If you’ve ever wondered how large manufacturers manage their costs, optimise production, and still stay profitable — the answer often lies in the hands of a Certified Industrial Accountant.

In the UK, the role of a Certified Industrial Accountant is gaining recognition as industries evolve toward data-driven decision-making and cost efficiency. Unlike traditional accountants who focus purely on financial statements, these professionals bridge the gap between finance and operations, ensuring that every pound spent on production translates into measurable value.

This guide breaks down everything you need to know — from what a Certified Industrial Accountant actually does to how to become one in the UK. Exploring this advanced accounting field can open doors for students and professionals looking to shape their future careers.

What Is a Certified Industrial Accountant?

A Certified Industrial Accountant is a finance expert who specialises in managing the financial aspects of industrial and manufacturing operations. Their main role is to monitor production costs, improve efficiency, and help businesses make smarter, profit-focused decisions.

In simple terms, think of a Certified Industrial Accountant as the strategic link between production lines and boardrooms. They track where money is spent in manufacturing, analyse material and labour costs, and design systems that keep wastage low and profitability high.

In the UK context, the Certified Industrial Accountant title often represents a specialised certification or advanced course rather than a regulated chartered qualification. Many professionals pursue it to gain niche expertise in cost accounting, budgeting, and process control, particularly for roles within manufacturing, engineering, and industrial sectors.

A Certified Industrial Accountant helps businesses:

- Control production costs efficiently

- Plan and monitor budgets across departments

- Support management with real-time financial insights

- Drive profitability through cost-based strategy

What Does a Certified Industrial Accountant Do?

A Certified Industrial Accountant plays a critical role in helping industrial and manufacturing businesses control costs and make informed decisions. Their work goes far beyond balancing books — they actively shape how production and financial strategies align.

In the UK, a Certified Industrial Accountant typically focuses on cost management, budgeting, and operational efficiency. They analyse how resources are used, monitor production expenses, and create systems to minimise waste without affecting quality.

Here’s what their day-to-day responsibilities often include:

- Cost Analysis & Control: Monitoring raw material, labour, and overhead costs to ensure production stays within budget.

- Budgeting & Forecasting: Creating financial forecasts based on production data and expected market trends.

- Performance Evaluation: Comparing actual results to planned targets to identify inefficiencies.

- Internal Auditing: Ensuring financial records accurately reflect operational performance.

- Decision Support: Advising management on pricing, process improvements, and investment feasibility.

In many UK companies, the Certified Industrial Accountant works closely with engineers, production heads, and supply chain managers — serving as the financial translator between technical and strategic teams.

In short, this professional ensures that every manufacturing decision, from purchasing machinery to adjusting production schedules, is guided by solid financial insight.

Is “Certified Industrial Accountant” a Recognised Qualification in the UK?

A Certified Industrial Accountant is a valuable professional credential — but in the UK, it’s not a formally regulated chartered qualification like ACCA, CIMA, or ICAEW. Instead, it’s typically awarded by private institutes or training bodies that specialise in industrial and cost accounting.

That means while the Certified Industrial Accountant title carries practical recognition for its skills and industry relevance, it doesn’t grant the same legal or professional standing as “Chartered Accountant” status.

However, employers in manufacturing, logistics, and construction often value this qualification because it shows expertise in:

- Cost control and process optimisation

- Financial decision-making in industrial environments

- Advanced budgeting and performance analysis

Some UK-based and international academies (including online providers) offer Certified Industrial Accountant programmes that align with modern industry needs — combining management accounting, ERP systems, and industrial finance.

Is Certified Industrial Accountant recognised in the UK?

Not as a regulated chartered body, but as a specialised professional certification respected by employers in manufacturing, production, and cost-focused sectors.

Steps to Qualify as a Certified Industrial Accountant in the UK

In the UK, certification as an Industrial Accountant is earned through a blend of education, skill development, and practical experience. While there’s no single licensing authority, most professionals follow a structured pathway that blends academic study with industrial finance skills.

Here’s how you can start:

Step 1 – Meet the Educational Requirements

Begin with a background in accounting, finance, business, or economics.

Most training providers require at least an A-level qualification, though a bachelor’s degree in accounting or commerce can improve your eligibility.

If you already hold qualifications like AAT, ACCA Foundation, or CIMA Certificate, you may be exempt from some modules in the Certified Industrial Accountant course.

Step 2 – Enrol in an Approved Course or Training Programme

Choose a recognised institute that offers a Certified Industrial Accountant programme focused on cost management, industrial accounting systems, and performance analysis.

