When you search ACCA find an accountant, you’re likely looking for a trustworthy professional who can handle your business finances, ensure HMRC compliance, and provide strategic financial advice. An Accountant directory is one of the most reliable tools in the UK for doing exactly that. Operated by the Association of Chartered Certified Accountants (ACCA) — a globally respected accounting body — it helps you locate verified, regulated accountants and firms that meet the highest professional standards.

Finding an accountant can be overwhelming, especially when every firm claims to offer “expert” service. The ACCA directory simplifies your search by letting you filter accountants based on location, expertise, and services. Whether you’re a sole trader, small limited company, or a growing startup, using ACCA regulated accountants ensures you’re working with a certified professional who understands your business’s needs and UK financial regulations.

What is the ACCA “Find an Accountant” Directory?

A clear and trusted way to connect with certified accountants

The ACCA Find an Accountant directory is an official online tool managed by the Association of Chartered Certified Accountants (ACCA). It helps individuals and businesses in the UK locate qualified accountants who are fully regulated, insured, and compliant with ACCA’s strict professional standards.

Unlike general online directories or freelance marketplaces, ACCA tax accountant UK lists only ACCA members or firms that have been verified for competence, ethics, and continuing professional development. This means every listing represents an accountant who has demonstrated extensive training, passed rigorous exams, and adheres to a global code of ethics — ensuring accuracy, transparency, and trust.

The ACCA Find an Accountant directory is a free online service by ACCA that allows UK users to search for verified, qualified accountants and accountancy firms by location or service type.

Who is the ACCA, and what does membership mean?

ACCA is a top global accountancy body with 240,000 members and 540,000 students in over 180 countries, making it one of the largest and most trusted professional organisations in the world.

When you choose an accountant listed on hire ACCA accountant, you’re hiring someone backed by a global professional community, guided by continuous education, and monitored under strict ethical rules.

ACCA membership means the accountant must:

- Maintain up-to-date knowledge of UK tax, finance, and accounting regulations.

- Uphold the ACCA Code of Ethics and Conduct at all times.

- Complete the required CPD hours each year to stay updated.

- Hold valid professional indemnity insurance to ensure client protection.

This structure ensures that every accountant you find through ACCA Find an Accountant is both competent and accountable — two pillars of reliable financial advice.

How does the ACCA directory work in the UK?

The ACCA directory is simple yet powerful. You can access it through the official ACCA website and use filters to find accountants or firms near you. The process usually involves:

- Entering your location (city or postcode).

- Selecting the type of service you need — such as tax, audit, bookkeeping, payroll, or business advisory.

- Filtering by firm size or specialisation (e.g., small business accounting, e-commerce, contractors, etc.).

- Viewing contact details and verifying membership credentials directly on the ACCA platform.

Each listing includes the accountant’s ACCA registration number, practice certificate, and sometimes links to their own website or client reviews.

The ACCA Professional registry connects you directly to qualified, regulated accountants in your local area — verified by the Association of Chartered Certified Accountants to ensure professional competence and trustworthiness.

What Makes an ACCA-Qualified Accountant the Right Choice?

Choosing an accountant isn’t just about tax returns — you need a trusted partner who protects your business and keeps you compliant. Using an ACCA-qualified accountant ensures you’re working with a regulated professional who meets global standards of ethics and expertise.

Key Benefits of Choosing an ACCA Member

Every accountant listed through ACCA Find an Accountant is part of a globally respected professional body. Here’s why that matters:

- Global recognition & credibility — ACCA membership is accepted worldwide, meaning your accountant has proven expertise through rigorous exams and experience.

- Regulated by ACCA — All members must comply with professional standards and are subject to regular quality reviews.

- Up-to-date knowledge — ACCA accountants must complete annual Continuing Professional Development (CPD) to stay current with UK tax laws and financial reporting standards.

- Ethical and insured — Members adhere to a strict Code of Ethics and hold Professional Indemnity Insurance, safeguarding you if anything goes wrong.

- Strategic insight — ACCA accountants go beyond compliance to offer growth advice, forecasting, and business improvement strategies.

In short, using ACCA Find an Accountant connects you with professionals who combine technical skill, practical experience, and ethical accountability.

