Finding a chartered accountant in the UK can save you time, reduce stress, and help you avoid costly financial mistakes. When you search “find a chartered accountant,” you’re usually looking for someone qualified, trusted, and experienced enough to handle your tax, accounts, or business finances with confidence. This guide gives you a clear, step-by-step explanation of what a chartered accountant does, why you might need one, how much they cost, and how to choose the right professional for your situation.

If you’re a small business owner, a freelancer, a landlord, or someone preparing a tax return, this article answers the key questions people ask when trying to find a reliable UK chartered accountant. Each section follows a voice-search, answer-first style—so you get simple, direct, and helpful answers without jargon.

What Is a Chartered Accountant?

A chartered accountant is a fully qualified accounting professional who has completed advanced training, passed rigorous exams, and is regulated by a recognised UK accounting body such as ICAEW, ACCA, or CIMA. They’re trusted experts in tax, accounting, business finance, and compliance.

In other words, a chartered accountant is always qualified as an accountant, but not all accountants hold chartered status.

This qualification gives you extra assurance that they follow strict professional standards and stay updated with UK tax laws.

Chartered accountants typically help with:

- Tax planning and tax returns

- Year-end accounts

- Business structure advice

- Financial forecasting

- HMRC compliance

- Growth and cash flow support

If you want someone who can offer expert advice—not just number-crunching—a chartered accountant is usually the best option.

Why Rely on a Chartered Accountant in the UK?

You need a chartered accountant when you want expert financial guidance, reliable tax support, and peace of mind that your accounts are accurate and compliant with UK laws. They don’t just “do your books”—they help you make smarter financial decisions that save you money and reduce risk.

What Problems Do They Solve?

A chartered accountant helps you avoid HMRC penalties, reduce tax bills, and stay organised. They fix issues like:

- Incorrect or late tax returns

- Overlooked tax-deductible costs or allowances

- Inaccurate or disorganised financial records

- Issues with managing incoming and outgoing cash

- Confusing financial reports

- Business structure mistakes

- HMRC investigations or notices

What Services Do They Offer?

Most UK chartered accountants offer:

- Tax returns (self-assessment, corporation tax)

- Year-end accounts and statutory reporting

- VAT returns and compliance

- Bookkeeping and payroll

- Business advisory and forecasting

- Company formation support

- CIS, subcontractor, and contractor accounting

- HMRC representation

- Cash flow and budgeting

Their skills cover everything from simple tax help to full business finance management.

When to Bring a Chartered Accountant on Board?

Consider working with a chartered accountant when:

- You’re launching a new business

- You’re setting up a limited company

- You earn over £50,000 and file self-assessment

- You’re a landlord with multiple properties

- Your tax situation becomes complicated

- You want strategic advice to grow

- You’re facing HMRC enquiries

- You want long-term financial planning

Simple rule:

If your finances affect your stress, time, or profitability, you’re ready for a chartered accountant.

