If the question “How much does an accountant cost?” is on your mind, you’re definitely not the only one. Thousands of individuals and small business owners across the UK search this every month — usually right before tax season or when their business starts to grow. The truth is, there isn’t a single fixed price, because how much an accountant costs depends on your business type, the complexity of your finances, and the support level you need. But the good news is: you can absolutely get a clear price range and know what’s fair before you hire anyone.

Whether you’re a sole trader filing a simple tax return, a limited company needing monthly bookkeeping, or a landlord managing multiple properties, this guide breaks down how much an accountant costs in the UK, what affects those costs, and how to choose the right accountant without overpaying.

How Do Accountants Charge? (Pricing Models Explained)

When people ask “How much does an accountant cost?”, the answer depends heavily on how the accountant charges for their services. In the UK, accountants typically use three main pricing models: fixed monthly fees, hourly billing, and one-off service fees. Understanding these models makes it easier to compare quotes fairly.

- Fixed Monthly Fees

Most modern accountants offer monthly subscription-style packages.

Small businesses like this option due to the steady support and fixed-cost structure.

Typical monthly costs:

- £50 – £350+ per month depending on business size and bookkeeping volume.

Usually includes:

- Managing your books

- Producing year-end accounts

- Handling tax submissions

- Software access (Xero, QuickBooks, etc.)

- Unlimited support and advice

Best for:

Sole traders, limited companies, contractors, landlord portfolios, and growing businesses that need ongoing help.

- Hourly Billing

Some accountants still charge by the hour, especially for specialist work.

Rates per hour usually sit between £25 and £150+, varying with the accountant’s skills and your area

Commonly used for:

- One-time tax consultations

- Tax investigation support

- Business financial planning

- Complex accounting corrections

Pros: Pay only for what you use.

Cons: Can be unpredictable if the work takes longer than expected.

- One-Off Service Fees

If you do not need monthly support, you can request single services instead.

Typical one-off accounting service prices:

|

Service |

Approx. Cost (UK) |

|

Self Assessment tax return |

£120 – £350 |

|

Company year-end accounts + CT600 |

£900 – £3,000 |

|

VAT return filing |

£75 – £200 |

|

Payroll setup |

£50 – £120 one time |

|

Payroll management |

£5 – £10 per payslip or £20 – £60 per month |

This model is popular for businesses that handle bookkeeping themselves but need help with specialist submissions.

Accountants charge using either monthly fixed fees, hourly rates, or one-off service fees.

- Monthly fees are best for businesses needing ongoing support.

- Hourly rates apply to specialist or advisory work.

- One-off fees are ideal for tax returns or annual accounts.