ACCA vs Other Accounting Qualifications

|

Feature |

ACCA |

ACA |

CIMA |

AAT |

|

Focus |

Global accountancy + audit + finance |

Audit & UK practice |

Management accounting |

Technician-level accounting |

|

Recognition |

Global |

UK-focused |

Global |

UK-focused |

|

CPD Requirement |

Mandatory annually |

Mandatory |

Mandatory |

Optional |

|

Professional Regulation |

Strict |

Strict |

Moderate |

Moderate |

Common Services Offered by ACCA Accountants in the UK

When you connect via ACCA Find an Accountant, expect access to full-service support that goes beyond basic bookkeeping:

- Company formation & registration

- Bookkeeping and payroll

- VAT and tax return preparation

- Financial forecasting and budgeting

- Annual accounts and statutory reporting

- HMRC correspondence & compliance management

- Business growth and advisory services

Many ACCA firms also integrate cloud accounting software (like Xero or QuickBooks), giving clients real-time financial insights and digital convenience.

ACCA-qualified accountants offer more than compliance — they deliver strategic financial insight, guaranteed regulation, and professional accountability. When you work with an ACCA tax accountant in the UK, you get expertise backed by world-class professional standards.

How to Search for an Accountant via ACCA (UK)

Using the ACCA Find an Accountant tool is straightforward — designed to save you time and help you connect with verified professionals who match your needs. Whether you’re a startup, freelancer, or established limited company, the directory makes it easy to locate accountants by location, service type, and experience level.

Step-by-Step: How to Use the ACCA Directory Search Tool

- Visit ACCA’s “Find an Accountant” page.

- Just add your postcode to find nearby accountants.

- Choose the services you need.

- Apply filters for specialisations.

- Check profiles for qualifications and contact info.

- Contact 2–3 firms to compare fees and expertise.

The process takes just minutes and ensures every professional you find is ACCA-qualified, insured, and regulated — a level of trust you won’t always get from general search results.

You can use ACCA tax accountant UK by entering your UK location, selecting services, and reviewing verified member profiles to choose the right accountant for your needs.

What Filters Help You Get the Best Match

With ACCA Find an Accountant, you can refine your results using several useful filters:

- Location: Find accountants near your business or who work remotely across the UK.

- Service Type: Tax returns, bookkeeping, payroll, audit, or business strategy.

- Industry Expertise: E-commerce, contractors, property, retail, or hospitality.

- Practice Size: Choose between small local practices or larger firms with multi-disciplinary teams.

Tips for Narrowing Down to 2–3 Good Prospects

Before you contact every name on the list, narrow your options strategically:

- Check their profile details — look for years of experience and listed specialisms.

- Confirm active ACCA membership — every listing shows a membership number and practice certificate.

- Look for client testimonials — many accountants link to their websites or review pages.

- Request a free consultation — many ACCA firms offer an introductory call.

- Compare communication styles — choose someone who explains clearly and understands your business goals.

Use the filters on ACCA Find an Accountant to shortlist two or three accountants based on experience, services, and fit with your business. Then, arrange brief calls to find your ideal partner.

Important Things to Look for When Selecting an Accountant

Finding an accountant through ACCA Find an Accountant gives you a verified starting point — but how do you know which professional is the right fit for your business? The answer lies in asking the right questions and evaluating their experience, communication style, and compatibility with your financial goals.

Checklist of Questions to Ask Before Hiring

Use this quick checklist when shortlisting candidates from ACCA accounting services:

- Are you a practising ACCA member?

– Confirm their membership number and certificate status on the ACCA directory. - Which client profiles do you most often work with?

– Check if they understand your industry (e.g., e-commerce, contractors, or small limited companies).

- What are your pricing options?

– Ask whether they charge a fixed monthly fee, hourly rate, or per-service cost. - What services are included?

– Ensure your package covers tax returns, bookkeeping, payroll, VAT, and year-end accounts. - How do you communicate with clients?

– Do they use cloud accounting platforms like Xero or QuickBooks for real-time collaboration? - What’s your turnaround time for key filings?

– This shows their efficiency and reliability. - Do you offer business advisory or forecasting services?

– Ideal for growing companies that want more than basic compliance.

