The journey of running a business is rewarding — the financial admin, usually less so. Receipts build up, HMRC deadlines sneak closer than expected, and one small mistake on a tax return could cost you penalties. Many business owners start with spreadsheets or software like Xero/QuickBooks, only later realising that they spend more time fixing errors than running their business.

That’s where a local accountant becomes a game changer.

A reliable UK accountant can help you file taxes correctly, keep books organised, submit accounts to HMRC and Companies House, manage payroll, and even register your business from day one. And best of all — they cut your time, costs, and stress, all while ensuring full accuracy and compliance.

If you’ve ever felt overwhelmed by paperwork or unsure about tax rules, working with a local accountant is likely the smartest investment you can make.

What is a Local Accountant?

A local accountant is a UK-based financial professional who assists businesses and individuals with accounting, tax management, bookkeeping, business registration, and ongoing compliance obligations. They handle everything from day-to-day financial records to annual reporting and tax submission.

Quick definition:

A local accountant manages tax, bookkeeping, payroll and company finances for UK businesses to ensure compliance and support financial growth.

What a Local Accountant Helps You With

A local accountant plays a key role in keeping your business financially organised, legally compliant, and stress-free. Instead of juggling paperwork, receipts, and tax deadlines on your own, a local accountant manages everything from tracking your income and expenses to preparing accurate financial statements that reflect the true performance of your business. They also take responsibility for filing tax returns and communicating with HMRC on your behalf, reducing the risk of mistakes, penalties, or late submissions.

Beyond tax and bookkeeping, a local accountant can register your business with Companies House or HMRC, guide you on whether to start as a sole trader or form a limited company, and handle all ongoing compliance work. They offer continuous financial advice, helping you make informed decisions, improve cash flow, and identify legitimate tax-saving opportunities so you keep more profit in your pocket.

In short, a local accountant becomes an essential partner for smooth business operations and long-term financial growth.

When You Need One:

You should consider hiring a local accountant if:

- You feel unsure about HMRC rules

- Your bookkeeping takes too much time

- You must file your yearly tax return or company accounts.

- You’re about to launch a new business.

- You want to reduce tax liability and increase profits

- You want clarity on cash flow and business performance

Services a Local Accountant Usually Handles

Local accountants offer more than just tax submission — they provide a complete financial support system.

- HMRC Compliance & Tax Filing

Designed for freelancers, small business owners, and limited companies.

- Get your Self Assessment return submitted with no errors and no delays

- Prepare, calculate, and file your Corporation Tax return

- Handle VAT registration and submit VAT returns on schedule

- CIS support for contractors

- Capital allowance claims

- Direct communication with HMRC on your behalf

- Advice to legally reduce tax payments

Why it matters: Minimises risk of errors, claims maximum reliefs, prevents penalties.

- Bookkeeping & Financial Records

Accurate bookkeeping is the foundation of stress-free accounting.

- Record income & expenses

- Categorise business transactions correctly

- Maintain digital or cloud-based records

- Bank reconciliation & statement checks

- Monthly/quarterly management reports

- Prepare books for year-end filing

Result: You stay on top of everything, tax season feels simple, and you always know exactly where your money goes.

- Payroll, VAT & CIS Management

Helpful for growing businesses with teams or contractors.

- Payroll processing for employees

- PAYE setup & submissions

- VAT registration guidance

- Quarterly VAT return filing

- CIS deductions reporting

Prevents: Overpayments, late submissions, payroll miscalculations.

- Limited Company Setup & Business Registration

Your accountant can register your business correctly from day one.

- Assist with forming and registering your limited company

- Manage your HMRC tax setup — Corporation Tax, PAYE, and VAT

- UTR setup for self-employed individuals

- Help choosing tax-efficient structure

Outcome: Correct formation saves tax long-term and avoids compliance mistakes.

- Accounting Software Setup & Digital Support

Modern accounting is now digital — your accountant ensures smooth setup.

