Choosing an accountant for tax return support can make the UK tax filing process easier, clearer, and far less stressful — especially if your income comes from self-employment, property, investments, or multiple sources. Many people seek professional help to ensure accuracy, avoid mistakes, and have peace of mind that everything is reported correctly. A tax return accountant UK or self assessment accountant can review your income, advise on allowable expenses, prepare your figures, and submit your return securely. They provide structured guidance, reduce uncertainty, and help you navigate complex records.

In this guide, you’ll learn when to hire a professional, how they support your filing, what they check, and how to choose the right accountant for your situation.

What Does an Accountant for a Tax Return Do?

AEO Summary (Answer-First)

An accountant for a tax return checks your income, reviews your expenses, prepares your calculations, and submits the return correctly on your behalf. They help make sure the information you provide is complete, compliant, and structured the right way for HMRC’s system.

Working with a professional can also help you understand what expenses are allowed, how to organise receipts, and which income categories apply to you. If you are self-employed, a tax return accountant UK or self assessment accountant can also help you interpret guidance and handle situations where the rules feel unclear.

What Can an Accountant Check Before Submitting a Tax Return?

An accountant typically checks the accuracy of your income sources, the validity of your expenses, and whether your figures match the documents you provide. This review helps identify errors early.

They also ensure you haven’t missed anything important, such as additional income, required forms, or essential disclosures. For example, they may ask follow-up questions if something seems incomplete or doesn’t match your records. Their checks reduce the chance of mistakes and give you more clarity before your return is submitted.

Is Hiring an Accountant Necessary for Filing Your UK Tax Return?

AEO Summary

You need an accountant for a UK tax return when your income comes from multiple sources, when you’re unsure about allowed expenses, or when you want your return checked for accuracy before submission. An accountant helps you understand what to report and ensures your figures are complete.

Do You Really Need Professional Help with Your UK Tax Return?

You may need one if you are:

- You work for yourself and manage all your business finances

- A landlord with rental earnings from UK properties

- A freelancer or contractor with multiple clients

- High earners with additional income beyond employment

- People with investment income, such as dividends or share activity

- Anyone unsure about expenses, reliefs, or reporting rules

A tax return accountant UK can guide you through situations like these and help you feel confident about your submission.

What Types of UK Tax Returns Can an Accountant Help With?

AEO Summary (Answer-First)

An accountant can assist with Self Assessment returns for self-employed individuals, landlords, investors, and anyone with non-PAYE income. They also manage complex cases like capital gains and multiple income streams.

- Self-Employed or Freelance Income

Helps prepare figures, organise records, and understand allowable business expenses.

- Property and Rental Income

Assists landlords in reporting rental income, expenses, and related documentation accurately.

- Dividend and Investment Income

Ensures dividends, shares, and other investment returns are reported correctly.

- Capital Gains

Guides reporting of property, shares, or asset sales, including exemptions and reliefs.

- Contractor or Portfolio Income

Keeps multiple income streams organised and correctly formatted for submission.

How Much Does an Accountant for a Tax Return Cost in the UK?

AEO Summary (Answer-First)