Check Regulation, Membership, and Credentials

Every accountant listed through ACCA Find an Accountant is regulated — but it’s still important to double-check credentials:

- Active membership: Confirm they hold a valid ACCA practising certificate.

- Professional indemnity insurance: Ensures protection against errors or disputes.

- CPD compliance: ACCA accountants must complete annual training to stay updated.

- Ethical Assurance: ACCA members uphold the ACCA Code of Ethics and Conduct, giving you confidence in their services.

Evaluate How Well They Fit Your Business

While technical skills are essential, strong communication and industry knowledge matter too. Ask your accountant:

- Are they experienced with your type of business: sole trader, SME, or limited company?

- Are they experienced with UK tax systems and HMRC digital tools?

- Do they use cloud-based accounting software for transparency?

- Are they proactive — do they offer financial advice, not just compliance?

The right accountant should feel like a team member, not just someone you hire. Using ACCA Find an Accountant helps you shortlist professionals who combine technical expertise with approachable client support.

Don’t just pick the first name you see in hire ACCA accountant. Choose someone whose experience, pricing, and approach align with your goals — and who can grow with your business.

Online Accountant vs. ACCA Accountant

|

Aspect |

Online Accountant |

ACCA Accountant |

|

Regulation |

May or may not be regulated. Some online firms employ qualified professionals, but regulation is not guaranteed. |

Regulated at all times by ACCA, one of the world’s leading professional accountancy organisations. |

|

Qualification Requirement |

Staff qualifications vary between firms; not all advisers are professionally qualified. |

Required to succeed in ACCA exams, meet practical experience requirements, and maintain rigorous ethical and professional conduct. |

|

Service Model |

Generally focuses on digital, streamlined processes and high-volume workflows. Interactions are primarily online. |

Can operate online or in person, but regulation, ethics, and competence requirements remain consistent. |

|

Support Level |

Some online firms provide limited or automated support, often depending on the package chosen. |

Must maintain professional competence and provide advice aligned with ACCA standards. |

|

Complex Work Handling |

Capabilities vary. Some are well-equipped, others are more suited to routine tasks based on automation. |

Trained to handle more technical or complex areas within the scope of ACCA guidelines. |

|

Accountability |

Accountability depends on the company’s internal policies. If unregulated staff are involved, there may be fewer formal protections. |

Subject to monitoring, quality assurance reviews, professional discipline, and mandatory professional indemnity insurance. |

|

Consistency of Standards |

Standards differ between firms; some rely heavily on software-driven processes. |

Must follow ACCA’s Code of Ethics, maintain CPD, and meet regulated practice requirements. |

|

Best For |

Businesses seeking low-cost, highly digital, routine accounting solutions—depending on the firm’s structure and qualifications. |

Businesses needing regulated, professionally overseen services where reliability, technical competence, and accountability are priorities. |

Short Explanation

- An online accountant is defined by how services are delivered (digitally), not who delivers them. Some online accountants are ACCA-qualified; others are not.

- An ACCA accountant is defined by regulation, qualification, and professional standards—regardless of whether they work online, in a hybrid model, or in person.

