The finance and business world runs on precision, credibility, and professional insight — and that’s exactly what a Certified Public Accountant (CPA) brings to the table. In the UK, both individuals and companies rely on these professionals to manage financial records, ensure tax compliance, and offer strategic business guidance.

But here’s the key: while the term “certified public accountant” (CPA) originated in the United States, it’s also recognised in the UK through organisations like the Certified Public Accountants Association (CPAA). Whether you’re looking to hire one or become one, understanding the UK context of this role can help you make smarter financial decisions.

In this guide, we’ll break down everything you need to know about an accounting certified public accountant — what they do, how they differ from chartered accountants, the benefits they bring to your business, how to qualify as one, and how much they typically charge in the UK.

By the end, you’ll have a clear, practical understanding of whether an accounting certified public accountant is right for your business or career goals — and how to take the next step.

What Is the Significance of Being a Certified Public Accountant (CPA) in the UK?

A Certified Public Accountant (CPA) in the UK is a qualified accounting professional who has completed rigorous training and certification to provide trusted financial, auditing, and advisory services. While the title “accounting certified public accountant” is widely recognised globally, in the UK it is granted through the Certified Public Accountants Association (CPAA) — an official body that represents public accountants across the country.

Unlike general accountants, a CPA must meet specific professional standards, adhere to ethical guidelines, and demonstrate ongoing competency through continuous professional development (CPD). This ensures clients receive advice that’s not only accurate but also compliant with the latest UK accounting and tax regulations.

How does the CPA qualification fit into the UK accounting landscape?

In the UK, accounting titles such as Chartered Accountant (CA), ACCA, and CIMA are more commonly recognised. However, the accounting certified public accountant designation is respected for its practical, results-driven approach and global alignment — especially among businesses that operate internationally.

Who awards the CPA designation in the UK?

The Certified Public Accountants Association (CPAA) serves as the main authority for accrediting CPAs in the UK. It regulates membership, maintains ethical standards, and supports professional growth. Members can use the post-nominal letters “ACPA” (Associate Certified Public Accountant) or “FCPA” (Fellow Certified Public Accountant), demonstrating credibility and experience.

In short, an accounting certified public accountant in the UK combines technical expertise, legal compliance, and ethical practice — making them a reliable partner for individuals and businesses seeking high-quality accounting support.

CPA versus Other UK Accounting Qualifications

|

Qualification |

Certifying Body |

Focus / Strengths |

Ideal For |

|

CPA (Certified Public Accountant) |

Certified Public Accountants Association (CPAA) UK |

Practical accounting, auditing, tax compliance, international standards |

SMEs, international businesses, clients seeking hands-on financial guidance |

|

Chartered Accountant (CA) |

ICAEW, ICAS, CAI |

Audit, taxation, corporate finance, traditional UK accounting standards |

Corporate roles, top audit firms, large enterprises |

|

ACCA (Association of Chartered Certified Accountants) |

ACCA Global |

Corporate finance, audit, regulatory compliance |

Global finance roles, multi-country business operations |

|

CIMA (Chartered Institute of Management Accountants) |

CIMA UK |

Management accounting, internal business strategy, financial planning |

Businesses seeking internal strategic planning and management reporting |

Which title is more appropriate for your needs?

- CPA: Flexible, globally recognised, client-focused — ideal for SMEs and international business.

- CA / ACCA / CIMA: Academically intensive and traditional, better suited for corporate careers or specialised roles.

- Decision Tip: Match the qualification to your career or business goals. If practical expertise and global reach matter most, an accounting certified public accountant is often the best fit.

Quick Summary:

- CPA – Practical, globally recognised, and ideal for SMEs.

- CA/ACCA/CIMA – Traditional, academically robust, and often required in corporate roles.

In the end, the “best” qualification depends on your business needs or career ambitions — but the accounting certified public accountant offers an excellent blend of credibility, flexibility, and international value.

Why Hire a Certified Public Accountant – Benefits for UK Businesses

Hiring an accounting certified public accountant can make a measurable difference to your company’s financial health, compliance, and long-term growth. In the UK’s complex tax and regulatory environment, CPAs bring both technical precision and strategic insight — helping business owners save money, avoid penalties, and plan smarter.

1. Expertise, Compliance, and Peace of Mind

A certified public accountant is trained to interpret UK tax laws, manage statutory filings, and ensure every financial statement meets HMRC and Companies House requirements.