These courses are often available:

- Online or blended learning (6–12 months duration)

- Through private academies or professional training centres in the UK

Opt for courses that include key areas such as:

- Strategic and cost accounting

- Budgeting and forecasting

- ERP and financial modelling

- Industrial cost analysis

Step 3 – Complete Exams and Assessments

To earn your Certified Industrial Accountant certification, you’ll need to pass module-based exams or final assessments.

These typically evaluate your skills in:

- Cost control and variance analysis

- Budget preparation

- Financial statement interpretation

- Industrial process costing

Step 4 – Obtain Professional Field Experience

Seek roles in manufacturing, construction, logistics, or energy sectors, where cost control and production analysis are key. Employers highly value candidates who can apply Certified Industrial Accountant knowledge in operational environments.

How to become a Certified Industrial Accountant in the UK:

- Get an accounting or finance qualification.

- Enrol in a Certified Industrial Accountant training programme.

- Pass exams and practical assessments.

- Gain experience in industrial finance or cost control roles.

What Skills Do You Need to Succeed as a Certified Industrial Accountant?

Achieving excellence in this role requires more than accounting skills alone—it requires analytical acumen, strategic foresight, and a deep familiarity with industrial processes.

In the UK job market, employers look for professionals who can connect financial data to real operational decisions — from pricing products to optimising resource use.

Here are the core skills every successful Certified Industrial Accountant should have:

-

Cost and Management Accounting Expertise

Understanding how costs flow through production is fundamental.

You’ll need to master concepts like marginal costing, variance analysis, and standard costing to identify inefficiencies and improve profitability.

-

Financial Analysis and Forecasting

A Certified Industrial Accountant interprets complex financial data to predict future performance.

You’ll create budgets, forecast material costs, and assess project feasibility with data-driven accuracy.

-

ERP and Data Tools Proficiency

Today’s industrial accountants use ERP systems (like SAP or Oracle), Excel analytics, and automation tools to monitor operations in real time.

Digital literacy is now as important as financial knowledge.

-

Business and Operational Insight

A great Certified Industrial Accountant understands how production works — from machinery costs to labour efficiency.

This operational awareness helps connect finance teams with on-site realities.

-

Communication and Decision-Making

Beyond analysis, you must be able to explain findings clearly to non-financial managers.

Presenting complex reports in simple, actionable language is key to influencing company strategy.

Key skills for Certified Industrial Accountants:

- Cost accounting and budgeting

- Financial forecasting and data analysis

- ERP and Excel expertise

- Operational awareness

- Strong communication and decision-making

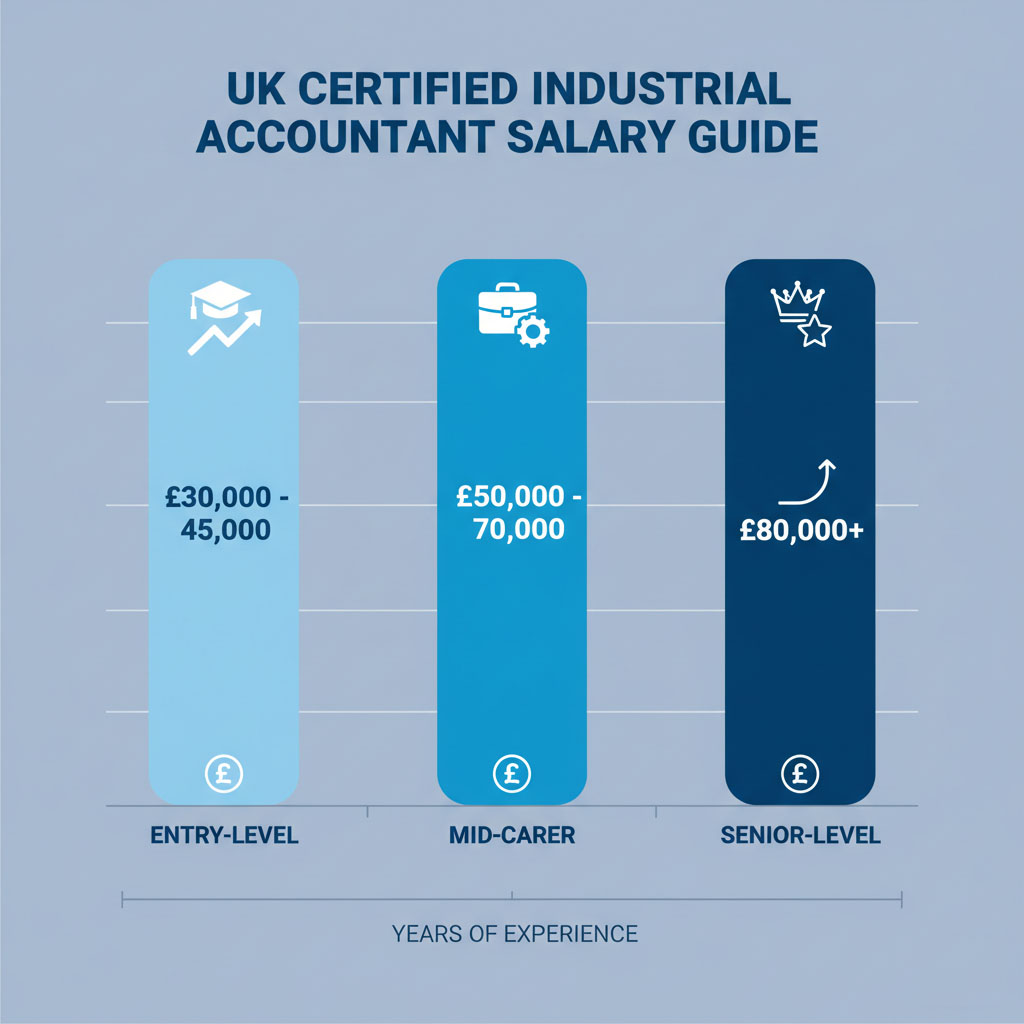

How Much Does a Certified Industrial Accountant Earn in the UK?

In the UK, Certified Industrial Accountants typically earn strong, competitive salaries that mirror their technical proficiency and sector-focused expertise.

Because they operate at the intersection of finance and operations, their pay often exceeds that of general accountants in manufacturing and production roles.

In 2025, the average salary for a Certified Industrial Accountant in the UK ranges from £35,000 to £70,000 per year, depending on experience, location, and the size of the organisation.

Here’s a quick breakdown:

- Entry-level: £28,000 – £40,000

- Mid-level (3–5 years experience): £45,000 – £55,000

- Senior / Specialist roles: £60,000 – £75,000+

Industries such as energy, construction, engineering, and manufacturing tend to offer the highest salaries, especially for candidates with ERP system expertise or hybrid financial-operations roles.

Average Salary in the UK

In the UK, Certified Industrial Accountants typically earn between £40,000 and £75,000 per year, depending on experience, certification level, and sector.

Senior professionals in manufacturing or logistics can earn upwards of £90,000, especially those with advanced cost management and financial modelling expertise.

Tax Return Accountants’ certified pathway ensures you gain not just credentials but the practical exposure employers value most — preparing you for real-world roles that reward skill, precision, and business acumen.

Factors That Influence Salary

- Experience: Practical exposure to cost analysis and budgeting can significantly increase your pay.

- Industry: Heavy industries and large manufacturing plants pay more than retail or service-based firms.

- Qualification Level: Holding additional credentials like CIMA or ACCA alongside your Certified Industrial Accountant certification can boost career opportunities.

- Location: In areas like London, Birmingham, and Manchester, salaries are generally higher because of increased market demand and elevated living costs.

Certified Industrial Accountant salary in the UK (2025):

- Average: £35,000–£70,000 annually

- Higher pay in manufacturing, energy, and construction

- Experience, location, and advanced certifications increase earnings

Certified Industrial Accountant vs Chartered Accountant – What’s the Difference?

A Certified Industrial Accountant and a Chartered Accountant may sound similar, but their focus areas and career paths are quite different.

While both deal with finance and accounting principles, their objectives, qualifications, and job environments set them apart.

In the UK, Chartered Accountants (through ACCA, CIMA, or ICAEW) are regulated professionals often specialising in financial reporting, auditing, and taxation.

Meanwhile, a Certified Industrial Accountant focuses on cost management, production finance, and internal decision-making within industrial sectors.

Here’s a detailed comparison:

|

Feature |

Certified Industrial Accountant |

Chartered Accountant |

|

Main Focus |

Industrial, cost, and management accounting |

Financial, audit, and tax accounting |

|

Certification Type |

Course-based or institute-certified |

Professionally chartered (ACCA, CIMA, ICAEW) |

|

Core Skills |

Cost analysis, budgeting, production efficiency |

Audit, financial reporting, compliance |

|

Industry Relevance |

Manufacturing, construction, logistics, energy |

Corporate finance, audit firms, consulting |

|

Duration |

6–12 months (typically) |

3–5 years with exams and articleship |

|

Recognition |

Specialised industry certification |

Globally recognised professional status |

In essence, a Certified Industrial Accountant is ideal for professionals who want to work within industries and improve operational profitability, while a Chartered Accountant is better suited for those seeking roles in audit, finance, or public accounting.