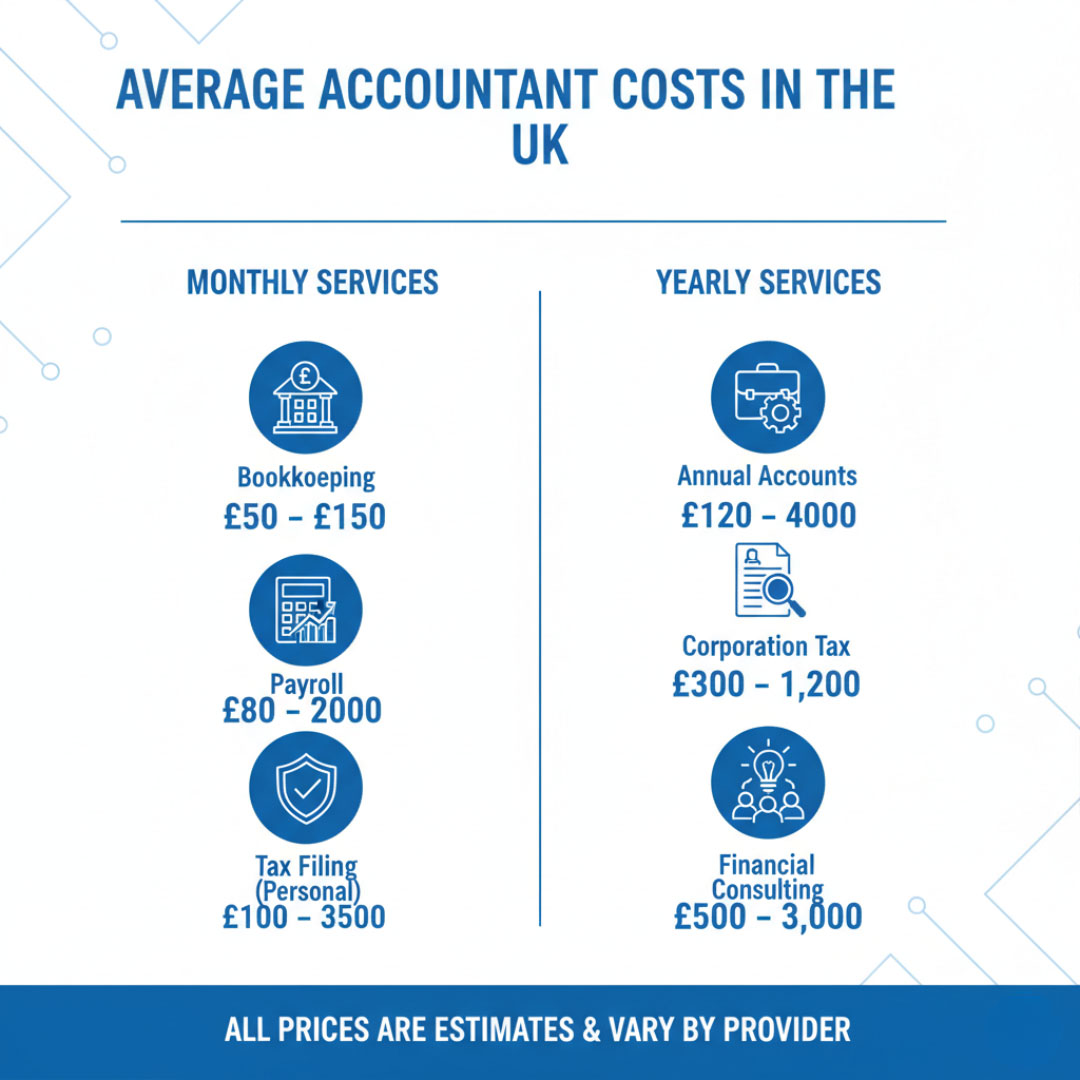

What Are the Average Accountant Fees in the UK?

Here is the quick, direct answer:

|

Service Type |

Typical UK Cost Range |

|

Self Assessment (individual tax return) |

£120 – £350 per return |

|

Sole Trader Annual Accounts + Tax Return |

£300 – £900 per year |

|

Limited Company Year-End Accounts |

£900 – £3,000 per year |

|

Monthly Accounting Packages (Bookkeeping + Support) |

£50 – £350 per month |

|

Payroll Services |

£5 – £10 per payslip (or fixed monthly fees) |

|

VAT Returns |

£75 – £200 per return |

Most individuals and small businesses use fixed-fee monthly packages because they are predictable and include ongoing support. Limited companies usually pay more than sole traders because accounting requirements are more complex.