This ensures greater accuracy, timely compliance, and clearer financial visibility.

When you work with an accounting certified public accountant, you’re not just outsourcing bookkeeping — you’re partnering with someone who understands both the letter and spirit of UK financial regulations.

2. Strategic Business Advice and Growth Support

Beyond compliance, CPAs offer data-driven advice that helps businesses grow sustainably.

They can:

- Analyse your profit margins and cash flow trends

- Identify tax-saving opportunities

- Advise on expansion, investments, or restructuring

For small and medium-sized enterprises (SMEs), an accounting certified public accountant often becomes a long-term financial mentor — guiding business decisions with clarity and foresight.

3. Enhanced Credibility and Trust

Having a CPA manage your accounts signals professionalism and reliability. Investors, lenders, and clients often view certified accountants as more trustworthy because they adhere to strict ethical codes and ongoing professional development.

Simply put, an accounting certified public accountant enhances your business reputation and ensures external stakeholders have confidence in your financial reporting.

4. Cost-Effectiveness and Long-Term Value

While hiring a CPA may seem like an added expense, their expertise often results in significant savings — through efficient tax planning, reduced audit risks, and smarter resource allocation.

Unlike standard accountants, CPAs go beyond bookkeeping, offering insights that guide smarter decisions and positively impact your profits.

A skilled accounting certified public accountant doesn’t just balance books — they balance your business strategy, compliance, and profitability for long-term success.

Primary Functions and Services of a Certified Public Accountant

A certified public accountant in the UK offers a comprehensive range of financial, regulatory, and advisory services to assist both individuals and businesses. Their work goes far beyond basic bookkeeping — they offer strategic guidance that helps companies thrive in a competitive market.

Here are the main services you can anticipate when working with a certified public accountant in the UK.

- Financial Recordkeeping and Accounting

A CPA keeps your business’s financial records precise and current. By overseeing revenue, costs, and both assets and liabilities, they offer a thorough understanding of your business’s financial position.

Whether you’re a startup or a growing enterprise, an accounting certified public accountant can manage everything from daily bookkeeping to year-end reporting.

- Tax Policy and Compliance Requirements

UK tax regulations are intricate and frequently updated. A CPA helps you:

- File accurate and timely returns with HMRC

- Maximise allowable deductions and reliefs

- Stay compliant with VAT, PAYE, and corporation tax regulations

The right accounting certified public accountant will also help design a tax strategy that legally minimises liabilities while optimising cash flow.

- Audit and Assurance Services

For companies that require audits — whether statutory or voluntary — a CPA ensures transparency and credibility.

They examine financial records, spot inconsistencies, and ensure that your accounts accurately reflect the company’s financial position.

This builds confidence among investors, shareholders, and regulators.

- Business Advisory and Financial Strategy

- A certified public accountant does more than handle figures—they act as a strategic advisor. They can help with:

- Financial forecasting and planning for different scenarios

- Financial modelling and risk analysis

- Business restructuring and investment decisions

In this sense, an accounting certified public accountant acts as both advisor and analyst, aligning financial planning with your business goals.

- Payroll and Regulatory Filings

From payroll management to statutory submissions, CPAs streamline the administrative side of running a business.

They ensure employees are paid correctly, PAYE is managed efficiently, and all reports meet HMRC’s deadlines.

- Personal Financial Planning

For individuals, CPAs provide tailored services such as tax-efficient wealth management, pension planning, and estate guidance.

Their expertise helps you protect assets and build long-term financial security.

An accounting certified public accountant in the UK wears many hats — financial controller, strategist, tax expert, and compliance guardian.

Their multi-disciplinary role makes them indispensable to businesses that want both operational efficiency and sustainable growth.

Pathway to Earning CPA Status in the UK

If you’re thinking about pursuing a career as an accounting certified public accountant, the UK offers a clear yet competitive path. Becoming a CPA requires education, practical experience, and professional ethics — all of which ensure you can handle complex financial responsibilities confidently.

1. Meet the Educational Requirements

To start your journey, you’ll typically need:

- A degree in accounting, finance, business management, or a comparable area of study

- Strong numeracy and analytical skills

- Foundational knowledge of UK accounting standards (GAAP) and international frameworks (IFRS)

The Certified Public Accountants Association (CPAA) recognises degrees and prior learning that demonstrate relevant competence. Many candidates start with AAT (Association of Accounting Technicians) or a finance degree before enrolling in the CPA programme.