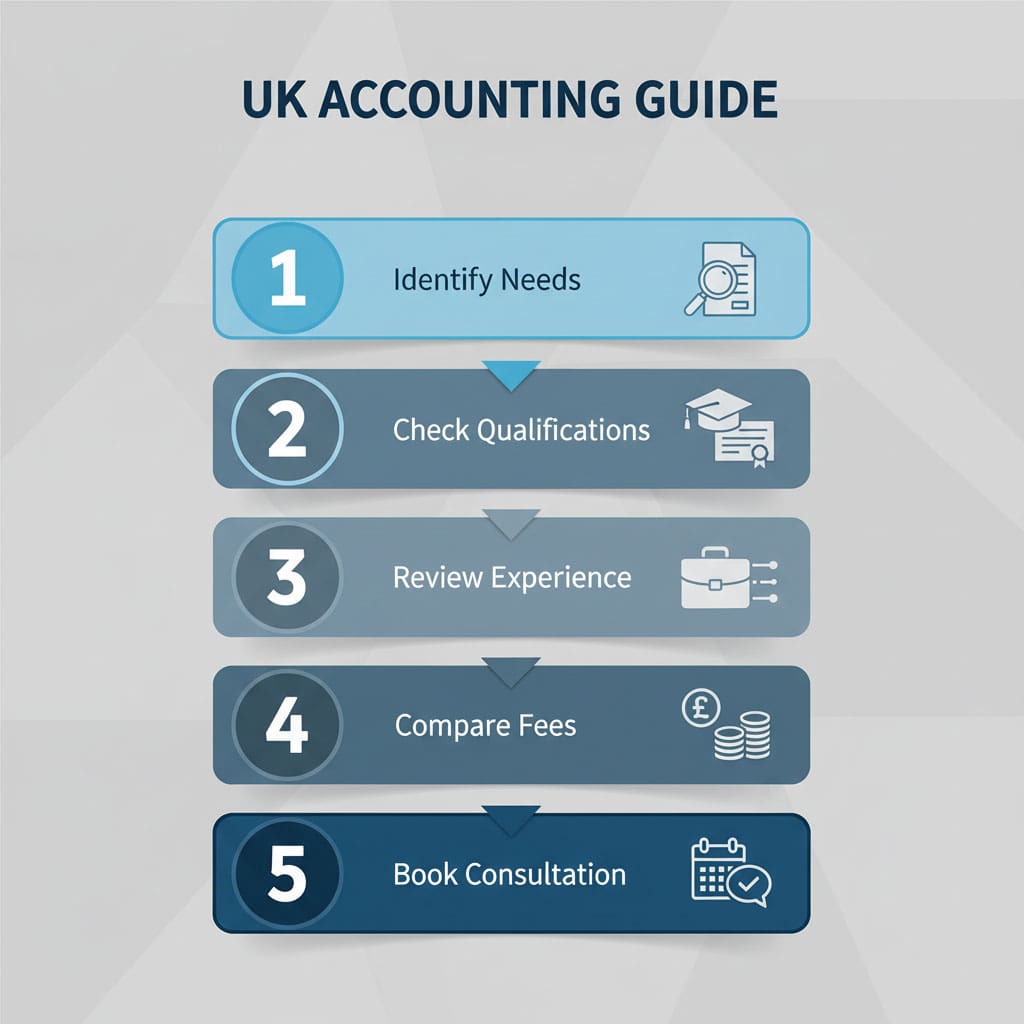

UK Chartered Accountant Search: Step-by-Step Instructions

The easiest way to find a good chartered accountant in the UK is to follow a simple, structured process. You should start by identifying what you need, checking their qualifications, and comparing experience and fees before you make a final decision. This ensures you choose someone who fits your business, budget, and goals.

Step 1 — Identify What You Need

Before searching, get clear on your requirements.

Ask yourself:

- Do I need assistance preparing my tax return?

- Do I need full-year accounting support?

- Am I looking for business advice or just compliance?

- Do I prefer online or in-person support?

This helps you avoid overpaying and ensures you choose the right type of accountant.

Step 2 — Check Qualifications (ICAEW, ACCA, CIMA)

Always confirm the accountant is truly chartered.

Look for membership in:

- ICAEW

- ACCA

- CIMA

These bodies ensure strict standards, continuous training, and ethical requirements.

If they can’t show a valid membership number, avoid them.

Step 3 — Choose an Accountant with Experience in Your Field

Choose an expert who has sector-specific knowledge.

For example:

- Contractors need someone familiar with IR35

- E-commerce brands need digital-savvy accountants

- Landlords need property accounting experts

- Small businesses need compliance + cash flow support

Experience saves you time and ensures fewer mistakes.

Step 4 — Review Fees and Pricing Models

Chartered accountants usually charge using one of these models:

- Fixed monthly fee (most common)

- Hourly rate

- Service-based pricing (per tax return, per payroll run)

Compare fees carefully, but don’t make your decision only on price.