Difference between Certified Industrial Accountant and Chartered Accountant:

- Certified Industrial Accountant: primarily handles cost analysis and accounting within industrial operations.

- Chartered Accountant: focuses on audit, tax, and financial reporting.

- Both paths offer valuable but distinct career outcomes.

Career Opportunities for Certified Industrial Accountants in the UK

A Certified Industrial Accountant opens doors to a range of career opportunities across the UK’s most dynamic sectors.

Since these professionals combine accounting precision with operational insight, they’re highly valued in industries that rely on cost control and production efficiency.

Top Industries Hiring Certified Industrial Accountants

- Manufacturing: Analysing production costs and improving efficiency.

- Construction: Managing budgets for large-scale projects and materials.

- Energy & Utilities: Monitoring fuel and operational costs for power generation.

- Engineering & Automotive: Evaluating component pricing and cost optimisation.

- Logistics & Supply Chain: Streamlining transport and storage expenses.

Common Job Titles

With a Certified Industrial Accountant certification, professionals commonly step into roles including:

- Cost Accountant

- Industrial Analyst

- Management Accountant

- Budget Controller

- Operations Finance Specialist

- Cost and Performance Auditor

These positions allow you to work closely with production managers, finance directors, and procurement teams to ensure every operational decision supports financial goals.

Career Growth Outlook in the UK

The demand for cost-focused professionals is growing as businesses prioritise efficiency and sustainability.

With automation and analytics reshaping industrial accounting, a Certified Industrial Accountant with strong data skills and ERP knowledge can progress into senior roles like Finance Manager, Operations Controller, or Chief Cost Strategist.

Career opportunities for Certified Industrial Accountants in the UK:

- Roles: Cost Accountant, Management Accountant, Industrial Analyst

- Industries: Manufacturing, Construction, Energy, Logistics

- Growth: Strong demand for cost-control and data-driven accounting skills

Where to Study Certified Industrial Accounting in the UK

If you’re planning to become a Certified Industrial Accountant, the UK offers a variety of training routes — from private academies to online professional development programmes. While it’s not a government-regulated qualification like ACCA or CIMA, several respected institutions offer practical, industry-focused training in cost and industrial accounting.

Top Institutions and Training Providers

Here are some popular options where you can pursue Certified Industrial Accountant or equivalent cost-accounting programmes in the UK:

- London School of Business and Finance (LSBF) – Offers specialised management and cost accounting courses that align closely with industrial accounting standards.

- The Association of International Certified Professional Accountants (AICPA-CIMA) – Provides advanced cost management and performance evaluation modules relevant to industrial settings.

- Online Platforms – Offer short courses in industrial accounting, ERP systems, and management finance suitable for flexible learners.

- Chartered Institute of Management Accountants (CIMA) – While not identical, CIMA’s management accounting pathway shares key competencies with Certified Industrial Accountant

Course Duration and Format

- Typical Duration: 6–12 months (part-time or flexible learning)

- Format: Online, hybrid, or classroom-based

- Modules Include:

- Cost analysis and budgeting

- Industrial process costing

- Financial modelling

- Decision-making and performance evaluation

For international students or working professionals, many institutes offer distance learning options that allow you to earn your Certified Industrial Accountant credential from anywhere in the UK.

Where to study Certified Industrial Accounting in the UK:

- Institutions: LSBF, CIMA, AICPA-CIMA, online learning platforms

- Duration: 6–12 months

- Focus: Cost management, industrial finance, and budgeting

Is Becoming a Certified Industrial Accountant Worth It?

If you’re wondering whether investing time and resources to become a Certified Industrial Accountant is the right decision, the answer is a resounding yes — for the right candidates.

In today’s competitive UK industrial landscape, companies are actively seeking professionals who can bridge finance and operations, reduce production costs, and support strategic decision-making. A Certified Industrial Accountant is not just a credential — it’s a ticket to high-demand roles with better pay, influence, and career growth.

Why Pursuing a Certified Industrial Accountant Certification Pays Off

- Specialised Expertise in High-Demand Industries

Manufacturing, construction, and logistics businesses increasingly rely on cost management specialists. A Certified Industrial Accountant demonstrates targeted skills that employers value over generic finance credentials. - Career Growth & Salary Advantage

Professionals with this certification often earn 10–30% more than standard management accountants due to their niche expertise. Senior roles like Operations Finance Manager or Cost Controller are more accessible. - Practical Skills That Translate Immediately

Unlike theoretical certifications, this program equips you with real-world industrial accounting skills — cost analysis, budgeting, ERP proficiency — making you immediately productive in your role. - Flexible Learning & Fast Track to Certification

Many UK institutes offer short, intensive programmes (6–12 months), meaning you can upskill without quitting your job. - Improved Positioning in the UK Job Market

Standing out in a crowded field of accountants requires niche skills. With a Certified Industrial Accountant title, you demonstrate both finance expertise and industrial know-how, making you highly attractive to employers.