2. Enroll with the Certified Public Accountants Association (CPAA)

The CPAA is the official UK organisation responsible for granting the Certified Public Accountant (CPA) qualification.

To apply, you must:

- Submit academic transcripts and work experience details

- Pass the CPAA’s membership evaluation

- Commit to its professional code of conduct and ethics

Once accepted, you become a member and can use the title “Accounting Certified Public Accountant”, symbolising credibility and trust.

3. Pass the Examinations

The CPAA examination process tests practical and theoretical skills across areas such as:

- Financial Accounting Standards

• Business Legislation and Taxation

• Audit and Assurance Services

• Management and Cost Accounting

• Corporate Governance and Compliance

Each module strengthens your ability to handle real-world accounting challenges. Passing these exams is a major milestone toward becoming a fully qualified accounting certified public accountant.

4. Gain Relevant Work Experience

Most candidates need at least two to three years of supervised accounting experience before full certification.

This may include working in:

- Audit firms

- Finance departments of private companies

- Public sector accounting roles

The CPAA values hands-on experience because it builds the confidence and judgment expected from a professional CPA.

5. Commit to Continuous Professional Development (CPD)

Once qualified, you must complete annual CPD hours to keep your knowledge current.

This includes training on tax updates, technology, and ethical standards — ensuring that every accounting certified public accountant continues to meet modern business needs.

The requirements to qualify as a CPA in the UK include:

- Hold a recognised finance qualification

- Join the CPAA and follow its ethics code

- Pass all required exams

- Gain real-world accounting experience

- Maintain ongoing CPD compliance

This structured process ensures every accounting certified public accountant upholds the highest professional standards — trusted by clients, employers, and regulators alike.