A low-cost accountant who misses reliefs or expenses can cost you more in the long run.

Step 5 — Book a Consultation

Nearly all firms offer a free call.

Use it to ask:

- What support is included?

- How do they communicate (email, phone, WhatsApp)?

- Do they offer unlimited advice?

- Do they specialise in my type of business?

Approach it like you’re interviewing a key player for your team.

How to find a chartered accountant in the UK:

- Identify what services you need

- Check ICAEW/ACCA/CIMA qualification

- Look for relevant industry experience

- Compare fees and pricing models

- Book a consultation and ask key questions

Chartered vs Non-Chartered Accountants: What You Need to Know

A chartered accountant is a professional who has passed rigorous exams, completed advanced training, and is regulated by a recognised UK accounting body such as:

- ICAEW: Chartered accountants for England and Wales

- ACCA: Globally recognised chartered accountancy body

- CIMA: Leading institute for management accountants

This qualification guarantees that the accountant adheres to high professional and ethical standards, completes continuing professional development (CPD) each year, and stays up-to-date with UK tax law, accounting regulations, and best practices.

Benefits of Choosing a Chartered Accountant:

- Expertise & Knowledge: They understand complex tax rules, business structures, and compliance requirements.

- Regulated & Trusted: Membership with ICAEW, ACCA, or CIMA ensures accountability and oversight.

- Peace of Mind: They minimise errors, reduce risk of HMRC penalties, and provide strategic financial advice.

- Indemnity Coverage: Protects you if your accountant makes a mistake.

Non-Chartered Accountants:

- May have accounting experience but aren’t required to follow strict ethical codes.

- Not regulated by a professional body, so oversight is limited.

- Might handle simple bookkeeping or tax filing, but less likely to provide strategic business advice or advanced tax planning.

How to Verify a Chartered Accountant’s Membership

- ICAEW Members

- ACCA Members

- CIMA Members

- Ask for Membership Number

Tip: If an accountant cannot prove their chartered status, it’s a major red flag. Always double-check before hiring.

UK‑Specific Cost Ranges for Chartered Accountant Services

Here are ballpark figures based on current UK market data (2024–2025), pulled from various accounting firms and industry averages:

| Service | Typical Cost Range (UK, Chartered / Professional) |

| Self-Assessment Tax Return | £150 – £400+ per year for individual / self‑employed returns |

| Limited Company (Year-End Accounts + Corporation Tax) | £300 – £1,000+ annually, depending on size and complexity |

| Monthly Accounting / Ongoing Packages (Ltd) | £60 – £450 per month is common for a full accounting + tax package |

| Payroll Services | £5 – £10 per payslip, or £15 – £50 per employee per month depending on the firm and scale |

| VAT Returns | £50 – £200+ per quarter depending on transaction volume and complexity |

| Bookkeeping | £20 – £50+ per hour (for ad hoc or disorganised bookkeeping) Or as part of a monthly package: £50 – £500+ / month depending on volume of transactions. |

What Drives Chartered Accountant Fees

- Business Structure & Compliance – Limited companies, VAT-registered businesses, or those with dividend planning require more work than sole traders.

- Complexity & Volume – More transactions, multiple revenue streams, or payroll increase bookkeeping effort and cost.

- Level of Service – Basic accounts and tax are cheaper; full-service packages including advisory, planning, or forecasting cost more.

- Location & Overhead – Accountants in major cities or larger firms usually charge higher fees.

- Technology Use – Cloud accounting can reduce costs, but messy books require extra work.

- Expertise & Specialisation – Specialist knowledge (contractors, landlords, e-commerce) or advisory services carry a premium.

- Frequency of Work – Ongoing monthly reporting is pricier than one-off tasks.

- Record Quality – Well-organised records reduce fees; disorganised books increase them.