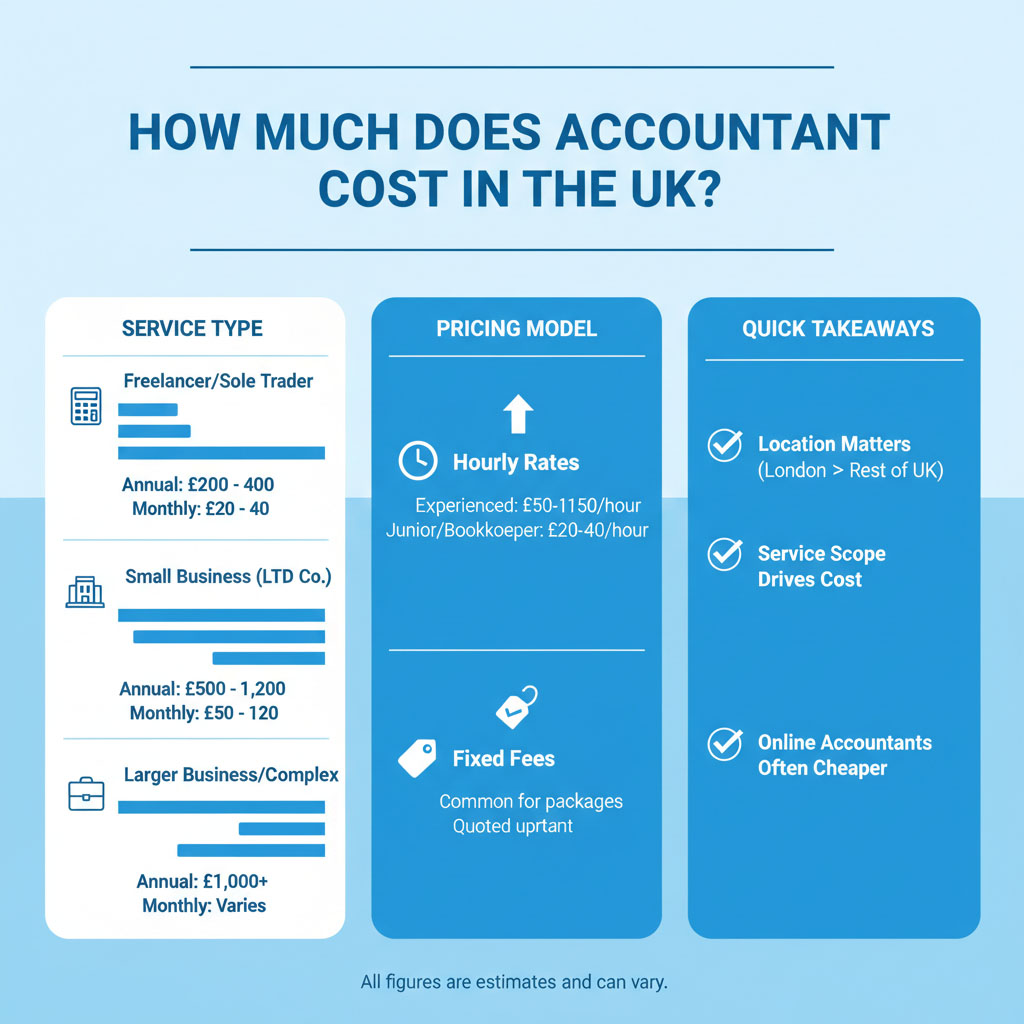

Accountant Cost Breakdown by Business Type

The cost of accounting varies depending on your business structure. A sole trader usually pays less than a limited company because reporting requirements are simpler. If you’re still comparing how much does an accountant cost, these breakdowns will help you estimate what’s normal and what’s overpriced.

1. Accountant Cost for Sole Traders

Typical annual cost: £300 – £900 per year

(or £25 – £75 per month if paying monthly)

Most sole traders need:

- Bookkeeping support (optional)

- Year-end accounts

- Self Assessment tax return

Example: How much does an accountant cost for a sole trader

A sole trader earning £32,000 annually with simple income and expense records may pay around £350 – £500 per year.

A sole trader with multiple income streams or high transaction volume may pay £600 – £900.

Good fit for:

Freelancers, tradespeople, online sellers, tutors, consultants.

2. Accountant Cost for Limited Companies

Typical annual cost: £900 – £3,000+ per year

(or £80 – £350+ per month)

Limited companies require more compliance, including:

- Annual accounts (Companies House)

- Corporation tax return (CT600)

- Bookkeeping

- Payroll for directors/employees

- VAT (if registered)

Example:

A small LTD with one director paying themselves a mix of salary + dividends might pay £90 – £150/month.

A VAT-registered business with staff, suppliers, invoices, and stock might pay £150 – £350+/month.

Why higher:

More reporting rules + greater accuracy required.

3. Accountant Cost for Freelancers & Contractors (PSC / IR35)

Typical monthly cost: £70 – £160 per month

Contractor accountants often offer specialist packages, including:

- Salary + dividend tax planning

- IR35 compliance advice

- Monthly bookkeeping

- Year-end accounts + CT600

- Personal Self Assessment

For contractors working via a limited company, monthly fees usually range from £90 to £140.

If you use an umbrella company: fees are usually built into payroll — no accountant needed.

4. Accountant Cost for Landlords

Typical cost: £150 – £600+ per Self Assessment tax return

Costs depend on:

- Number of properties

- Whether furnished holiday let rules apply

- Whether you operate as individual or limited company landlord

Example:

1 rental property → £150 – £250

5+ properties or LTD portfolio → £450 – £900+

5. Accountant Cost for Startups

Startups often need more advice, not just compliance. You can expect to pay £80–£250 monthly, based on factors like:

- Investor reporting

- R&D tax credits

- Payroll

- Software integrations

- Bookkeeping level

Tip: Look for accountants who work with startups specifically. They’ll offer growth-focused guidance instead of just paperwork.

