qualities of a Trustworthy Accountant

When you’re comparing options to find accountant services, make sure your chosen professional has these essential qualities:

- Qualifications & Credentials – Look for membership in ICAEW, ACCA, or AAT.

- Industry Experience – Accountants who know your sector (e.g. trades, eCommerce, property) can give more relevant advice.

- Communication Skills – They simplify accounting language and ensure you’re kept up to date.

- Proactive Approach – A great accountant doesn’t wait for problems — they anticipate them and plan ahead.

- Transparency – It’s important to know exactly what your charges cover and why they apply.

These traits turn an average accountant into a trusted financial partner.

Signs You’ve Found the Right Accountant

Once you find accountant options, look for these positive signs early on:

- They inquire about your business strategy, not just your financials.

- They offer recommendations that suit your goals and budget.

- They rely on advanced accounting tools for accuracy and speed.

- They provide timely, clear responses.

- They make you feel confident and supported — not confused or rushed.

If you feel clarity, confidence, and calm after your first meeting — you’ve probably found the right one.

Red Flags to Avoid When You Find Accountant Services

It’s equally important to spot red flags. If you see these, walk away:

- Vague answers about fees or services.

- Slow or inconsistent communication.

- No verified qualifications or reviews.

- Overly aggressive upselling.

- Poor knowledge of your business type or industry.

A trustworthy accountant will earn your trust, not demand it.

What Makes an Accountant the Right Fit?

Choose an accountant who is qualified (ACCA, ICAEW, or AAT), communicates clearly, understands your business, is proactive, and provides transparent pricing. Avoid anyone who hides fees or lacks credentials.

Mini-Case Examples for Different Business Types

Freelancer Example

Scenario: Sarah, a freelance graphic designer in Manchester, was spending hours tracking expenses and filing her Self Assessment. She wasn’t claiming all allowable deductions.

Result with Eternity Accountants:

- Claimed £1,800 in additional expenses.

- Automated bookkeeping using Xero saved 5 hours per month.

- Avoided late HMRC penalties.

Key Takeaway: A sector-specific accountant can save time and uncover tax savings that the average freelancer may miss.

Property Landlord Example

Scenario: John owns three rental properties in London. He struggled with tracking rental income, mortgage interest, and allowable expenses.

Result with Eternity Accountants:

- Correctly claimed £6,500 in allowable deductions.

- Prepared annual accounts and submitted rental income accurately.

- Reduced risk of HMRC penalties and improved cash flow visibility.

Key Takeaway: Specialist landlord accountants protect your investments and ensure tax efficiency.

Summary

- Freelancers: £1,800 tax savings, 5 hours/month saved.

- Landlords: £6,500 in allowable deductions.

Frequently Asked Questions about find accountant

How Much Will Hiring an Accountant in the UK Cost?

Most accountants in the UK charge between £25 and £150 per hour, or offer fixed monthly packages from £50 to £250, depending on the services you need.

If you’re comparing costs to find accountant help, always ask for a detailed quote and confirm whether VAT is included.

Does Switching Accountants Impact My Taxes or Business?

Not at all — if managed properly, changing accountants won’t affect your taxes and can even improve your compliance and uncover savings.

Do Self-Employed Individuals Need an Accountant?

Yes — if you earn regularly or have complex expenses, an accountant can save time, ensure compliance, and help you claim more deductions.

Bookkeeper vs Accountant: What’s the Difference?

A bookkeeper handles the recording of daily financial transactions. An accountant interprets that data, prepares tax returns, and offers financial advice.

When you find accountant services, ensure they handle both compliance and strategic planning — not just bookkeeping.

Can an accountant help me save tax?

Absolutely. A skilled accountant knows legal ways to reduce your tax bill — through expense claims, allowances, and smart business structure planning.

Is My Accountant Properly Qualified?

You can check their credentials through professional organisations like ACCA, ICAEW, or AAT. These organisations list registered accountants and firms.

To find a good accountant, check professional credentials (ACCA, ICAEW, or AAT), ask for transparent pricing, read client reviews, and ensure they understand your business sector. Expect fees from £25–£150/hour or £50–£250/month.

Conclusion — Find Accountant Services You Can Trust

Finding the right accountant in the UK isn’t just about filing taxes — it’s about having a trusted partner who helps your money work smarter, saves time, and keeps you compliant year-round. No matter if you’re a freelancer, small business owner, landlord, or running a limited company, the right accountant can transform your finances.

Ready to take control?

Find accountant support today with Eternity Accountants — book your free consultation now and discover how our expert team can save you time, reduce stress, and help your business thrive.