This summary captures the main factors influencing accounting costs in a concise way.

Practical Examples to Illustrate

| Business Type | What’s Included | Typical Fees |

| Freelancer / Sole Trader | Annual self-assessment return (simple). Using own records in Xero/FreeAgent. | £150–£300 per return |

| Small Limited Company (1 director, no employees) | Year-end accounts, corporation tax, director’s self-assessment. Minimal payroll/VAT. | £60–£200/month or £700–£1,000+ annually |

| Company with Employees & VAT | Annual accounts, corporation tax, monthly payroll, quarterly VAT returns. | £250–£450+/month |

Cheap vs Experienced — The Real Difference

Cheaper accountants may overlook key deductions, reliefs, and compliance issues. Experienced chartered accountants deliver greater accuracy, better tax savings, and more reliable guidance. In short, a £200 accountant who saves you £1,000+ is far better value than a £99 option that leads to mistakes.

How Expensive Is a Chartered Accountant in the UK?

Most small businesses pay £150–£350 per month, while individuals pay £150–£450 for a tax return. Prices depend on complexity, industry, and required services.

Chartered Accountant vs Standard Accountant — A Simple Comparison

The main difference is that a chartered accountant has completed advanced training, passed professional exams, and is regulated by bodies like ICAEW, ACCA, or CIMA. Experience alone doesn’t make a regular accountant professionally qualified. If you want accuracy, compliance, and expert advice, choose a chartered accountant.

Clear Comparison Table

| Feature | Regular Accountant | Chartered Accountant |

| Formal qualification required | No | Yes (ICAEW, ACCA, CIMA) |

| Regulated by a professional body | No | Yes |

| Advanced training & exams | Not required | Mandatory |

| CPD (continuing professional development) | Not guaranteed | Required |

| HMRC compliance expertise | Basic | High |

| Strategic tax planning | Basic | Strong |

| Best for | Simple tasks | Businesses, limited companies, complex tax |

When a Regular Accountant Is Enough

A regular accountant can handle:

- Basic bookkeeping

- Simple sole trader accounts

- Low-volume transactions

- Basic administrative tasks

This works if your finances are uncomplicated.

When a Chartered Accountant Is Essential

Choose a chartered accountant when you:

- Operate a limited company

- Have a high income (over £50,000 per year)

- Have multiple income streams

- Need business advice

- Want tax-saving strategies

- Need HMRC enquiry support

- Manage staff payroll

- Are planning to scale your business

Their expertise protects you from financial mistakes and compliance risks.

How to Find a Local Chartered Accountant — Best Choices

The best way to find a chartered accountant near you is to use trusted directories, compare local specialists, and check online reviews. You can also choose modern online accountants who work remotely across the UK.

Online Directories (Most Reliable Sources)

Start with official directories where only verified chartered accountants are listed.

These platforms let you filter by industry, postcode, or specialist services.

Local Accounting Firms

If you prefer face-to-face support, look for accountants in your area:

- High-street practices

- Regional firms

- Local business support centres

- Chambers of commerce listings

Local accountants are helpful if you want regular in-person meetings or support with paperwork.

Industry-Focused Accountants

Accountants with field-specific expertise can make your finances more efficient and cost-effective.

Examples:

- Contractor accountants

- E-commerce accountants

- Landlord accountants (rental income, capital gains)

- Freelancer & sole trader accountants

- Startup accountants

- Construction / CIS accountants

Specialists understand industry rules, common deductions, and hidden tax risks.

Recommendations and Reviews

Before choosing, always check:

- Google reviews

- Trustpilot scores

- LinkedIn recommendations

- Testimonials

- Case studies

It shows how dependable, responsive, and helpful they truly are.

Specialist Chartered Accountants: Why They Matter

Industry-specific accountants help improve accuracy, minimise tax, and avoid mistakes.

Who Needs One:

- Contractors & Freelancers: IR35, PAYE, dividends, allowable expenses.