- Account setup with Xero, QuickBooks or FreeAgent

- App integration for receipt capture

- Real-time financial dashboards

- Automation to reduce admin work

Benefit: Less paperwork. More clarity.

Why Choose a Local Accountant Over DIY or Software Alone?

While many small business owners begin with DIY spreadsheets or accounting software, issues often arise over time—missing receipts, mismatched transactions, confusion over expense categories, and hours spent fixing errors. Software can record data, but a human accountant provides expert judgement, ensures compliance, and prevents expensive mistakes.

Key Advantages of Hiring a Local Accountant

- Personal advice tailored to your business

A local accountant understands your situation and offers customised financial and tax guidance. - Prevents costly financial errors

They spot mistakes early, helping you avoid penalties, inaccuracies, or incorrect reporting. - Helps you pay the right tax — not more

They uncover tax reliefs and deductions to help you pay less tax within the law. - Frees up time so you can concentrate on business growth

Instead of bookkeeping headaches, you use time for sales, clients, and business development. - Acts as your HMRC representative if needed

If HMRC contacts you, your accountant can respond, handle queries, and manage compliance on your behalf.

Mini Case Example

Tom, a contractor, used to file taxes himself and unknowingly missed expenses like mileage and equipment. After hiring a local accountant, he claimed all eligible reliefs, saved over £1,000 yearly, and stopped worrying about deadlines or paperwork.

How a Local Accountant Helps With Tax Filing

Step-by-Step Tax Filing Process Explained

- Review Your Financial Documents

The accountant checks all your receipts, invoices, bank statements, and records to ensure accuracy and completeness. - Organise Income and Expenses

All income and expenses are categorised correctly, making it easier to calculate profits and prepare for tax. - Calculate Tax Owed Accurately

Using the organised data, they work out the exact amount of tax you need to pay, avoiding underpayment or overpayment. - Identify Tax Reliefs You Qualify For

They find all eligible deductions, allowances, and reliefs to legally reduce your tax liability. - Submit Tax Return to HMRC

The prepared tax return is filed securely and on time with HMRC, ensuring compliance and avoiding penalties. - Provide a Copy and Post-Year Tax Advice

You receive a copy of your filed return along with advice on planning for future tax years and improving financial efficiency.

Common Allowances Many People Miss:

- Home office use

- Mileage & travel

- Equipment costs

- Professional fees

- Marketing expenses

- Professional growth and training programs

Self-Assessment & Corporation Tax Guidance:

- Help with tax returns for sole traders and individuals

- Annual accounts + corporation tax for LTD companies

- Advice for directors on salary vs dividend

A local accountant handles your entire tax process, ensures accuracy, claims reliefs and files your return on time.

Local Accountant for Bookkeeping & Financial Clarity

Bookkeeping is ongoing — not just for year end. When handled properly, it can reveal opportunities to cut costs and increase profits.

What Bookkeeping Includes:

- Categorising transactions

- Tracking unpaid invoices

- Monitoring expenses

- Producing monthly statements

- Financial dashboard access

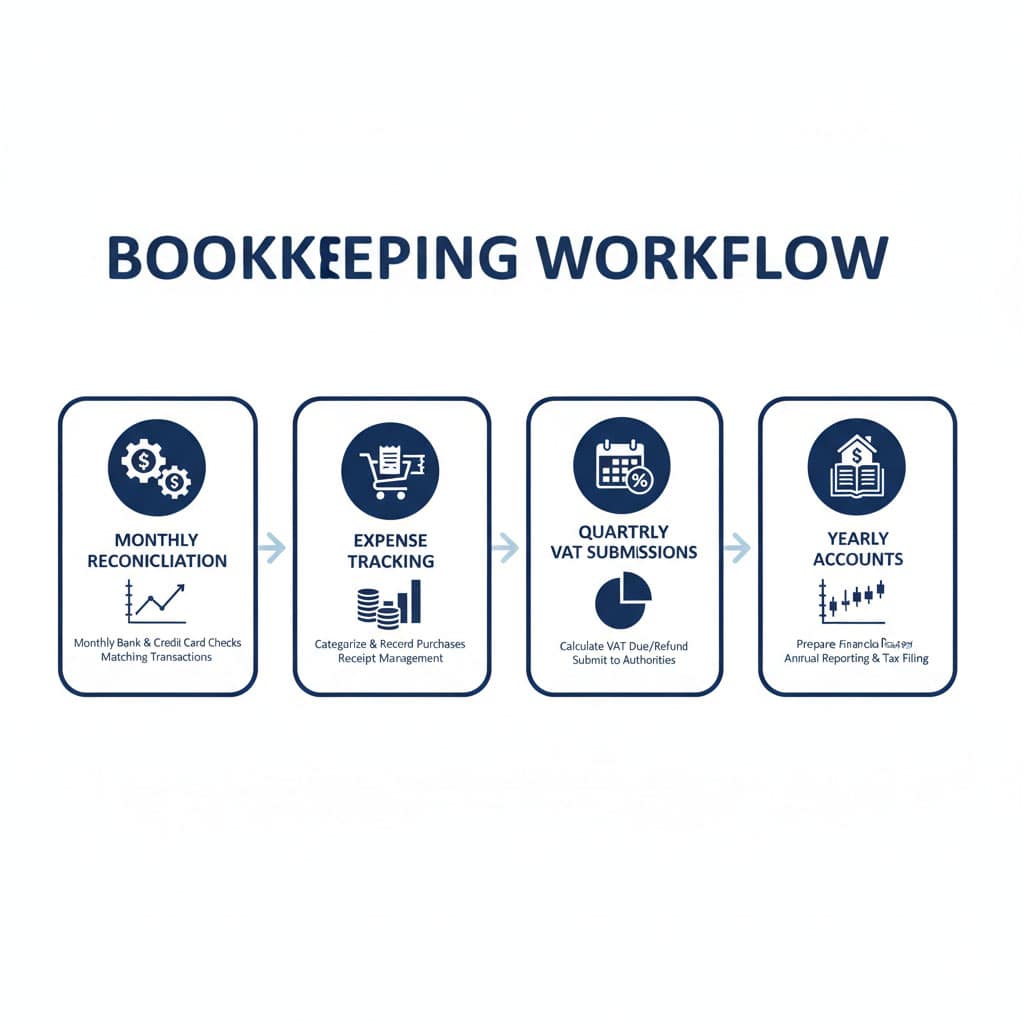

Workflow:

|

Period |

Tasks |

|

Monthly |

Bank reconciliation, expense tracking |

|

Quarterly |

VAT submissions, financial review |

|

Yearly |

Final accounts & tax filing |

Why it Helps You Make Better Decisions:

- See your cash flow as it happens

- Know exactly which products or services drive profit

- Spot overspending early

- Budget confidently

Business Registration Support (UK)

Building a business is rewarding, though navigating compliance can be confusing. Local accountants guide you from day one.

Business Structure Comparison:

|

Structure |

Tax Type |

Suited For |

Benefits |

|

Sole Trader |

Income Tax |

Freelancers, small operators |

Simple setup, low admin |

|

Limited Company |

Corporation Tax |

Growing businesses |

More tax planning options |

|

Partnership |

Income Tax |

Shared ownership |

Flexible for joint ventures |

Documents Needed:

- Proof of identity & address

- Business name & activity description

- Shareholder/director details

- Contact information

How an Accountant Helps

A local accountant plays an essential role in setting up and maintaining your business compliance from the very beginning. They can register your new company with Companies House, ensuring the formation process is done correctly and legally.

Once registered, your local accountant will also handle important setup tasks such as registering for Corporation Tax, PAYE for employees, and VAT if your turnover requires it. They provide expert advice on the right business structure for tax efficiency, whether sole trader, partnership, or limited company, to get your finances on track.