Summary

|

Business Type |

Cost Range (UK) |

|

Sole Trader |

£300 – £900/year |

|

Limited Company |

£900 – £3,000+/year |

|

Freelancer / Contractor |

£70 – £160/month |

|

Landlord |

£150 – £600+ per tax return |

|

Startup |

£80 – £250/month |

What Affects the Cost of an Accountant? (Key Pricing Factors Explained)

If you’re still comparing how much does an accountant cost, it’s important to understand why prices vary. Two businesses can look similar on the outside, yet one may pay double the accounting cost because of complexity, bookkeeping volume, or support needs. Here are the key factors that influence accountant pricing in the UK.

1. Complexity of Your Accounts

If your finances are complex, expect your accountant to spend more time and apply more specialised knowledge.

Complexity increases if you:

- Operate a limited company instead of sole trader

- Have employees (payroll)

- Handle stock, imports, or exports

- Are VAT registered

- Receive income from multiple sources

Simple = cheaper.

Complex = higher monthly or annual fees.

2. Number of Transactions Per Month

Accountants often base pricing on transaction volume because it affects bookkeeping workload.

|

Transaction Level |

Typical Fees |

|

Low (0–40/m) |

Lower monthly fees |

|

Medium (40–200/m) |

Mid-range fees |

|

High (200+/m) |

Higher professional fees or custom pricing |

If your business uses automation (e.g., bank feed + receipt app), you may pay less.

3. Whether You Need Bookkeeping Included

Some businesses do their own bookkeeping, others leave it entirely to the accountant.

- Doing your bookkeeping yourself → lower accountant fees

- Accountant handles everything → higher monthly fees but less stress

Bookkeeping typically adds £30 – £250+/month depending on volume.

4. Software and Cloud Tools Included

Many accountants provide tools like Xero, QuickBooks, FreeAgent and receipt capture apps.

If included, your monthly fee might be slightly higher, but you avoid:

- Software subscriptions

- Data mistakes

- Manual spreadsheet headaches

In most cases, having software included saves money in the long run.

5. Experience and Location of the Accountant

- Local high-street firms in London and big cities charge more.

- Online accountants tend to be more affordable and flexible.

- Specialist or chartered accountants cost more but offer higher-level guidance.

If you only need compliance, cost matters more.

If you want tax strategy, experience matters more than price.

6. Support Level and Response Speed

Some accountants offer:

- Next-day email support

- Quarterly reviews

- Annual tax planning meetings

Others only contact you once a year at year-end.

More support = higher monthly fees, but better tax savings and fewer mistakes.

The cost of an accountant in the UK depends on complexity, bookkeeping volume, business type, software needs, and support level.

Small, simple businesses pay less; larger, multi-income, VAT-registered or payroll businesses pay more.

Simple Cost-Reduction Strategies for Accountant Fees: How much does an accountant cost for a sole trader

1. Choose the Right Service Level

- Tip: Choose only the essential services to keep costs down.

- Example: A freelancer may only need tax return filing and basic bookkeeping, not full advisory packages.

- Benefit: Paying only for the services relevant to your business can save hundreds per year.

2. Use Cloud Accounting Software

- Tip: Tools like Xero, QuickBooks, or FreeAgent can automate bookkeeping and reduce manual work.

- How it helps: Accountants spend less time on your accounts, lowering hourly fees.

- Extra advantage: You gain real-time insights into your business finances.

3. Prepare Your Documents in Advance

- Tip: Keep receipts, invoices, and bank statements organised throughout the year.

- Benefit: Less time spent by your accountant means lower fees.

- Practical example: Monthly bookkeeping vs. annual rush filing can reduce unexpected costs.

4. Compare Quotes and Packages

- Tip: Request quotes from multiple accountants and compare services, not just price.

- Benefit: Ensures you get the best value for your budget.

- Extra tip: Look for fixed monthly packages to avoid surprise bills.

5. Consider Online or Hybrid Accountants

- Tip: Remote or cloud-based accountants often charge 20–50% less than traditional London firms.

- Best for: Small businesses and freelancers comfortable with digital tools.

Reduce accountant fees by choosing the right service level, using cloud software, staying organised, comparing quotes, and considering online accountants. Little improvements can translate into big savings over the year.

Is Hiring an Accountant Worth It? A Look at Costs and Savings

How an Accountant Can Save You Money

- Tax Optimization: Accountants ensure you claim all allowable expenses and reliefs.

- Penalty Avoidance: Accurate and timely filings prevent costly HMRC fines.

- Financial Strategy: Effective planning can minimise tax obligations and enhance cash flow.

- Increased Efficiency: Spend more time on business growth instead of routine accounting.