- Landlords & Property Investors: Rental income, capital gains, property deductions.

- E-commerce Businesses: VAT, multi-currency sales, platform accounting.

- Startups & SMEs: Cash flow, growth, R&D relief, funding, sector-specific advice.

Finding the Right Specialist:

Use ICAEW/ACCA/CIMA directories, check LinkedIn, testimonials, case studies, and ensure experience with relevant cloud software.

Specialist accountants keep you compliant, reduce tax, and support sector-focused financial planning.

Tips for Finding the Right Chartered Accountant for Your Company

The right chartered accountant understands your business, communicates clearly, and acts as a long-term financial partner—not just a tax filer.

Key Questions to Ask When Choosing an Accountant

- Are you ICAEW, ACCA, or CIMA qualified?

- Do you specialise in my industry?

- What does your monthly fee cover?

- Will I get a dedicated accountant?

- How do you communicate—email, phone, WhatsApp?

- Do you offer unlimited advice or extra charges?

- What software do you use?

- Do you offer legal ways to cut my tax liability?

Their answers give you the full picture.

Red Flags to Avoid

Avoid accountants who:

- Can’t prove chartered status

- Offer unclear or hidden fees

- Don’t communicate well

- Don’t understand your industry

- Rush through the consultation

- Only provide compliance work and no advisory

- Are slow to reply or disorganised

- Don’t use modern accounting software

A reliable accountant should feel confident, transparent, and proactive.

What a Good Chartered Accountant Looks Like

A great accountant will:

- Give clear explanations

- Spot tax-saving opportunities

- Offer proactive advice

- Maintain business compliance

- Support your growth strategy

- Update you on financial changes

- Always be available when needed

They become a partner who protects your finances and strengthens your business.

Checklist: How to Verify a Chartered Accountant Before Hiring

Before choosing a chartered accountant, confirm their qualifications, reliability, and professionalism.

- Confirm Qualifications

Ensure they’re registered with ICAEW, ACCA, or CIMA. Request their membership number and check it in the official registry. - Check Insurance

Confirm they hold valid professional indemnity insurance and can provide proof. - Review Reputation

Look at Google Reviews, Trustpilot, LinkedIn, and request references or case studies relevant to your industry. - Look for Red Flags

Avoid accountants who can’t verify chartered status, hide fees, communicate poorly, offer unrealistic pricing, lack relevant experience, or refuse insurance/reference checks. - Assess Compatibility

Make sure they use suitable cloud accounting software, communicate clearly, respond promptly, and match your preferred communication style.

Pro Tip:

Use this checklist during your consultation—credible accountants will happily provide all verification details.