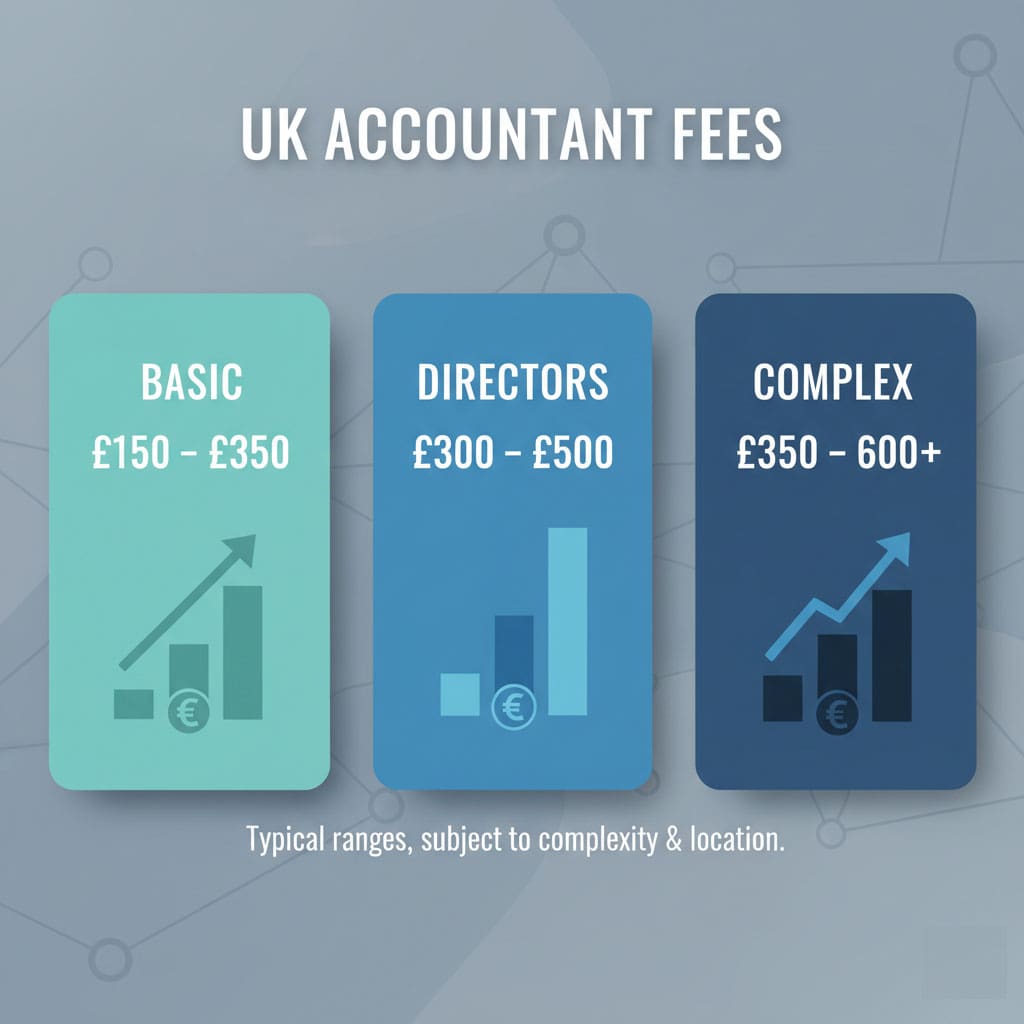

The cost of using an accountant for a standard UK self-assessment tax return is typically £150 to £350. For more complex situations — such as limited company directors, property income, or multiple income streams — the fee can go higher, sometimes £500+.

-

Typical Fee Ranges

Here are some common price bands based on UK sources:

|

Service Type |

Typical Accountant Fee |

|

Basic Self-Assessment (sole trader or simple return) |

£150 – £350 |

|

Director’s Tax Return (Limited Company) |

£300 – £500+ |

|

Partnership Return |

£200 – £650 |

|

Self-Employed with Complex Income / Investments |

£350 – £600+ |

-

What Affects the Cost

Several factors influence how much your tax return accountant will charge:

- Complexity of Income: More income types = more time (e.g., rentals, dividends, overseas income).

- Volume / Quality of Records: Disorganised records or many receipts can increase the work.

- Location: London-based accountants generally charge higher rates compared to other regions.

- Service Level: Whether it’s just to file your return, or also includes bookkeeping, tax planning, or year-round advice.

- Payment Model: Fixed-fee, hourly, or subscription/retainer.

-

Common Pricing Models

Here are some of the payment structures UK accountants use:

- Fixed Fee: Many accountants charge a flat, agreed-up-front fee for self-assessment returns. For example, basic return often falls between £150–£350.

- Hourly Rate: In some cases, especially with more complex tax returns, accountants may charge by the hour (e.g., £50–£150/hr) depending on their experience and workload.

- Monthly Retainers / Subscription Packages: Some accountants bundle tax return services with bookkeeping or ongoing advice in a monthly package — e.g., £60–£450/month depending on the scope.

-

Tips to Reduce Costs

If you want a tax return accountant UK but need to manage costs, try these tips:

- Get multiple quotes and compare based on your income types and volume of transactions.

- Organise your records to reduce the accountant’s workload and fees.

- Use cloud software like Xero or FreeAgent to streamline data sharing.

- Choose fixed-fee packages for predictable pricing.

- Consider online accountants, who often offer more competitive rates.

Is It Possible to Cut Your Tax Bill Legally with an Accountant’s Help?