Sample Cost vs Savings Scenarios: How much does an accountant cost for a sole trader

|

Business Type |

Accountant Cost (per year) |

Potential Tax Savings / Penalty Avoidance |

Net Benefit |

|

Freelancer / Sole Trader |

£200–£400 |

£500–£1,000 |

£300–£600 |

|

Micro Limited Company |

£500–£1,200 |

£1,500–£3,000 |

£1,000–£1,800 |

|

SME with 5–20 Employees |

£1,500–£5,000 |

£3,000–£10,000 |

£1,500–£5,000+ |

|

Property / Investment Business |

£2,000–£6,000 |

£5,000–£15,000+ |

£3,000–£9,000+ |

Note: Savings vary depending on business complexity and accountant expertise.

Key Takeaways

- Even small businesses often save more in taxes than the annual accountant fee.

- Planning ahead with an accountant maximizes both compliance and profitability.

Accountant vs DIY: Is Hiring an Accountant Worth It?

It’s a frequent question: “Should I hire an accountant, or can I do my taxes on my own?” It really comes down to how well you understand numbers and tax requirements. While doing it yourself can seem cheaper at first, hiring an accountant often saves money, time, and stress in the long run.

When Hiring an Accountant Is Worth It

You’ll benefit most from using an accountant if you:

- Run a limited company

- Are VAT registered

- Employ staff or subcontractors

- Receive dividends or multiple income sources

- Manage rental properties

- Need advice on tax planning

In these cases, the accountant doesn’t just file your taxes — they optimise your tax position, which often saves more than their fee.

Example:

A small business paying £120/month for accounting support could easily save £500 – £2,000 per year in reduced tax liability and better financial structuring.

When DIY Might Be Enough

DIY accounting tools can work if you:

- Are a sole trader with simple income

- Have very few transactions

- Understand basic record-keeping

However, even simple mistakes such as misreporting expenses or missing allowances can trigger penalties or overpaying tax.

Time vs Cost

Ask yourself:

|

Question |

If Answer is Yes… |

|

Do I value my time? |

Outsourcing makes sense. |

|

Do I find HMRC rules frustrating? |

Hire an accountant. |

|

Do you find tax reliefs and allowances confusing? |

Advice will save money. |

|

Do I want to avoid errors or penalties? |

Professional support is safer. |

Your time has value.

Even 5 hours per month spent managing finances = 60 hours per year. That’s time that could be used on work that grows your business.

For business owners or anyone with complicated finances, an accountant is usually worth the cost. While DIY is possible for simple sole traders, accountants help you avoid errors, reduce tax bills, and save time, often making their fee a net financial benefit.

Region-Based Pricing: London vs Online vs Local Accountants

London-Based Accountants: How much does an accountant cost for a sole trader

· Profile: Accountants located in central or Greater London.

· Typical cost: £1,000–£3,500+ per year for SMEs; freelancers: £250–£600.

· Why costs are higher: Higher office rent, demand for premium services, and specialized advisory support.

· When it makes sense: If you need face-to-face meetings frequently or specialised advice for complex businesses.

Local Accountants (Outside London)

· Profile: Regional accountants serving towns and cities across the UK.

· Typical cost: £500–£2,000 per year for SMEs; freelancers: £150–£400.

· Why costs are lower: Lower overheads and smaller client base.

· Benefits: Personalised service, easier access for local businesses, often flexible packages.

Online / Cloud-Based Accountants

· Profile: Fully remote accountants using cloud accounting software.

· Typical cost: £200–£2,000 per year depending on services and complexity.

· Why online can save money: No office overhead, automation reduces manual work, flexible monthly packages.

· Pros and cons:

Pros: Affordable, fast communication, software integration.

Cons: Limited face-to-face support, requires tech-savvy business owners.

London accountants charge a premium due to location and expertise. Local accountants offer a personal touch at lower prices, while online accountants provide flexibility and cost savings. Choose the best option suits your business size and comfort level.

Bookkeeper vs Accountant: Simple Comparison

Key Differences in Roles

|

Feature / Task |

Bookkeeper |

Accountant |

|

Primary Role |

Record and organise financial data |

Analyse, advise, and file taxes |

|

Typical Tasks |

Enter transactions, manage invoices, reconcile accounts |

Prepare accounts, tax returns, financial advice, cash flow analysis |

|

Legal Requirement |

Not required by law |

Required for filing statutory accounts, corporation tax |

|

Typical Cost (UK) |

£15–£30/hour or £100–£500/month |

£150–£3,500/year depending on complexity |

|

Best For |

Small or micro businesses, freelancers |

SMEs, property businesses, VAT-registered companies |

|

Software Familiarity |

QuickBooks, Xero, FreeAgent |

Xero, Sage, QuickBooks + advanced accounting software |

|

Strategic Advice |

Minimal |

Extensive |

How to Decide Which You Need: How much does an accountant cost for a sole trader

· Tip: If your business only needs transaction recording and basic bookkeeping, a bookkeeper may be sufficient.