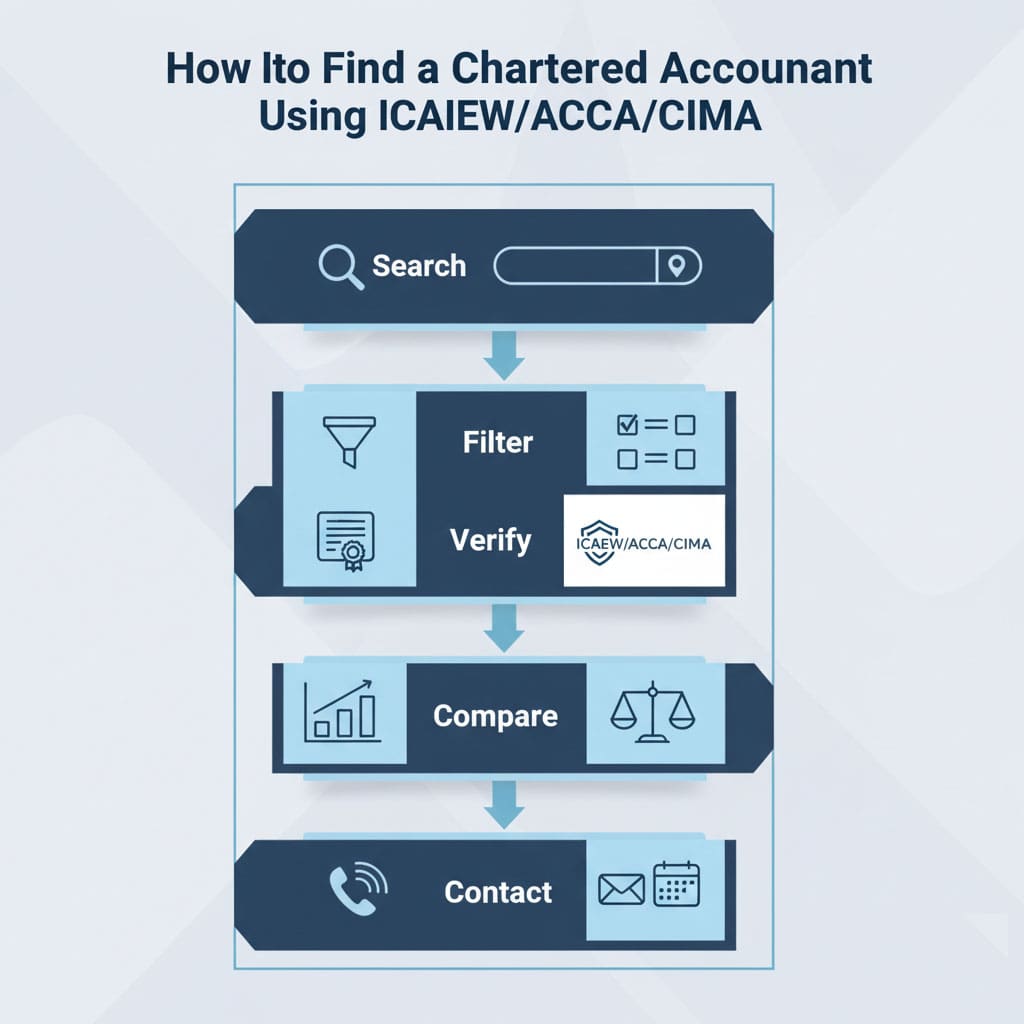

Step-by-Step: Using Directories to Find a Chartered Accountant

Using official directories makes it easier to find a qualified accountant.

- Start with Official Directories

Use ICAEW, ACCA, or CIMA directories to ensure the accountant is properly qualified. - Filter by Location

Enter your postcode, set a search radius, and decide whether you prefer local or online support. - Filter by Services

Select the services you need—tax returns, company accounts, VAT, payroll, or business advice—to narrow results to relevant accountants. - Filter by Specialisation

Look for sector experience (contractors, landlords, e-commerce, startups, SMEs) by checking filters or profile details. - Review Profiles & Verify Credentials

Check chartered status, membership number, experience, testimonials, and proof of professional indemnity insurance. - Contact & Compare

Speak to 2–3 shortlisted accountants, ask about fees, software, communication, and choose the one that fits your needs best.

Summary

- Use ICAEW/ACCA/CIMA directories

- Filter by location

- Filter by services

- Filter by industry expertise

- Verify credentials and insurance

- Contact, compare, and choose

This streamlined process helps you find a qualified, reliable, and well-matched chartered accountant.

Changing Accountants: Quick Guide

- Choose Your New Chartered Accountant

Check qualifications (ICAEW, ACCA, CIMA), industry experience, fees, services, software, and references. - Notify Your Current Accountant

Review your engagement letter, give required notice, and request key records such as accounts, tax returns, VAT, payroll, and reconciliations. - Transfer Your Records

Share digital files, cloud access, and statutory documents so your new accountant can continue your accounts without interruption. - Update HMRC & Relevant Bodies

Submit or sign the necessary authorisations (64-8) for tax, VAT, and PAYE. Your new accountant can usually manage this. - Maintain Continuity

Schedule a handover if possible, have your new accountant review past filings, and confirm deadlines and ongoing tasks. - Finalise Engagement

Sign the new engagement letter and store all correspondence.