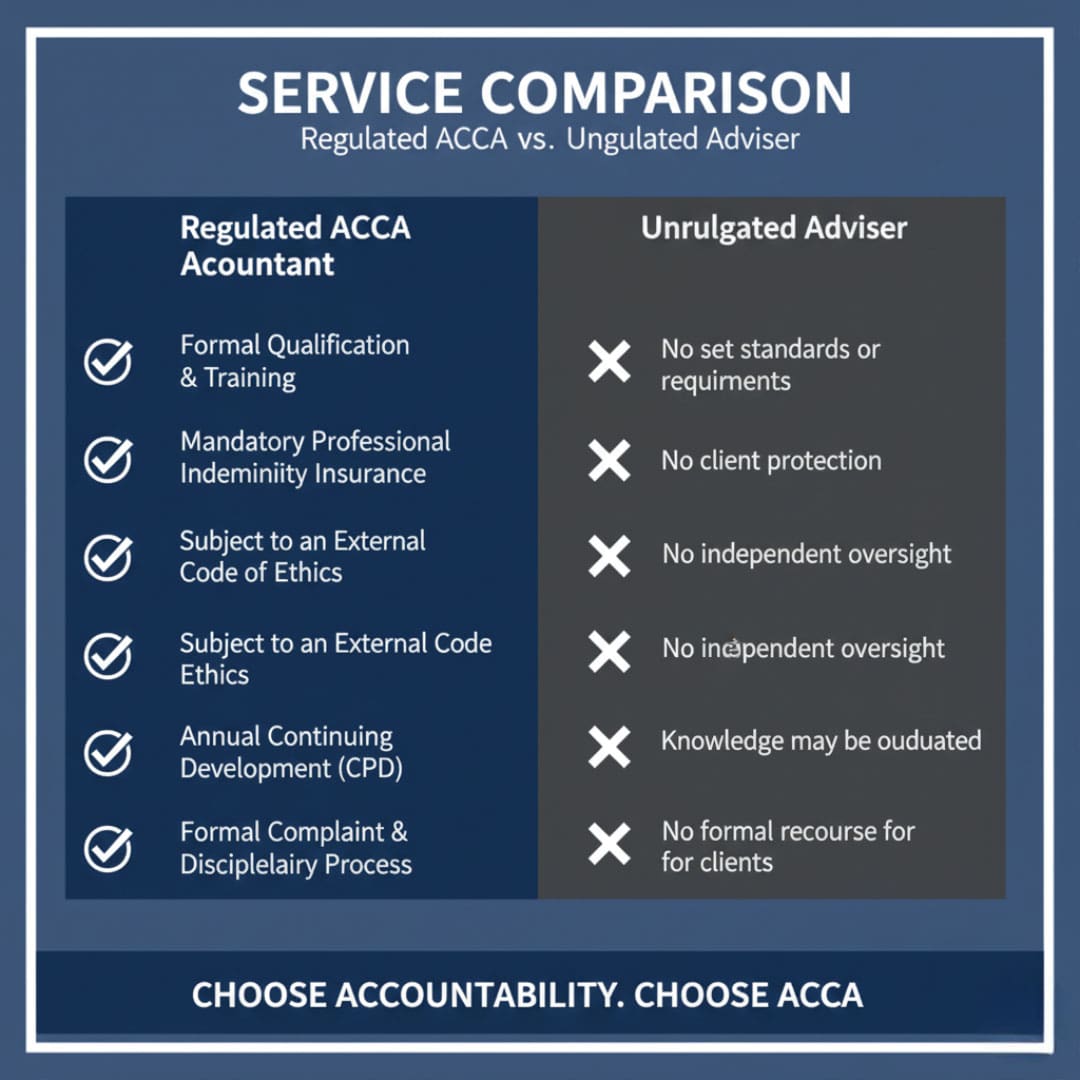

ACCA vs. Unregulated Advisers

|

Aspect |

ACCA Accountant |

Unregulated Adviser |

|

Regulation & Oversight |

Members are regulated by the Association of Chartered Certified Accountants, which sets standards for ethics, professional behaviour, and ongoing competence. |

No governing body; quality and conduct vary widely because they are not bound by a professional regulator. |

|

Education & Qualification |

Must complete ACCA exams, ethics training, and practical experience requirements before membership is granted. |

No formal qualification is required to offer accounting or tax services in the UK. Training, if any, differs from person to person. |

|

Ethical Requirements |

Must follow ACCA’s Code of Ethics and Conduct, including integrity, objectivity, confidentiality, and professional competence. |

Ethical standards are self-determined and not enforced by an external authority. |

|

Professional Liability Insurance |

ACCA members offering services to the public are required to hold appropriate professional indemnity insurance. |

Insurance may or may not be held; there is no mandatory requirement. |

|

Quality Assurance Reviews |

ACCA performs periodic monitoring and practice reviews to ensure standards are met. |

No external reviews unless voluntarily adopted. |

|

Complaint & Disciplinary Process |

Clear, formal mechanisms exist for investigating complaints and imposing sanctions if standards are breached. |

No structured system for clients to file complaints or seek disciplinary outcomes. |

|

Continuing Professional Development (CPD) |

CPD is mandatory each year to maintain competence. |

No legal requirement to maintain or update knowledge. |

|

Suitability for Complex Work |

Generally well-placed to handle regulated, technical, or high-risk work due to formal training and oversight. |

Capability varies, and complex matters may exceed their expertise if no recognised qualification is held. |

Choosing an ACCA accountant ensures regulated, qualified, and ethical financial support, backed by mandatory training, professional liability insurance, and formal oversight. Unregulated advisers lack standard qualifications, consistent ethics, and structured accountability, making ACCA members a safer choice for complex or high-risk accounting and tax matters.