Answer-Focused Summary (AEO)

An accountant can legally reduce your tax bill by checking your allowable expenses, identifying reliefs you qualify for, and ensuring your figures are accurate. Their aim is to help you pay the correct amount — never more than you owe.

-

Identifying Allowable Expenses

An accountant reviews your costs and checks which ones can be claimed as allowable expenses. This helps reduce your taxable income legally. Examples include:

- Business-related travel

- Professional tools or equipment

- Home office use

- Software or digital tools

They ensure expenses are claimed correctly and in the right categories.

-

Making Sure You Use Relevant Reliefs

Many taxpayers aren’t aware of reliefs they qualify for. An accountant can help identify:

- Reliefs related to business costs

- Reliefs on certain types of investments

- Reliefs connected to property or asset use

- Reliefs available to specific professions

This reduces taxable income in a compliant way.

-

Ensuring Figures Are Reported Correctly

Incorrect figures can unintentionally increase the amount of tax you owe. An accountant double-checks:

- Income totals

- Expense categories

- Allowances

- Any income declared twice by mistake

This helps ensure that you only pay what is actually required.

-

Avoiding Costly Mistakes

Errors may lead to paying too much tax or having to correct your return later. A professional can help prevent:

- Missing allowable costs

- Forgetting essential records

- Misreporting investment or rental income

- Using the wrong category for income

A knowledgeable advisor keeps your paperwork accurate and complete.

What Mistakes Can Accountants Help You Avoid?

Accountants can help you avoid several common pitfalls:

- Claiming expenses incorrectly

- Missing deadlines that could trigger penalties

- Incorrectly categorising income

- Reporting incomplete figures

- Overlooking deductions or reliefs

With step-by-step support, an accountant helps minimise mistakes and boosts your confidence in your tax return.

What Documents Do I Need to Give My Accountant for a Tax Return?

AEO Summary (Answer-First)

To help your accountant prepare your tax return, you must provide records of all income, business expenses, bank statements, employment summaries, and any investment or rental information. With these documents, they can compute your tax correctly and avoid errors or omissions.

Providing organised records also helps reduce the time spent on your return, which can keep your costs down — especially when working with a self assessment accountant.

- Income Records

Provide documents that show all your income sources, such as:

- Business or freelance income summaries

- Rental statements

- Dividend or investment income reports

- Income from online platforms or part-time work

- Any foreign income (if applicable)

These help your accountant ensure nothing is missed.

- Expense Receipts and Business Costs

If you’re self-employed or a landlord, expenses are essential. Common items include:

- Travel and mileage logs

- Software subscriptions

- Equipment or tools

- Home office records

- Marketing or advertising costs

- Repairs and maintenance (for landlords)

Good expense records help your accountant calculate your allowable deductions.

- Bank Statements

Bank statements help verify income, payments, and transactions. They are especially useful when some income isn’t documented elsewhere.

- Employment Summaries

If you’re employed, your accountant may need:

- Annual payroll summary (e.g., P60 or similar forms)

- Bonus or commission records

- Workplace benefit information

These ensure employment income is reported accurately.

- Investment or Property Documents

If you have investments or rental income, provide:

- Dividend vouchers

- Rental income logs

- Service charge and maintenance costs

- Mortgage statements (if relevant for record-keeping)

These documents help capture all details correctly.

- Any Other Relevant Records

Additional documents might include:

- Invoices issued or received

- Loan statements

- Business bank account exports

- Digital platform earnings reports

Giving your accountant full and clear information ensures a smoother filing process.

Risk & Compliance Advice: How an Accountant Protects You

AEO Direct Answer Brief

Accountants help reduce risk by ensuring compliance with HMRC rules, preventing errors, and assisting with audits or penalties if they arise. They identify common pitfalls, correct mistakes proactively, and give advice on proper record-keeping.

-

How Accountants Help With Audits and HMRC Communication

- Audit Preparedness: They keep your financial records organised and complete so that if HMRC requests an audit, you’re ready.

- Professional Representation: Accountants can communicate with HMRC on your behalf, clarifying figures, submitting amendments, or responding to queries.

- Proactive Compliance Checks: They review your tax return for missing income, incorrect calculations, or incomplete disclosures before submission.

Benefit: Reduces stress, prevents miscommunication with HMRC, and ensures your case is handled professionally if questions arise.