In addition, a local accountant manages annual accounts and confirmation statements, keeping your business compliant and helping you avoid late filing penalties.

Accounting Costs in the UK (Transparent & Realistic)

Prices vary depending on service level, business size, and bookkeeping volume.

|

Service Type |

Typical Cost |

|

Sole Trader Returns |

£30–£70/month |

|

Limited Company Accounts |

£70–£150/month |

|

Bookkeeping |

£40–£120/month extra |

|

Payroll |

£3–£6 per employee |

|

VAT Returns |

£80–£200 quarterly |

Tips to Reduce Accounting Fees

- Keep Receipts Organised

Well-organised documents save your accountant time, which reduces billable hours and overall cost. - Use Cloud Accounting

Using tools like Xero or QuickBooks automates data entry and makes collaboration easier, lowering admin work. - Submit Documents on Time

Providing information promptly helps avoid extra charges for urgent work or deadline pressure. - Avoid Last-Minute Filing

Early preparation prevents rush fees and reduces the risk of errors or penalties from late submissions.

How to Choose the Right Local Accountant

Checklist for Choosing the Right Local Accountant

- Qualified (ACCA / ICAEW / AAT)

Ensure your accountant is professionally certified, proving they meet industry standards and ethical regulations. - Transparent Pricing

Make sure pricing is clear and upfront, so you always know what to expect financially. - Experience With Your Industry

An accountant familiar with your sector understands typical expenses, tax rules, and challenges specific to your business. - Offers Tax Planning — Not Just Filing

A great accountant helps you reduce tax legally through proactive planning, rather than just submitting returns. - Uses Digital Accounting Software

Modern tools like Xero or QuickBooks make bookkeeping faster, accurate, and easier for you to access real-time financial data. - Responsive Communication & Support

Choose someone who replies promptly, answers questions clearly, and offers ongoing support when you need it.

Top of Form

Bottom of Form

Ask before hiring:

- How will you help me reduce tax?

- Do you provide bookkeeping or only year-end accounts?

- Can we work remotely or face-to-face?

High Precision Quick Answers

- Do I need a local accountant? Yes — if you want accurate accounts, stress-free tax filing and financial clarity.

- Can they help with tax returns? Absolutely — they handle filing, calculations and HMRC communication.

- Are accountants expensive? Costs are flexible and often much cheaper than mistakes or penalties.

- Do they help start a business? Yes — they register companies, set up taxes and guide structure.

Voice Search FAQ

How can a local accountant help me?

They manage your tax, bookkeeping and business finances so you save time and avoid HMRC mistakes.

What does bookkeeping include?

Recording income, expenses, receipts and bank reconciliation to keep accounts accurate.

Should I hire one if I’m self-employed?

Yes — it reduces stress, saves tax and keeps your accounts organised all year.

Can accountants register a Limited Company?

Yes, they handle Companies House and HMRC setup for you.

Real Scenario

Emma runs a small e-commerce store from home. She handled bookkeeping herself using spreadsheets but constantly fell behind. VAT confused her, tax deadlines were stressful, and she feared overpaying.

After hiring a local accountant:

- Bookkeeping was moved to Xero and automated

- She claimed home office & packaging expenses correctly

- VAT returns were submitted quarterly without stress

- She saved over £1,500 in tax the first year alone

- She now had the freedom to prioritise growth

A simple decision created real financial impact.

Conclusion

A local accountant gives you clarity, confidence and compliance — three things every business needs. From tax filing to everyday bookkeeping and even helping you register a new business, the right accountant saves you time, reduces mistakes, and helps you keep more of your earnings.

If you want expert financial support without the overwhelm, now is the perfect time to work with a professional.

Call to action

Want stress-free accounting?

Let us handle your tax, bookkeeping and registration so you can focus on growing your business.

Book your free consultation today.