UK Accountant Fees Explained: Pricing Models and What You’ll Pay

A common question after using ACCA Find an Accountant is: ‘What will it cost?’ Fees vary by business complexity and service level, but understanding pricing models makes it easier to compare options.

Fixed Fee vs Hourly vs Monthly Retainer

|

Model |

How It Works |

Best For |

|

Fixed Fee |

You pay a set price per service (e.g., tax return or company accounts). |

Freelancers or small businesses with predictable needs. |

|

Hourly Rate |

You’re billed for the time spent on your work (often £50–£150/hour). |

One-off consultations or irregular projects. |

|

Monthly Retainer |

You pay a flat monthly fee that includes multiple services (VAT, payroll, accounts). |

Growing SMEs or limited companies that need ongoing support. |

Typical UK Accounting Costs (2025 Estimates)

Below is a general overview of what you might expect to pay:

- Sole traders: £30–£70/month (basic bookkeeping & tax returns)

- Limited companies: £80–£250/month (VAT, payroll, accounts, advice)

- Startups: £50–£120/month (depending on growth stage & support)

- One-off services:

- Company formation: ~£100–£200

- Annual accounts filing: ~£300–£800

- Tax return preparation: ~£150–£300

Regional Pricing Comparison

- London and the South East – Higher fees due to demand, operating costs, and complex client needs.

- Large Cities (Manchester, Birmingham, Leeds, Bristol) – Wide pricing range; competition offers both premium and budget options, often with specialised services.

- Mid-Sized Towns & Regional Hubs – Moderate fees for small businesses and local trades; lower operating costs reduce prices.

- Rural Areas & Smaller Communities – Lower fees with generalist services suited to local businesses.

- Online, Nationwide & Remote Practices – Often competitive pricing due to lower overheads; cost depends on qualifications and service level.

A Guide to Budgeting for Accounting Services

Tips for Getting the Most Out of Your Accountant:

- Ask about costs early: Always request a written breakdown before signing on.

- Bundle services: Combining bookkeeping, VAT, and payroll often lowers total costs.

- Use cloud accounting tools: Firms that use software like Xero or QuickBooks can reduce admin time (and save you money).

- Invest strategically: A good accountant helps you save more through efficient tax planning than they cost in fees.

UK accounting costs vary by service model, business type, and region. Fixed fees suit predictable tasks, hourly rates cover one-off work, and monthly retainers provide ongoing support. Typical costs range from £30–£250/month, with higher fees in London and lower in rural areas. Budget effectively by clarifying fees upfront, bundling services, using cloud accounting, and investing in an accountant who delivers long-term tax savings.

Industry-Wise Accounting Needs vs. How an ACCA Accountant Helps

|

Industry |

Key Accounting Needs (Well-Established, General Requirements) |

How an ACCA Accountant Typically Addresses Them |

|

E-commerce & Online Retail |

• Managing high-volume transactions |

• Designs systems to automate transaction capture |

|

Construction & Trades |

• CIS compliance |

• Manages CIS filings and deductions |

|

Healthcare (Clinics, Dentists, Care Providers) |

• Payroll sensitivity & compliance |

• Supports compliant payroll |

|

Property and Real Estate Services |

• Monitoring Rental Income |

• Maintains compliant rental accounts |

|

Hospitality (Restaurants, Cafés, Hotels) |

• Cash-intensive operations |

• Builds strong cash-control processes |

|

Freelancers & Contractors |

• Expense categorisation |

• Helps identify allowable expenses |

|

Manufacturing |

• Cost of goods produced |

• Designs costing models |

|

Nonprofit & Charities |

• Restricted/unrestricted fund tracking |

• Establishes fund-tracking structures |

Different industries have unique accounting needs, from VAT and multi-currency management in e-commerce to CIS compliance in construction and payroll sensitivity in healthcare. An ACCA accountant provides tailored solutions—automating processes, ensuring regulatory compliance, and optimizing financial management—to meet each sector’s specific requirements efficiently.