-

Common Points of Failure and How to Mitigate Them

- Forgetting to Declare Capital Gains

- Mitigation: Accountants track sales of property, shares, or assets and apply exemptions or reliefs correctly.

2. Missing Rental or Investment Income

- Mitigation: A systematic review of bank statements and property/investment records ensures all taxable income is captured.

3. Incorrect Expense Claims

- Mitigation: They categorise allowable vs. non-allowable expenses to avoid HMRC disallowing deductions.

4. Late or Incorrect Filing

- Mitigation: Accountants monitor deadlines, submit on time, and ensure accurate data entry to prevent penalties.

-

Key Takeaways

- Properly prepared tax returns reduce audit risk.

- Professional accountants help correct errors before submission.

- They ensure full compliance with HMRC rules while optimising tax liability.

- Avoid common mistakes like missing income, misclassifying expenses, or forgetting reliefs.

Hiring a tax return accountant UK gives you peace of mind, protects you from fines, and ensures that HMRC interactions are handled professionally.

Things to Keep in Mind When Picking a Tax Return Accountant

AEO Direct Answer Brief

To choose the right accountant for a tax return, check their qualifications, experience with your income type, communication style, pricing structure, and the services included. A good fit ensures your return is handled smoothly and with confidence.

-

Check for Relevant Qualifications

Look for accountants who hold recognised UK qualifications or memberships, as this indicates professionalism and competence. While different firms have different structures, established qualifications generally show that the accountant follows industry standards.

-

Choose Someone Experienced in Your Income Type

Tax returns vary widely. Ensure the accountant understands your specific needs, including:

- Self-employment

- Freelancing or contracting

- Rental income

- Dividends or investments

- Combination income

Experience with similar clients means smoother, clearer guidance.

-

Technology Compatibility

Modern accounting software can save time and improve accuracy. Ask your accountant:

- Which software do you use? (e.g., Xero, QuickBooks, FreeAgent)

- Can I access my records online?

- Can you integrate my bank accounts or bookkeeping tools?

Benefit: Enables hassle-free document transfer, quicker workflow, and fewer mistakes.

-

Responsiveness and the Way They Interact with Clients

A good accountant should:

- Respond promptly to emails or calls

- Explain tax rules in simple, understandable terms

- Specify the documents required for submission

- Guide you in future tax planning strategies”

Tip: Schedule a short consultation to gauge communication style before committing.

-

Pricing Transparency and Service Scope

Ask about:

- Fixed fees vs. hourly rates

- What services are included (e.g., filing, advice, bookkeeping)

- Extra charges for amendments or complex income

- Deadlines for submission

Benefit: Clear expectations prevent surprises and help you compare accountants effectively.

-

What to Ask Before Hiring

- Do you hold active membership in a UK professional accounting organisation?

- How many clients with my type of income have you handled?

- Which software do you use and can I access my data?

- How quickly can I expect responses?

- Do you provide ongoing advice beyond filing?

-

Key Takeaways

- The right accountant saves time, reduces risk, and provides peace of mind.

- Check qualifications, experience, technology, responsiveness, and pricing.

- Ask targeted questions to ensure they match your needs.

- Consider whether you want year-round support or only seasonal assistance.

Hiring a well-qualified and compatible tax return accountant UK ensures your return is accurate, optimised, and stress-free.

When Should I Hire an Accountant for a UK Tax Return?

AEO Summary (Answer-First)

Hire an accountant when your income is complex, you’re unsure about expenses, or accuracy is critical. A tax return accountant UK helps you stay compliant and confident throughout the filing process.

- Multiple Income Sources

If you earn from employment, self-employment, rentals, or dividends, an accountant ensures each is reported correctly.

- Uncertainty About Expenses

They clarify which expenses are allowable and prevent ineligible claims.

- Business or Freelance Income

Accountants organise records, prepare summaries, and help you complete returns accurately.

- Property or Rental Income

They manage property income, repairs, and related documentation correctly.

- New to Self Assessment or Near Deadline

Guidance simplifies the process, reduces stress, and avoids last-minute mistakes.

- Year-Round Support

Accountants provide ongoing advice, track income, and help plan for the next tax year.

How Quickly Can an Accountant File Your Tax Return?