Who Should Consider This Certification?

- Finance professionals wanting to specialise in industrial accounting

- Engineers or operations managers looking to move into finance roles

- Students seeking a clear path to high-paying, practical careers

- Companies wanting to upskill their teams in cost management

Is Certified Industrial Accountant worth it?

- Yes — high demand in manufacturing, logistics, and construction.

- Offers better pay, faster career growth, and practical industrial finance skills.

- Ideal for professionals and students seeking specialised, industry-relevant expertise.

Real Success Stories

Case Study 1: Reducing Costs in UK Manufacturing

Client: Mid-sized manufacturing company in Birmingham

Challenge: Rising production expenses and inaccurate cost projections.

Solution: A qualified Accountants trained their internal finance team and helped place a Certified Industrial Accountant with cost-management expertise.

Result: Within six months, the company reduced production costs by 12% and improved budgeting accuracy, leading to higher profit margins.

Case Study 2: Career Turnaround for a Finance Graduate

Client: Finance graduate from Manchester

Challenge: Facing challenges in making your profile stand out amid intense job competition.

Solution: Through our mentorship programme, they pursued the Certified Industrial Accountant qualification with accountants’ one-to-one guidance and ERP training.

Result: Landed a £45,000-per-year position in a logistics company just three months after certification, managing operational budgets and performance metrics.

What These Results Mean for You

Whether you’re looking to advance your career or optimise your business performance, Tax Return Accountants offers the expertise, mentorship, and proven systems that deliver measurable results.

Our goal is simple: turn your Certified Industrial Accountant qualification into tangible success.

-

Qualified accountants delivers measurable results for Certified Industrial Accountants.

-

Clients achieve up to 12% cost savings and faster job placements.

-

Training combines mentorship, ERP skills, and industry-focused learning.

FAQs About Certified Industrial Accountant

- How long does it take to become a Certified Industrial Accountant in the UK?

Most courses run 6–12 months, with online and part-time formats helping professionals study while working.

- Can international professionals or students apply for this certification?

Yes. Many UK-based and online institutes offer distance learning, making the Certified Industrial Accountant credential accessible worldwide. Some courses also provide support for visa and enrollment procedures.

- Is Certified Industrial Accountant better than CIMA or ACCA?

It depends on your career goal. Certified Industrial Accountant is highly specialised for industrial cost and operations management, while CIMA or ACCA offer broader accounting and audit credentials. Combining them can maximise career flexibility.

- Do UK employers value this certification?

Absolutely. Companies in manufacturing, energy, construction, and logistics actively seek professionals with Certified Industrial Accountant skills because they improve profitability, budgeting accuracy, and operational efficiency.

- Can you work abroad with this certification?

Yes. While recognition varies by country, the practical skills in cost control, budgeting, and industrial finance are universally applicable. Pairing the certification with experience can open international career opportunities.

- What does a Certified Industrial Accountant usually earn on average in the UK?

Salaries typically range from £35,000 to £70,000 annually, with higher pay in senior roles or industries like manufacturing, energy, and construction.

- Is prior work experience required?

Not always, but practical experience in finance, accounting, or industrial operations significantly improves learning outcomes and employability. Many institutes recommend at least 1–2 years of relevant experience.

Certified Industrial Accountant FAQs:

- Duration: 6–12 months

- Accessibility: Open to international students and professionals

- Comparison: Specialised vs general accounting (CIMA/ACCA)

- Recognition: Highly valued in UK industries

- Salary: £35,000–£70,000+

- Experience: Recommended but not mandatory

Conclusion – Take the Next Step as a Certified Industrial Accountant

Becoming a Certified Industrial Accountant in the UK isn’t just a certification — it’s your gateway to a high-demand, high-paying career. With expertise in cost management, industrial finance, and operational efficiency, you become the professional companies rely on to drive profitability.

Benefits include:

- Industry-specific skills that stand out in the UK job market

- Higher income opportunities and rapid career progression

• Employment pathways in industries such as manufacturing, construction, energy, and logistics - Hands-on knowledge in budgeting, cost analysis, and ERP systems

Ready to advance your career?

Tax Return Accountants offers personalised guidance to help you get certified and excel in industrial finance.

Take Action Today: Contact with best Accountants to explore programmes, receive expert guidance, and fast-track your path to rewarding roles.