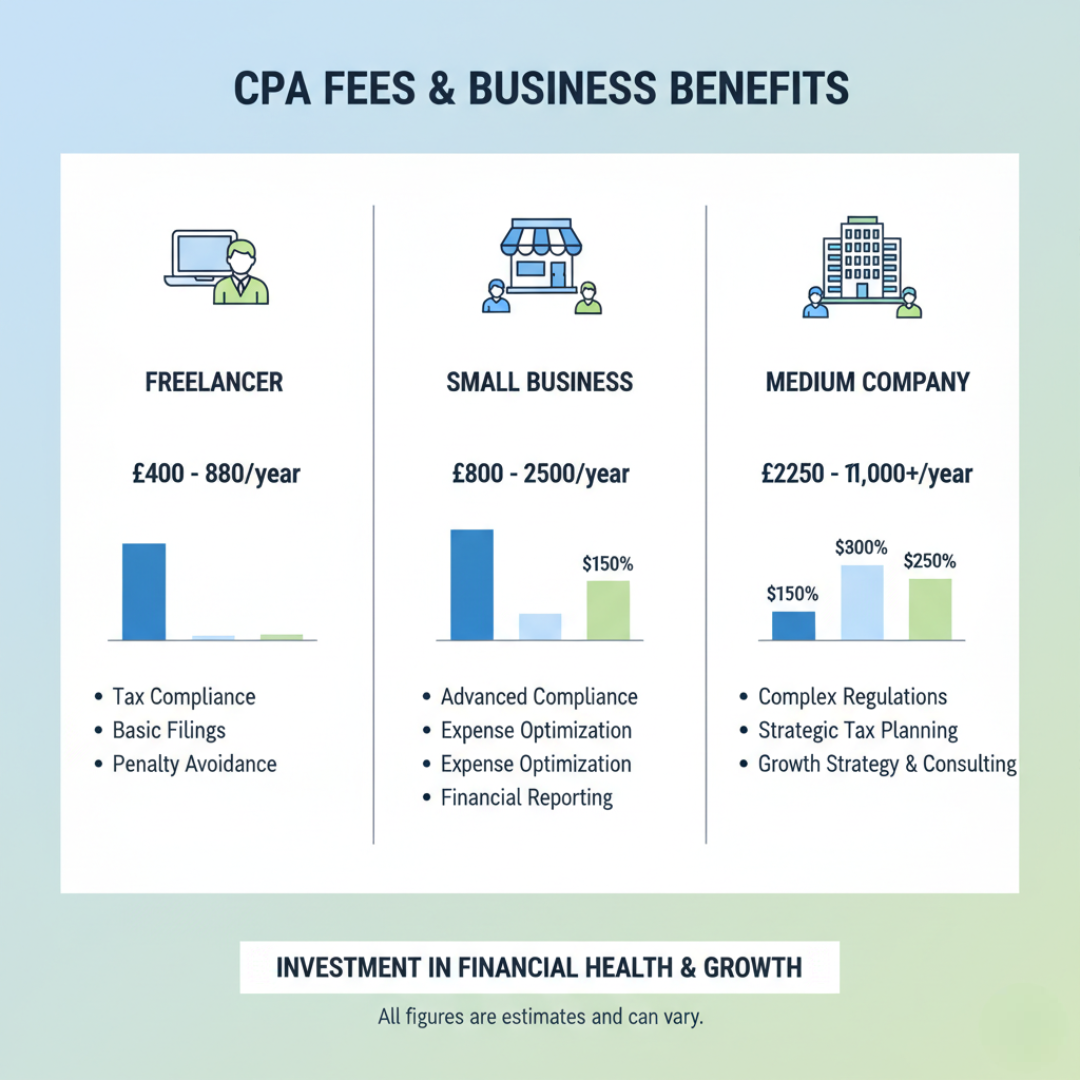

CPA Hiring Costs and Fees in the UK

The fees for employing a certified public accountant in the UK vary based on factors such as your business size, the intricacy of your finances, and the particular services needed.

However, one thing is consistent: a CPA’s value often far exceeds their cost, thanks to the financial clarity and compliance they bring.

1. Average CPA Fees in the UK

While rates vary, here’s a general guide to what you might expect:

- Sole traders & freelancers: £40–£100 per hour or £400–£800 per year for tax and bookkeeping services

- Small businesses: £1,000–£3,000 per year for full accounting and compliance management

- Medium to large companies: £3,000–£10,000+ per year, depending on audits, payroll, and strategic planning needs

For project-based work (like audits or annual reports), an accounting certified public accountant may charge a flat fee agreed upfront.

Cost vs Value: Hiring a Certified Public Accountant

|

Cost / Investment |

What You Get (Value) |

|

£40–£100 per hour (sole trader/freelancer) |

Accurate tax filings, VAT compliance, bookkeeping, peace of mind |

|

£400–£800 per year (basic services for sole traders) |

Saves hours of admin, ensures HMRC compliance, prevents fines |

|

£1,000–£3,000 per year (small business packages) |

Full accounting & compliance, cash flow analysis, strategic advice, risk management |

|

£3,000–£10,000+ per year (medium/large companies) |

Audits, payroll management, business planning, growth guidance, international tax advice |

|

Opportunity cost of DIY or unqualified accountant |

Risk of penalties, errors, lost tax savings, wasted time, slower business growth |

2. Factors That Influence CPA Costs

A CPA’s fees aren’t one-size-fits-all. The following factors usually determine pricing:

- Service scope: Tax filing, payroll, or audit support

- Business complexity: Multiple income streams, subsidiaries, or VAT registrations

- Experience level: Senior CPAs or FCPAs often charge premium rates

- Location: London and major cities tend to have higher hourly rates

A good accounting certified public accountant will offer transparent pricing and tailor packages to your business needs — so you only pay for what you truly require.

3. The Value of Investing in a Certified Public Accountant

Engaging a CPA goes beyond handling numbers; it’s about driving informed and strategic business choices.

A skilled accounting certified public accountant can:

- Identify tax reliefs that save thousands annually

- Prevent costly errors or HMRC penalties

- Offer strategic advice that boosts profitability

In many cases, their expertise pays for itself in better tax efficiency, stronger cash flow, and peace of mind.

Expect to invest between £1,000 and £3,000 per year for a qualified accounting certified public accountant — a modest cost compared to the long-term financial and compliance benefits they deliver.

Case Study 1: Tax Savings for a Small Retail Business

Business: GreenLeaf Organics, a small UK-based retail chain

Challenge: Struggling to manage VAT filings, payroll, and complex tax deductions

Solution: Hired an accounting certified public accountant from Eternity Accountants

Outcome:

- Accurately filed VAT and payroll reports, avoiding HMRC penalties

- Identified £15,000 in eligible tax reliefs and deductions

- Implemented efficient bookkeeping practices, saving 8 hours of admin work weekly

Takeaway: A CPA can turn compliance headaches into tangible savings while streamlining daily operations.