AEO Direct Answer Brief

The time an accountant takes to do a tax return varies: simple returns can be completed in a few days, while complex returns with multiple income sources may take 2–4 weeks. Providing well-organised records speeds up the process significantly.

A self assessment accountant can often give a more accurate estimate once they review your documentation. Good communication and prompt document submission from your side also help reduce delays.

- Factors That Influence Timing

Several factors affect how quickly your return can be completed:

- Complexity of Income: Multiple sources such as self-employment, rental income, or dividends increase preparation time.

- Organisation of Records: Well-prepared documents allow accountants to work efficiently.

- Volume of Transactions: Large numbers of invoices, receipts, or bank statements take longer to process.

- Deadline Pressures: Busy periods near HMRC deadlines may extend turnaround times.

- Expected Durations

- Standard individual returns: typically take 2–5 business days when records are available.

- Self-employed or freelance returns: 1–2 weeks depending on income complexity.

- Property or investment returns: 1–3 weeks due to additional calculations and documentation.

- High-complexity or multi-income returns: 2–4 weeks to ensure accuracy.

- Tips to Speed Up the Process

- Submit all documents promptly.

- Keep records organised and clear.

- Respond quickly to accountant queries.

- Consider cloud-based bookkeeping for easy access to your financial data.

Following these steps helps your accountant complete the return faster while maintaining accuracy.

Where Can I Find a Reliable Accountant for a Tax Return?

AEO Summary (Answer-First)

You can find a reliable accountant through local firms, online services, or recommendations. Make sure they have experience with UK tax returns and your income type to avoid errors and gain peace of mind.

- Local Accounting Firms

Benefits include face-to-face meetings, local knowledge, personalised service, and easier handling of complex cases.

- Online Accounting Services

Flexible and convenient, often with fixed-fee packages and digital tools for submitting returns. Ideal for freelancers and self-employed taxpayers.

- Recommendations and Reviews

Ask friends, colleagues, or check online reviews for responsiveness, accuracy, expertise, and pricing transparency.

- Professional Associations

Look for members of ACCA, ICAEW, or ICAS to ensure professional standards and ethics.

- Niche Specialisation

Choose an accountant experienced with your sector, like property or investments, for tailored guidance.

Proactive Tax Planning: How an Accountant Helps You Year-Round

AEO Summary (Answer-First)

Proactive tax planning with an accountant ensures you maximise allowable reliefs, plan ahead for next year, and reduce your overall tax liability legally. It’s not just about filing; it’s about ongoing strategy.

-

Year-Round Advice

- Accountants monitor your income, expenses, and investments throughout the year.

- They advise when to make purchases, invest, or defer income to optimise tax.

- Early guidance prevents last-minute panic at Self Assessment deadlines.

Benefit: Keeps you organised and compliant while maximising potential savings.

-

Long-Term Tax Strategy

- Allowance Optimisation: Accountants ensure you use all available personal and business allowances.

- Expense Planning: Advice on timing business purchases or claiming reliefs to reduce taxable income.

- Capital Gains Planning: Help you decide when to sell assets to minimise tax.

- Pension Contributions & Savings: Guidance on tax-efficient ways to save for retirement.

Benefit: A strategic approach reduces your tax liability legally and prepares you for future financial goals.

-

Mitigating Future Risks

- Accountants track changes in tax law and advise on the impact to your situation.

- They help structure income streams and investments to avoid overpayment.

- Proactive planning reduces errors, audits, or unexpected HMRC penalties.

Benefit: Peace of mind, confidence in compliance, and long-term financial efficiency.

-

Key Takeaways

- Tax planning is ongoing, not just filing.

- Year-round support helps you use allowances, claim reliefs, and make strategic financial decisions.

- A tax return accountant UK can provide guidance tailored to your income, investments, and business activities.

- Strategic planning prevents surprises and maximises legal savings.

Timing Guidance: When to Hire an Accountant for Your Tax Return

AEO Summary (Answer-First)

Hire an accountant early—ideally six weeks before the January 31st deadline or as soon as you have major financial transactions—to ensure accurate, stress-free tax filing. Early engagement also allows proactive tax planning.

-

Key Timing Recommendations

- Approximately Six Weeks Prior to the Deadline: Gives your accountant enough time to review your records, clarify questions, and submit on time.