· Tip: If you need tax filing, financial planning, or growth advice, an accountant is essential.

· Hybrid Approach: Many businesses use a bookkeeper for day-to-day tasks and an accountant for annual filings and advisory work.

Bookkeepers handle day-to-day record keeping, while accountants focus on financial analysis, taxes, and strategy. Many small businesses benefit from a combination of both to save costs and ensure compliance.

Real Business Scenarios: How Much Does an Accountant Cost in Practice

Scenario 1 – Sole Trader / Freelancer: How much does an accountant cost for a sole trader

- Profile: Single-owner business, no employees, basic bookkeeping, annual self-assessment.

- Typical cost: £150–£400 per year.

- What’s included: Tax return filing, basic advice, bookkeeping support.

- Why it matters: A small upfront cost can save you from HMRC penalties and ensure accurate self-assessment.

Scenario 2 – Micro Limited Company

- Profile: 1–2 directors, VAT-registered, occasional payroll.

- Typical cost: £500–£1,200 per year (monthly packages £40–£100).

- What’s included: Annual accounts, corporation tax filing, VAT returns, limited payroll.

- Key point: Choosing a fixed monthly package often gives predictable costs and peace of mind.

Scenario 3 – Property or Investment-Based Business

- Profile: Holds property, earns rental income, multiple transactions per month.

- Typical cost: £2,000–£6,000+ per year.

- What’s included: Specialized advice on property tax, capital gains, expenses, portfolio management.

- Why it matters: Expert guidance can prevent costly mistakes and maximize deductions.

Accountant costs vary from £150/year for a solo freelancer to £6,000+/year for property or investment businesses. The key is to match the accountant’s services to your business complexity, ensuring you pay for the value you receive.

Frequently Asked Questions

- How much should you expect to pay an accountant in the UK?

The average cost of an accountant in the UK typically ranges from £50 to £250 per month for small businesses, depending on bookkeeping needs, business structure, and support level. One-off services like a Self Assessment tax return usually cost £120 to £350, while limited company accounts cost £900 to £3,000 per year.

- What do accountants usually charge small businesses?

For a small limited company or sole trader, an accountant usually costs £50 to £200 per month if you choose a fixed-fee package. If you prefer one-off services, expect £300 to £900 annually for tax returns and end-of-year accounts.

- Do accountants charge monthly or yearly?

Both. Many accountants now offer fixed monthly plans that cover ongoing support, bookkeeping, payroll, and year-end filings. However, you can still choose one-off yearly services like tax returns or company accounts if you only need occasional help.

- What’s the typical cost of an accountant for Self Assessment?

A Self Assessment tax return generally costs £120 to £350 depending on income sources and complexity. For property landlords, contractors, or self-employed individuals with multiple income streams, it may cost £250 to £600.

- Is an accountant worth the cost?

Yes, in most cases. A good accountant can reduce your tax bill, prevent HMRC penalties, and save time by handling bookkeeping and compliance. Often, the tax savings alone are greater than the accountant’s fee, especially for limited companies and landlords.

- Can I do my own accounts instead of hiring an accountant?

Yes, if your finances are simple and you’re confident with digital accounting. But mistakes can be costly, so most businesses hire an accountant for accuracy, compliance, and tax efficiency.

- Can I claim accountant fees as a business expense?

Yes. Businesses, including sole traders and limited companies, can fully deduct accountant fees from their taxes. This means the cost of your accountant reduces your taxable profit.

Most UK businesses pay between £50 and £250 per month for accounting support, depending on their size and complexity. One-off tax services cost less, but ongoing support provides better financial guidance and long-term tax savings.

Conclusion — So, How Much Should You Expect to Pay?

So, how much does an accountant cost for a sole trader in the UK? The answer depends on your business type, complexity, and the level of support you need — but by now, you should have a clear idea of what’s normal and what’s fair.

For simple finances, you might only require one-off help each year.

If your business is growing, a monthly package offers better long-term value, support, and tax savings. A good accountant is not an expense. It’s an investment in your business.

Time to Choose the Right Accountant for Your Business?

Get a Free Consultation: Speak with a qualified UK accountant to discuss your business needs and get a personalised quote.