Case Study 2: Strategic Growth Planning for a Tech Startup

Business: TechNova Solutions, London-based software startup

Challenge: Rapid growth with cash flow uncertainty and international client billing

Solution: Partnered with an accounting certified public accountant from Eternity Accountants

Outcome:

- Developed cash flow projections and budgeting strategies

- Advised on international tax regulations for clients outside the UK

- Recommended restructuring options that improved profitability by 12% in the first year

CPAs provide more than financial management—they deliver strategic insights that support business growth and long-term stability.

The Future of the Certified Public Accountant: 5-Year Outlook

In the next five years, the role of an accounting certified public accountant in the UK will evolve significantly. Automation, AI, and cloud accounting software will handle routine bookkeeping, allowing CPAs to focus more on strategic advisory, risk management, and financial planning. International compliance and sustainability reporting will also become increasingly important. Businesses that work with a forward-thinking accounting certified public accountant, like those at Tax Return Accountants, will benefit from advanced insights, proactive tax strategies, and data-driven growth recommendations — ensuring they stay competitive in an ever-changing financial landscape.

Frequently Asked Questions on Accounting certified public accountant

Q1. How does a Certified Public Accountant differ from a Chartered Accountant in the UK?

- A Chartered Accountant is typically qualified through ICAEW, ICAS, or CAI.

- UK Certified Public Accountants earn their accreditation through the Certified Public Accountants Association (CPAA)

While CAs are more traditional, CPAs offer a globally recognised and practical approach, appealing to small businesses and international clients.

Q2. Is hiring a CPA necessary for managing a small business in the UK?

Legally, you’re not required to hire a CPA to run your business — but having an accounting certified public accountant ensures your books, tax returns, and compliance are handled correctly. For most small business owners, a CPA is a smart investment that prevents costly mistakes and saves time.

Q3. What are the typical fees for hiring a Certified Public Accountant for a business in the UK?

On average, a UK-based accounting certified public accountant charges between £1,000 and £3,000 per year, depending on the size and needs of your business.

Basic tax and bookkeeping support costs less, while audits or strategic financial advice typically cost more.

Q4. Can a CPA in the UK perform audits of limited companies?

Yes — if they’re registered auditors, CPAs can conduct statutory audits for limited companies.

Members of the Certified Public Accountants Association (CPAA) can apply for audit registration once they meet the required professional standards and experience criteria.

Q5. What Is the Procedure for Verifying a CPA’s Qualifications in the UK?

To confirm a CPA’s legitimacy, check their membership on the CPAA’s official register.

Every qualified accounting certified public accountant should have valid membership status, post-nominal letters (ACPA or FCPA), and proof of continuing professional development (CPD).

Q6. Does pursuing a Certified Public Accountant qualification in the UK offer significant benefits?

Absolutely. Becoming a CPA boosts your career, credibility, and earning potential, especially for international or freelance work.

Q7. Can a CPA help me with tax planning and business strategy?

Yes. A CPA not only manages taxes but also offers strategic advice to boost profits, cash flow, and long-term growth.

-

CPAs in the UK = Regulated professionals under CPAA.

-

Main benefits: Compliance, strategy, and financial peace of mind.

-

Ideal for: SMEs, freelancers, and anyone seeking trustworthy financial guidance.

Conclusion & Call to Action

Choosing or becoming an accounting certified public accountant in the UK is more than just a career or hiring decision — it’s an investment in financial clarity, compliance, and long-term success.

Throughout this guide, we’ve explored what a Certified Public Accountant is, how they compare to chartered accountants, the benefits they bring to businesses, their typical services, and the pathway to becoming one. The takeaway is simple: whether you’re a business owner seeking expert support or a professional aiming to build a trusted career, the accounting certified public accountant designation opens doors to credibility and confidence.

Why It Matters for You

- For business owners, a CPA helps streamline accounting, ensure compliance, and uncover financial growth opportunities.

- For aspiring accountants, the CPA qualification enhances your skills, professional standing, and global relevance.

No matter where you are in your financial journey, partnering with or becoming an accounting certified public accountant means making smarter, data-driven decisions every step of the way.

Next Steps:

If you’re ready to:

- Hire a qualified CPA for your business

- Explore how a Certified Public Accountant can improve your operations

- Or start your journey to becoming a CPA in the UK

Reach out to potetial Accountants today and experience how a dedicated accounting certified public accountant can transform your business finances. Your clarity, confidence, and growth start here.