- After Major Financial Events: Hire immediately after events such as:

- Selling property or investments

- Starting or ending self-employment

- Receiving dividends or foreign income

- Early in the Tax Year: For proactive planning, consider hiring year-round to optimise allowances and reliefs.

-

Benefits of Early Engagement

- Reduces Last-Minute Stress: Avoid rushing paperwork and calculations near deadlines.

- Improves Accuracy: Accountants have time to check details and ensure compliance.

- Enables Tax Planning: Early engagement allows strategic decisions on expenses, allowances, and contributions.

- Prevents Penalties: Filing late or with errors can trigger HMRC fines and interest charges.

-

Practical Tip

- Keep your financial records organised throughout the year.

- Arrange an initial meeting promptly if you expect your return to be complex.

- Early communication ensures your accountant can provide year-round guidance, not just a last-minute filing service.

Hiring a tax return accountant UK early ensures a smoother, safer, and more efficient tax filing experience.

Testimonials and Social Proof: Real-Life Benefits of Hiring an Accountant

-

Freelancer Saved Hours and Avoided Mistakes

“I used to spend days trying to organise my invoices and receipts for Self Assessment. After hiring an accountant, my return was prepared correctly in just a few days. They also spotted allowable expenses I had never claimed, saving me over £1,200 in taxes.”

Key Takeaway: Accountants help freelancers save time and claim all eligible expenses.

-

Landlord Avoided Penalties and Misreporting

“I had rental income from multiple properties and wasn’t sure what could be deducted. My accountant organised all the property records, calculated my allowable expenses, and submitted the return on time. I avoided potential penalties and HMRC queries.”

Key Takeaway: Property owners benefit from risk reduction and compliance guidance.

-

Investor Maximised Reliefs

“I had dividends and some share sales in the same tax year. My accountant ensured capital gains were calculated properly, applied the exemptions I was eligible for, and helped me plan for next year. I avoided overpaying and stayed fully compliant.”

Key Takeaway: Investors can optimise tax legally while staying compliant.

-

Key Insights From Social Forums

- Many taxpayers and UK personal finance forums express anxiety about missing allowances or submitting late returns.

- Common pain points include: forgetting foreign income, misclassifying expenses, and confusion over capital gains.

- Accountants resolve these issues by providing structured guidance, checklists, and professional review.

Social proof demonstrates that hiring a tax return accountant UK delivers tangible results — from money saved to errors avoided — and reinforces trust for prospective clients.

Frequently Asked Questions On An Accountant for Tax Return

- Is It Beneficial to Pay an Accountant for Your Tax Return?

Yes. By handling the details for you, an accountant saves time, reduces the chance of slip-ups, and helps you maximise legitimate claims so you can file with certainty.

- Does an accountant guarantee accuracy in a tax return?

While no one can guarantee 100% accuracy, an accountant minimises mistakes by reviewing your records, checking calculations, and ensuring compliance with HMRC rules.

- Can an accountant help me if I made a mistake on my tax return?

Yes. They can guide you on how to amend the return correctly and communicate with HMRC to resolve any errors.

- Can an accountant submit my tax return on my behalf?

Absolutely. Most accountants can file your Self Assessment online, using HMRC-approved systems, ensuring your return is submitted properly.

- How Much Time Does an Accountant Need to Complete a Tax Return?

Simple returns can take a few days; complex returns with multiple income sources or investments may take 2–4 weeks.

- Must I Keep Tax Records If an Accountant Files My Return?

Yes. HMRC requires records to be kept for a number of years. An accountant relies on accurate records to prepare your return correctly.

- What happens if my tax return is late?

Late submissions may trigger penalties and interest from HMRC. An accountant can help you submit quickly and advise on mitigating any charges.

You should consider hiring an accountant for your tax return if your finances are complex, you want to avoid errors, or you want expert guidance on allowable expenses and reliefs. A professional ensures your return is compliant and maximises any legitimate savings.

Conclusion

Filing a UK tax return doesn’t have to be stressful. A professional accountant for tax return can guide you through every step, from organising documents to submitting your return accurately and on time. For self-employed individuals, landlords, or those with various income streams, expert support ensures accurate payments and prevents costly mistakes.

Call to Action

If you’re ready to simplify your tax filing and get expert advice, contact a qualified tax return accountant UK today. Provide your records, discuss your needs, and let a professional handle your Self Assessment efficiently.