Mistakes to Avoid When Choosing an ACCA Accountant

- Assuming All Accountants Are Regulated – Only ACCA members are formally regulated; always check credentials.

- Not Verifying Membership – Use ACCA’s register to confirm active status.

- Choosing Only by Price – Low fees may indicate limited experience or support; consider expertise too.

- Unclear Service Scope – Confirm what’s included (bookkeeping, VAT, payroll) with a clear engagement letter.

- Ignoring Industry Experience – Sector knowledge matters to avoid errors and missed opportunities.

- Late Engagement – Early involvement allows better planning and reduces last-minute issues.

- Overlooking Communication – Clarify how updates and queries will be handled.

- Poor Record-Keeping – Organised records improve accuracy and compliance.

- Avoiding Cloud Accounting – Cloud tools streamline collaboration and reduce errors.

- Skipping Engagement Letter Review – Ensures clarity on responsibilities, fees, and services.

Avoid common pitfalls when choosing an ACCA accountant by verifying credentials, checking membership, and considering expertise over cost. Ensure clear service scope, sector experience, timely engagement, effective communication, proper record-keeping, and use of cloud accounting, all confirmed through a detailed engagement letter.

Case Studies: How ACCA Accountants Solve Real Business Problems

Case Study 1: Small Retail Business Reduces Tax Errors

- Problem: The owner managed bookkeeping using basic spreadsheets and often struggled with VAT rules, especially for mixed-rated products.

- Solution: Engaged an ACCA accountant who provided structured guidance on VAT treatments and implemented cloud accounting software.

- Outcome: Misclassified transactions were corrected, reducing the risk of penalties in future compliance checks.

Case Study 2: Contractor Gains Clarity on IR35

- Problem: An IT contractor operating through a limited company was unsure about IR35 compliance.

- Solution: An ACCA accountant conducted a detailed assessment using HMRC criteria and provided clear evidence-based guidance on contracts and record-keeping.

- Outcome: The contractor could make confident decisions on engagements and avoid potential disputes.

Case Study 3: Start-Up Establishes Strong Financial Foundations

- Problem: A new tech start-up needed support with incorporation, payroll setup, and early-stage tax planning.

- Solution: ACCA accountant guided the founders on company structure, directors’ responsibilities, and efficient payroll processes.

- Outcome: The start-up avoided common early-stage compliance errors and could focus on growth.

Frequently Asked Questions (FAQ)

- What if the accountant I like isn’t listed in the ACCA directory?

If they aren’t listed on ACCA Find an Accountant, they might not be an active member. Ask for their membership number to verify. If they can’t provide it, be cautious.

- Is ACCA Find an Accountant suitable for sole traders and freelancers?

Yes — it’s ideal for sole traders and startups. Many ACCA accountants specialise in small business work, and you can use filters to find them easily.

- Does ACCA guarantee the accountant’s work?

ACCA doesn’t guarantee the work, but it regulates members and can investigate complaints, providing protection not available with unregulated advisers.

- How do I change my accountant if I’m already with one?

Switching accountants is simple. Notify your current accountant, request your records, and your new ACCA accountant will manage the handover with HMRC.

- What about audit services — can I get those via ACCA members?

Yes — many ACCA-listed accountants are audit-qualified. Simply use the directory filters to find firms with audit certificates.

- Are ACCA accountants suitable for international or cross-border businesses?

Yes — ACCA-qualified accountants are trained in international standards and can handle cross-border compliance, multi-currency work, and overseas tax matters, making them suitable for globally operating UK businesses.

Conclusion

Find the right accountant — with confidence and clarity

Choosing the right accountant can shape the financial success of your business. The ACCA Find an Accountant directory gives you a clear, trusted path to finding qualified professionals who meet global standards for ethics, accuracy, and business insight. No matter if you’re a sole trader, a new business, or an expanding limited company, this ACCA-verified platform guarantees accountants who meet strict UK regulatory standards and maintain continuous professional development.

Next Steps: Start Your Search Today

Ready to find your ideal accountant?

Explore the official ACCA Find an Accountant directory, follow the steps, and secure professional management of your finances, so you can concentrate fully on growing your business.