Summary

- Pick a qualified, experienced accountant

- Inform your current accountant and gather records

- Transfer files and cloud access

- Update HMRC (64-8, VAT, PAYE)

- Ensure smooth handover and review past filings

- Sign the new engagement letter

Mini Case Studies: How Chartered Accountants Help Different Clients

- Freelancer / Sole Trader: Sarah, Graphic Designer

- Problem: Sarah earned £80,000 in a year but wasn’t claiming all allowable expenses and struggled with her self-assessment tax return.

- Solution: A chartered accountant organised her receipts, maximised tax deductions, and submitted her self-assessment correctly.

- Result: With expert guidance, Sarah reduced her taxes by £2,500 and stayed penalty-free.

Key takeaway: Even if your finances are simple, a chartered accountant can uncover savings you might miss.

- Landlord / Property Investor: Emma

- Problem: Emma owned 5 rental properties with income and expenses across multiple banks, struggling to track allowable deductions.

- Solution: A chartered accountant consolidated her records, calculated mortgage interest relief, and prepared her rental accounts and self-assessment.

- Result: Emma legally reduced her tax bill by £4,000 and had accurate records for each property.

Key takeaway: Property investors benefit from accountants who know the rules and reliefs specific to landlords.

- E-Commerce Business Owner: Mark

- Problem: Mark ran an online store selling through Shopify and Amazon UK/EU. VAT, cross-border rules, and inventory accounting were confusing.

- Solution: A chartered accountant set up cloud accounting software, calculated VAT obligations, and provided quarterly management reports.

- Result: Mark saved time, avoided VAT mistakes, and had better visibility of cash flow.

Key takeaway: E-commerce businesses thrive with accountants familiar with digital sales, VAT, and cloud systems.

Chartered accountants add value across industries:

- Freelancers: Maximise deductions & avoid penalties

- Landlords: Track property income & reliefs

- E-commerce: Handle VAT & cloud accounting

FAQs

Q1: Do I need a chartered accountant for my limited company?

Yes. Limited companies must file statutory accounts and corporation tax returns. A chartered accountant ensures compliance and can help reduce your tax liability.

Q2: Is a chartered accountant worth it?

Absolutely. They provide expert advice, save you money through tax planning, ensure compliance, and give peace of mind, especially if your finances are complex.

Q3: Can a chartered accountant help reduce my tax bill?

Yes. Chartered accountants identify allowable expenses, reliefs, and deductions legally, helping you minimise taxes while staying compliant with HMRC rules.

Q4: How fast can I switch accountants?

It’s usually a quick transition. Most accountants handle the transfer of records and communicate with HMRC for a smooth transition, typically taking 2–4 weeks.

Q5: Can you trust an online accountant?

Yes. Many UK chartered accountants work fully online using secure accounting software. Ensure they are qualified, regulated, and follow data protection rules.

Q6: How do I search for a chartered accountant in my area?

Use professional directories (ICAEW, ACCA, CIMA), search local firms, check reviews, or ask for industry-specific recommendations. You can also hire online accountants across the UK.

Q7: What sets a chartered accountant apart from a standard accountant?

A chartered accountant has formal qualifications, rigorous exams, and professional regulation. A regular accountant may have experience but isn’t required to meet these standards.

Conclusion

Ultimately, selecting the right chartered accountant in the UK is a wise decision for your money and business growth. They do more than file tax returns—they provide expert advice, ensure compliance, help reduce your tax burden, and support your growth.

By following the steps in this guide—checking qualifications, comparing experience, reviewing fees, and asking the right questions—you can confidently choose a chartered accountant who fits your needs.

Take Action Now:

Book a consultation with a local or online chartered accountant. And take your necessary advice to grow your business.